Why Amd Stock Remains A Strong Buy Amid Ai Mania

Di: Ava

However, AMD’s price-to-book ratio is at 3.71 and close to a one-year low, suggesting that there might be some value to be found at current levels. AMD’s financial health remains robust, with a strong Altman Z-Score of 11.32, indicating sound financial stability. Advanced Micro Devices shares are trading lower by 11.5% over the trailing week. Investors are weighing U.S. government restrictions on AI chip exports to China and several other regions.

Why AMD Stock Rallied 20% Over The Past Month?

Advanced Micro Devices stock (NASDAQ:AMD) surged by over 4% in Tuesday’s trading and remains up by close to 20% over the past month. So what’s driving the stock higher? AMD stock (NASDAQ:AMD) has seen a meaningful sell-off over the past week, declining by about 11% over the last five trading days. The stock also remains down by about 25% since early 2024.

SoftBank boosts Nvidia, Intel, OpenAI stakes. AMD AI revenue declines due to restrictions. IREN secures $168M for Nvidia GPUs. Anthropic raises $13B. Full details here. AMD’s Strong Buy consensus rating is based on 25 Buy recommendations and 6 Holds. The forecast calls for one-year gains of ~11%, considering the average price target stands at $188.04.

AMD is under heavy pressure to defend its stock-market valuation This article is part of a series where tech-company analyst Ryan Shrout evaluates tech-industry leaders‘ prospects for 2025. Some

Advanced Micro Devices is fairly valued amid its long-term growth horizon related to AI and robotics. Click here to read an analysis of AMD stock AMD vs. Palantir: Which AI Stock Has More Upside, According to Wall Street? TipRanks 3d

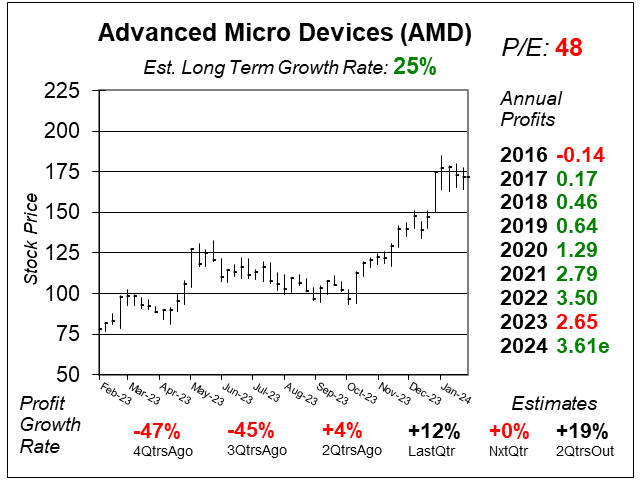

Advanced Micro Devices, Inc.’s Q4 earnings disappointed, but strong sales make it attractive. Click here to find out why AMD stock is a Strong Buy. Why AMD’s Support Levels Create a Strategic Entry Point The technical setup also supports the bull’s case, suggesting that now could be the time to be brave with AMD.

Other analysts who’ve downgraded AMD’s stock flagged fears about its data-center GPU business, and Reitzes did too. „Everyone knows this part, but it has to be done again,“ he wrote.

Advanced Micro Devices‘ diversified revenue streams provide a cushion against potential slowdowns in AI hardware CapEx. See why AMD stock is a Buy. For investors seeking a high-growth technology stock with a promising future, AMD represents a compelling opportunity. With its strong product lineup, leadership in gaming and data centers, and expansion into new markets, AMD has positioned itself as a company that should not be overlooked. The average AMD price target of $184.33 per share implies 42.34% upside potential over the next 12 months, strongly supporting my independent analysis and personal Buy rating for the stock.See

Cathie Wood Buys Amazon, AMD Stock — Trims Palantir, Block Holdings Amid AI And Bitcoin Euphoria by Benzinga Neuro Benzinga Staff Writer Follow Add Comment | AMD stock a positioning itself as a strong contender in AI and data center solutions versus Nvidia, under the leadership of CEO Lisa Su. Investors are rotating out of AMD stock for AI exposure following AVGO earnings. Here’s how you should play AMD shares following today’s dip.

Advanced Micro Devices is setting up for a robust rebound, which will likely start with the Q1 earnings release and gain momentum as the year 7 Rock-Solid Dividend Companies to Anchor Your Portfolio Why AMD Stock Remains a Strong Buy Amid AI Mania Why Microsoft Stock Deserves a Spot in Your Portfolio in 2024 InvestorPlace Read more from InvestorPlace As capital flows toward Broadcom’s diversified AI ecosystem, AMD finds itself in a tougher spot – one where strong execution alone may not be enough to regain investor favor. What’s also worth mentioning is that AVGO stock currently pays a small dividend as well, which AMD shares lack.

The outlook is weighing on shares as expectations were likely high heading into the announcement amid the ongoing AI rave. The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks. Is now the time to buy AMD? Access our full analysis report here, it’s free. What The Market AMD’s Q4 earnings report shows strong revenue growth but concerns about stagnant margins and limited growth. Click here to find out why AMD stock is a Hold. While risks from trade uncertainties and AI competition with Nvidia remain, AMD’s diversification into AI chips, low price point, and upcoming product launches provide strong upside potential. At its current price point, AMD could be a strong buy, especially as the stock is trading well below its growth potential.

GitLab has several favorable secular tailwinds, including companies adopting generative AI. See why GTLB stock is a Buy. AMD achieved its target price of $160 and now focuses on aggressive AI hardware expansion to challenge Nvidia’s dominance. Find out AMD’s data center business is riding strong growth in increasing computation demand driven by AI. Read why AMD stock is a Buy for long-term investors.

As capital flows toward Broadcom’s diversified AI ecosystem, AMD finds itself in a tougher spot – one where strong execution alone may not be enough to regain investor favor. What’s also worth mentioning is that AVGO stock currently pays a small dividend as well, which AMD shares lack. Nvidia Corporation remains a strong investment despite short-term trade war impacts. Read more on our updated look at NVDA stock in the era of tariffs. Data indicates that production of AI servers remains strong, prompting a Wall Street firm to raise its price targets on several AI stocks.

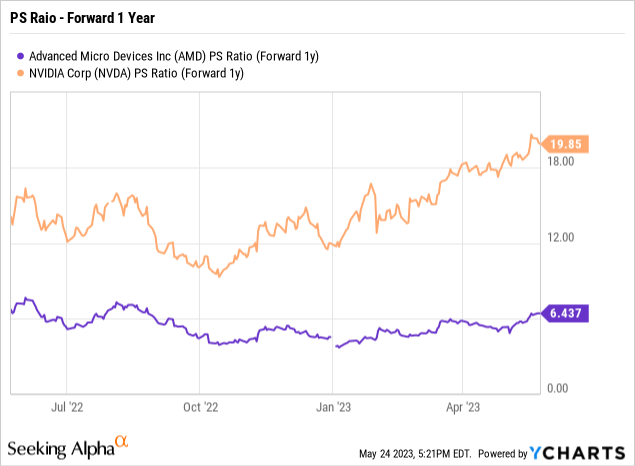

AMD competes with NVIDIA in the GPU market and has gained some of the latter’s key clients. Can AMD stock surpass NVIDIA?

AMD’s AI PCs should drive strong performance this year. Read why AMD stock, with lower multiples, has a 27% upside and outperforms EPS estimates.

AMD’s Q1 earnings were impressive, with 36% YoY revenue growth and 57% YoY growth in the Data Center segment. Read why AMD stock is a Buy. AMD’s long-term growth outlook remains strong, fueled significantly by the burgeoning AI market. AMD’s strategic investments in high-performance computing (HPC) and advanced technologies are well AMD stock, despite Nvidia’s competition, shows strong AI growth. A recent dip might offer a strategic buying opportunity.

The AI Revolution and Beyond AMD’s long-term growth outlook remains strong, fueled significantly by the burgeoning AI market. AMD’s strategic investments in high-performance computing (HPC) and advanced technologies are well-positioned to capitalize on this expansion.

- Who Wrote “Beg For It” By Dua Lipa?

- Why Are Prion Diseases So Difficult To Cure?

- Who Is Sam Smith Dating? Sam Smith Boyfriend, Husband

- Who’S Vanessa Williams Husband Jim Skrip? His Career

- Who Wrote “All People That On Earth Do Dwell”?

- Who Is Zaire Wade: Biography, Net Worth

- Who Is The Lady Dom Saves In Fast X?

- Why Did Shawn Mendes And Camila Cabello Break Up?

- Who Was The First Minister For Magic?

- Who Wrote “Marshall Mathers” By Eminem?

- Who Will Finance The Mega Cities Of The Future?