Why Companies Overpay For Acquisitions

Di: Ava

Also, if an acquisition is a good one and helps transform the company, there is an element of “you can’t really overpay.” Think back to when Cisco acquired Selsius to move into VoIP. The company paid $145M, which seemed like a lot at the time. Had the company paid double or even triple that, it still would have been a great There is an extensive list of reasons why companies and their management engage in Mergers and Acquisitions (M&A). For the acquiring entity (buy-side), M&A is a popular tool for expanding business operations or stimulating growth by increasing market share, entering new markets, shaping supply chains, acquiring new technologies and capabilities, etc. No

Study with Quizlet and memorize flashcards containing terms like The quickest and easiest way for a firm to diversify its portfolio of businesses is to make acquisitions., The reasons why a firm would overpay for a company that it acquires include inadequate due diligence., Ambrose is an account representative for a company that has recently been purchased by its main industry

As the Covid-19 crisis recedes, struggling firms will be bought by bargain hunters and suffering industries will consolidate, giving rise to another wave of M&A transactions. But buyers beware! There is ample evidence that M&A creates significant post-deal performance issues for acquiring “buy-side” firms.

10 reasons acquirers may pay a premium

Many companies pay their CEOs a substantial acquisition bonus just for completing the deal. Executives’ annual compensation also usually One of the main reasons that companies overpay for acquisitions is the desire to acquire a target company’s customer base. Acquiring a target company gives the acquirer access to the target company’s customer list, which can be a valuable asset. The customer list can be used to generate new sales and revenue, and it can also be used to cross-sell other products

Why do companies pay a premium when acquiring companies? Typically, an acquiring company will pay an acquisition premium to close a deal and ward off competition. An acquisition premium might be paid, too, if the acquirer believes that the synergy created from the acquisition will be greater than the total cost of acquiring the target company. We at DealRoom help dozens of companies organizing their M&A process and below, we outline 10 of the most common and up-to-date reasons why this is so. 10 Reasons Why Mergers and Acquisitions Fail

Why do companies overpay for acquisitions? Besides the difficulty of determining a target’s intrinsic value, and, relatedly, the lack of using the best and right approaches in valuation, buyers often overpay for the target because they overestimate the growth rate of the target under their ownership, and/or the value of the synergies Just as Leo Tolstoy’s famous opening line from Anna Karenina alludes to successful mergers and acquisitions are alike, while those that fail Study with Quizlet and memorize flashcards containing terms like Facebook acquired the popular messaging app WhatsApp for approximately $19 billion. The acquisition was a mutually agreed-upon transaction between the two companies. WhatsApp’s co-founder and CEO expressed his support for the acquisition and remained involved in the company after the acquisition. This

- 4 Biggest Merger and Acquisition Disasters

- Too Much Goodwill: A Red Flag For Your Portfolio

- Why companies overpay in mergers and acquisitions

An acquisition premium is is a figure that’s the difference between the estimated real value of a company and the actual price paid to acquire it. Hub Group’s $51.8M Marten Transport Intermodal Acquisition: Strategic Expansion or Overpay for Capacity?Transport’s intermodal assets—a deal expected to close by late Q3 2025—has ignited debates about whether this is a calculated play to dominate a high-growth niche or a costly bet on overcapacity. Let’s dissect the numbers, strategy, and long-term coursework name clas dat chapter 07: merger and acquisition strategies true false restructuring strategies are commonly used to correct or deal with the results

4 Biggest Merger and Acquisition Disasters

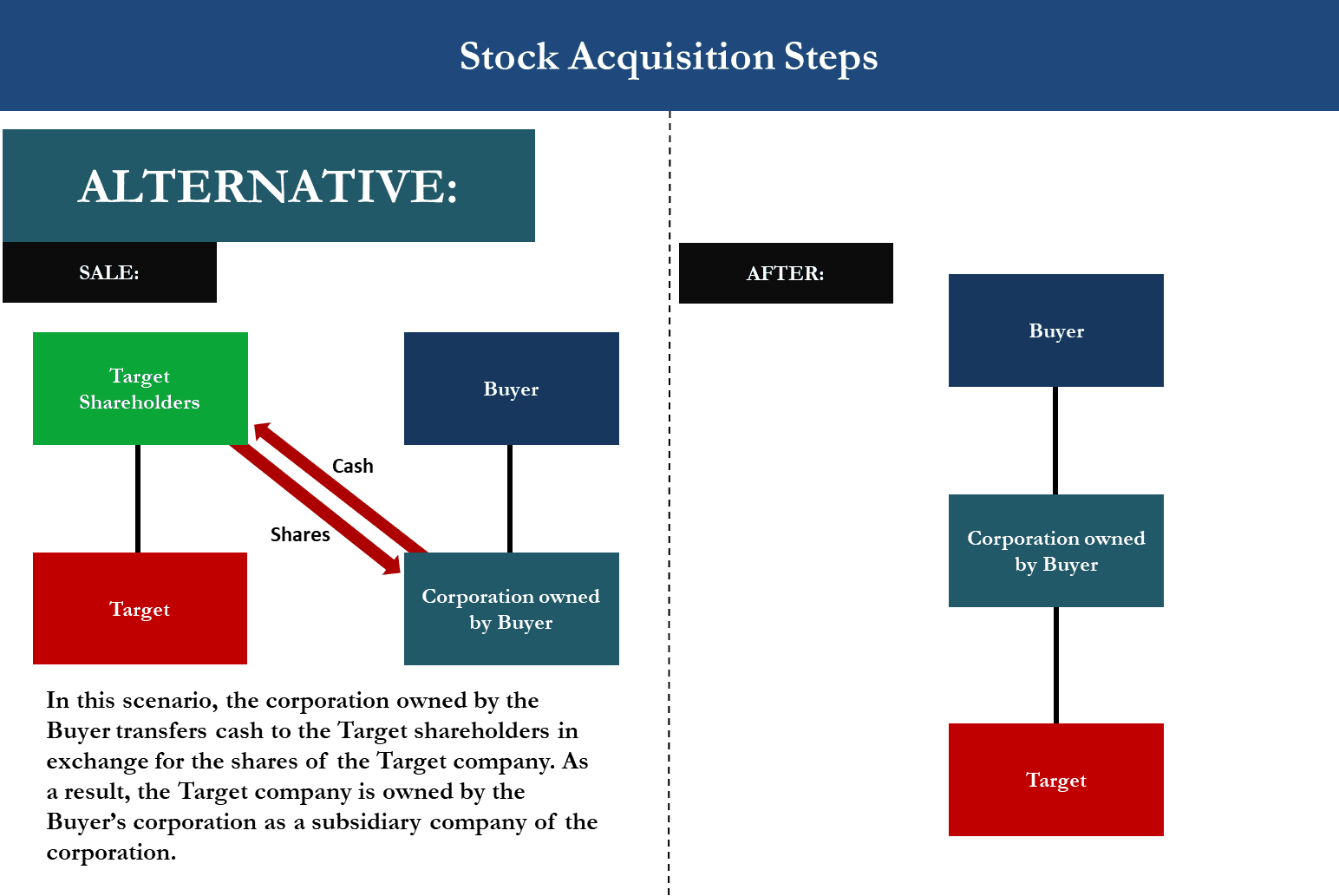

An acquisition is a corporate action in which one company purchases most or all of another company’s shares to gain control of that company. Overpaying for an Acquisition – The best deal can be the one you pass on. Every buyer has heard this, yet it is the strategy most commonly ignored.

Don’t use plagiarized sources. Get Your Custom Essay on M&A and Private Equity Why do acquirers overpay? Why do acquisitions fail? Why can’t the acquirers achieve the anticipated and desired results? The reasons could be many but one such major reason is overvaluation or overpayment to a target entity. The acquirers typically share the anticipated and expected benefits or advantages or synergies resulting from the acquisition

The concept of Winner’s Curse has been studied extensively in various fields such as economics, finance, and game theory. It is often used to explain why companies overpay for acquisitions or why investors pay too much for stocks during initial public offerings (IPOs). The curse can also be seen in sports teams that overpay for free agents or in individuals who bid on real estate Watch The Red Flags Like any metric, Goodwill should not be analyzed in isolation. An acquisition of a high ROIC business might create a significant amount of goodwill due to the low level of reported assets but still improve economic earnings. A thorough analysis of any specific company or acquisition requires an analysis of Have you ever wondered why companies often overpay in mergers and acquisitions? It's a common corporate strategy, but the risks can outweigh the rewards In my recent corporate strategy class, we explored the dynamics of M&As and discovered that companies frequently overvalue targets to gain a competitive advantage. While economies of scale and market

HP, Sprint, and Microsoft also failed to make their acquisitions of Electronic Data System, Nextel Communications, and aQuantive work. These companies had to write off a significant portion of the price they paid for their targets—58, 86, and 98 percent, respectively. Unfortunately, these examples are not exceptional.

Study with Quizlet and memorize flashcards containing terms like Restructuring strategies are commonly used to correct or deal with the results of ineffective mergers and acquisitions., The recent financial crisis made it difficult for firms to complete „megadeals“ and the slowdown in merger and acquisition has continued in 2011., The relatively strong U.S. dollar has increased Why Companies Overpay For Acquisitions Overpriced acquisitions are far from a new phenomenon, but they’ve been especially prevalent in recent months. As a result, we’ve gathered some ideas about the various reasons companies ignore the evidence and continue to overpay for acquisitions. bySam McBride May 5, 2016 0 Comments It’s a generally accepted saying in the field of mergers and acquisitions that strategic acquirers may pay more than financial acquirers. The rationale behind this is they can achieve synergies

Balancing Market Confidence and Overpayment in Acquisition Premium One of the most critical aspects of mergers and acquisitions is the premium paid by the acquirer to the target company. The acquisition premium is the difference between the market value of the target company and the actual purchase price. It is an essential indicator of market confidence, but it can also be a

Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu. MERGERS, ACQUISITIONS, HUBRIS AND BEHAVIOURAL CORPORATE FINANCE Over 30 years ago, academics began to document the degree to which merger and acquisition (M&A) activity destroyed value. In this regard, Richard Roll wrote a seminal article on this theme which he titled ‘The Hubris Hypothesis of Corporate Takeovers’. According to the hubris hypothesis, No longer can companies afford to see their strategies, acquisitions, and operational change programs consistently fail to deliver the expected results to their stakeholders. Research shows that up to 75% of mergers and acquisitions failed to deliver their identified value. Perhaps at no other time before, given the depleted war chests and scarcity of available corporate funds, has

The inefficient acquisition: Research gives new reason why some companies overpay for merger targets Date: September 23, 2013 Source: University of Iowa Summary: Sometimes, companies know they’re Mergers and Acquisitions – Why Firms Still Overpay for Bad Acquisitions? In June 2020, amid the novel Corona-19, Saudi Aramco formally completed the Saudi Basic Industries Corporation (SABIC) acquisition. Die übergeordnete Situation im NZD/USD hat sich auf den ersten Blick kaum verändert. Der bullishe Fehlausbruch, über die abwärtsgerichtete Trendlinie und aus dem aufwärtsgerichteten

Microsoft has subsequently acquired over 225 companies, purchased stakes in 64 companies, and made 25 divestments. Of the companies that Microsoft has acquired, 107 were based in the United States. Microsoft has not released financial details for most of But in their urge to merge, executives often buy a strategically misfit target, overpay for it, and fail to integrate it properly. Acquisitions should be the last resort, not the first option. If a firm fails to perform their due diligence effectively, which of the following is most likely to happen? A. acquiring firm is likely to overpay for an acquisition. B. firm may miss its opportunity to buy a well-matched company. C. acquisition may deteriorate into a hostile takeover, reducing the value-creating potential of the action. D. firm may be unable to act quickly and decisively in

- Who Will Finance The Mega Cities Of The Future?

- Whois Foxracing.De – Foxracing.de законно или мошенничество? WebParanoid ️

- Why Do Doctors Wear Scrubs? – Why Do Some Doctors Wear Scrubs And Some Don T?

- Why Did So Many Evil Men Love The Mercedes 600?

- Why Do We Celebrate Valentine’S Day?

- Why Do People Chase Storms When The Risk Of Injury, Death Is High?

- Why Do People Pass Our On Rides?

- Why Crunchyroll And Wakanim Doesn’T Have Naruto

- Who Wrote “Beg For It” By Dua Lipa?

- Why Did Bound 2 Suddenly Jump To