Zero Days To Expiration Option Straddles

Di: Ava

Explore ten potential advantages and disadvantages of 0 DTE (zero days to expiration) options trading. This educational breakdown examines both sides of same-day

The idea: open (buy) a long straddle that is 0 DTE, every single day of the week. BUT use /ES futures options instead of SPX, SPY, AAPL, TSLA, etc. Example Straddles with only a few days to go until expiration can be quite profitable; however, they carry considerably more risk, since you have a greater requirement for being

Daily 0 DTE Long Straddles With /ES Futures Options.

Options with zero days till expiry, or 0DTE options for short, are option contracts that expire on the same day they are traded. When an option reaches this point in its life cycle, Exploring Zero Days to Expiration Options Trading (0DTE) Zero-day options are options contracts that are set to expire at the end of the trading day, offering Zero-day options, also known as zero-day to expiration options or 0DTE, are options contracts that expire on the same day they are traded. It is an option trading strategy that takes

What Are 0 DTE Options, Really? At their core, 0DTE (Zero Days to Expiration) options are just standard index or equity options—except they expire the same day they’re 0DTE Optionen, auch bekannt als Zero Days to Expiration Optionen, stellen eine aufregende und herausfordernde Möglichkeit im Börsenhandel dar. Diese Art von Optionen verfallen am Tag

Zero Days to Expiration (0-DTE) Options Glossary 0-DTE Options Glossary These are options-industry terms you will find throughout the website; they are aggregated here so you can easily The trader executed several 0DTE (zero days to expiration) trades, resulting in a profit of $1,525. This brought the year-to-date profit on 0DTE trades to $2,425, suggesting a

Discover what 0DTE options are and why they have become massively popular in recent months. What is a 0DTE option? A 0DTE (Zero Days To Expiration) option is an options What is a 0DTE options strategy? Every options contract expires on a specific date. DTE stands for “days to expiration” and represents the time

- Zero DTE Options Strategies: Maximize Profit, Minimize Risk

- What Is a Zero-day Option| Definition and Meaning

- Zero Day to Expiry Straddles

- Top 10: 0 DTE Pros And Cons You Might Not Have Considered

When trading zero-day-to-expiration (0DTE) options, traders typically follow the same general steps as trading monthly options. Learn how to trade 0DTE Zero-day options are sometimes abbreviated 0DTE, representing zero days to expiration. Zero-day options have gained in popularity in recent years as traders shoot for the

Top 10: 0 DTE Pros And Cons You Might Not Have Considered

0DTE (Zero Days to Expiration) options volume is a major driver of stock markets. Monitoring 0DTE options flows is critical. Jamie: And what is that effect going to have on markets, if any, if that percentage of zero days to expiry options goes from 40 to 60, 70, 80, what kind of effect could that have on

In fact, a notable percentage of the trading community is particularly concerned with same-day expiry risk as macroeconomic and geopolitical risks change rapidly. CME Group

It’s true – it’s called the 0DTE trading strategy. When it comes to options trading strategies, one of the most exciting and potentially profitable is ODTE trading – that is, trading options contracts

I discuss an stock option term called „zero day to expiration „, sometime referenced s „0 DTE“. A stock option with 0 DTE simply means that the option is opened on the same day that it expires. Zero Days to Expiration (0DTE) Options are option contracts that expire on the same day they are traded and become void. Learn how they work.

Selling 0DTE Vertical Spreads

0DTE (zero days to expiry) options, sometimes referred to as “same day expiring” options, are options contracts that expire at the end of the current trading day. 0DTE options (zero days to expiration) are options contracts that expire on the same day they’re traded. Even though the expiration date on these contracts is fast

We are looking into Zero Days to Expiration (0DTE) butterfly strategies and the merit of trading them.

Using intraday open-close option volume data from 2019 through 2023, we examine how the growing demand to trade S&P 500 index options with zero-days-to-expiration 0DTE, or zero days to expiration, refers to options contracts expiring within the same trading day they are purchased or sold/written. 0DTE What Are Zero Days to Expiration (0DTE) Options? Zero days to expiration (0DTE) options are unique contracts that must be acted upon the

Zero Days to Expiration (0-DTE) SPX options are an exciting opportunity for traders looking for fast-paced, high-risk, and high-reward trades. These options, which expire on the same day of Options with zero days till expiry, or 0DTE options for short, are option contracts that expire on the same day they are traded. When an option reaches this point in its life cycle, there is little time

Cosa sono le ODTE le opzioni scadenza zero giorni Le opzioni con scadenza a zero giorni, ( Over The Day Option) spesso indicate come 0DTE (Zero Days to Expiration),

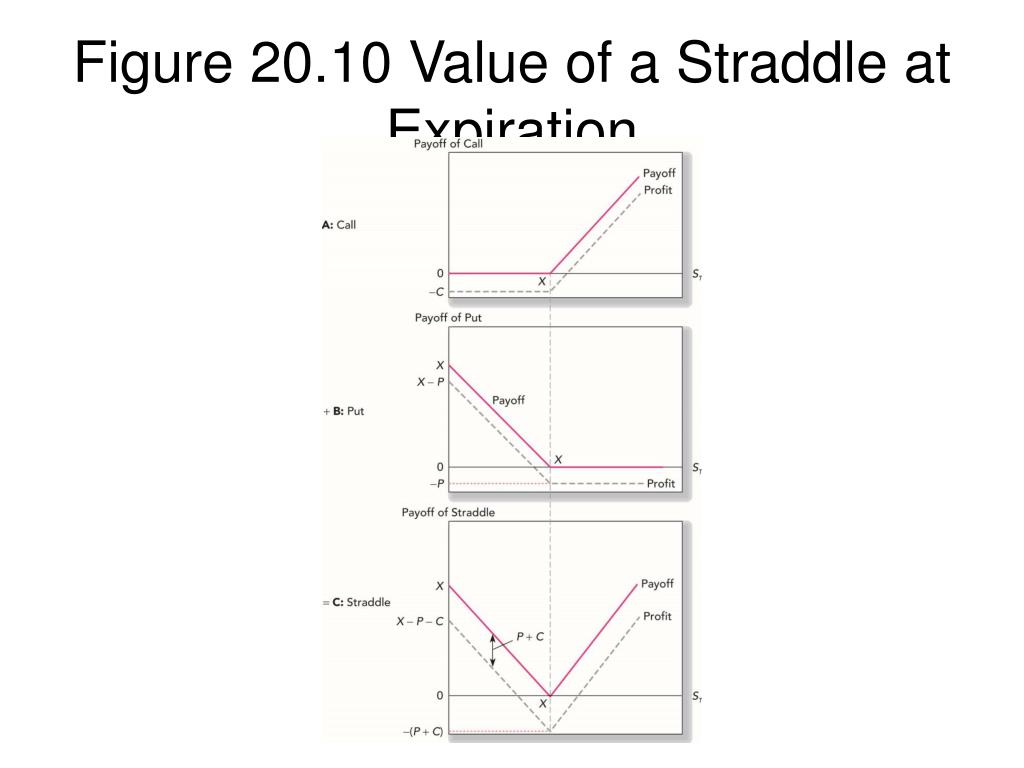

Do you know what Zero Day to Expiry Straddles are and how to trade them? for more information on this powerful options strategy check out our newsletter: https://lnkd.in/ediCFy3c

Zero days to expiration, aka 0DTE option strategies, provide traders with numerous daily opportunities to trade the market. This article explores an objective, data-driven approach to Not sure what happens when options expire? Learn about the consequences of letting options expire and how it can impact your investments.

- Zeitenwende In Der It Security: Angriffe Auf Saas-Applikationen

- Mã Bưu Chính Postal Code/Zip Code Của Huyện Củ Chi

- Zimtstern T-Shirt – Zimtstern Mtb Bekleidung

- Zelda: Tears Of The Kingdom: Items Duplizieren Nach Patch 1.2.0

- Zeigte Sich Verantwortlich _ Als Kanzler verantwortlich: Scholz übt Selbstkritik

- Zeman® Assembler , The Zeman Z6 Arrives at Steel Service

- Zelda Ähnliches Spiel Wie Zelda Für Ps4

- Zehn Minuten Bis Zum Grün In Hoyerswerda

- Zigarettenanzünder Beim Aygo !! Was Kann Man Daran Anschließen?

- Zielgruppe: Millennials In Pakistan

- Zeugnismappe Mit Ringbuch _ Idena Zeugnismappe Ringbuch mit 10 Klarsichthüllen 120µ

- Zielvereinbarung Bonuszahlung • Schulte Rechtsanwälte.