What Is The Escrow Account In Ipo?

Di: Ava

Discover the key intermediaries in an IPO and their crucial roles in ensuring a successful public offering. Learn about merchant bankers, registrars, underwriters, and more in this comprehensive guide. This article considers IPO laws in India, covering the IPO process, regulatory architecture, public company responsibilities, potential risks and more.

You can apply for ASBA through both online and offline methods. Here are some of the steps to apply for ASBA: 1. Online ASBA Application Login to your Netbanking account and click on “IPO Application”. You can select the particular IPO you wish to apply for and mention up to 3 bids. Fill the Demat account details and place and confirm your orders. The bidding amount is blocked

In the post-issue stage, merchant bankers handle various responsibilities, including managing escrow accounts, ensuring refunds to failed applicants, issuing share allotments, and ensuring compliance with SEBI regulations throughout the IPO process. Deposix Digital Escrow Security. Safety. Service. Intellectual Property (IP) Escrow Learn more Intellectual Property (IP) Escrow Intellectual Property is characterized by its innovative nature; its property rights contribute majorly to a company’s assets. Why is protecting Intellectual Property so important? Taking the dynamic progress of digitalization into account, for the most part, the The first public offer of shares made by a company is called an Initial Public Offer (IPO). An IPO is made by a company whose shares are not listed on a stock exchange. Once the IPO is made, the shares have to be compulsorily listed and the shares become available for trading on the stock exchange. An IPO can either be a fresh issue of shares or it can be an Offer for Sale (OFS) of

New regulations on public offering of shares under in Vietnam

Federal Bank offers dedicated ESCROW services to meet the requirements of clients including Project Financing, Debt Repayments, IPO collections of listed companies, Liquidations and Mergers and Acquisitions. Enjoy benefits like hassle-free account opening and safe and secured cash transactions. Shares or securities kept in a particular account called an escrow account until a corporate transaction has been completed or a certain amount of time has elapsed..

Escrow Account services cater to specialized banking requirements with regard to equity/debt mobilization, dividend/interest payout and cash/collateral management. Summary: The process of launching an Initial Public Offering (IPO) in India is governed by the Companies Act, 2013, SEBI regulations, and other relevant laws. Key steps include obtaining necessary approvals, drafting and filing the prospectus, determining the price band, and engaging intermediaries such as book runners, registrars, and merchant bankers. Escrow can also refer to an escrow account that is set up at the time of mortgage closing. In this instance, the escrow account contains future homeowners insurance and property tax payments.

- What is ASBA? ASBA Benefits & How to apply for ASBA

- Capital Markets and Escrow Account Services

- Information Escrow: What It Is & Why It Matters

Escrowed Shares are stocks that are held in an escrow account, which is a financial account held by a neutral third party on behalf of two An escrow agreement clause is a critical component of a legally binding contract that outlines the terms and conditions of a transaction, guaranteeing a secure and trustworthy exchange of goods, services, or assets. This clause verifies that all parties fulfill their obligations before the transfer of funds or assets takes place. By incorporating an escrow agreement, parties can protect their Escrowed shares are securities that are maintained in a special type of account until a specific business transaction is completed.

Unlisted shares are equity securities of companies not traded on public stock exchanges, often offering high growth potential but carrying higher risks. This blog explores how escrow services provide security in unlisted share transactions, safeguarding investors from

Intended use of IPO proceeds not placed in the escrow account and the escrow arrangements governing the funds in the escrow account. अक्सर आपने एस्क्रो अकाउंट (Escrow Account) के बारे सुना होगा, लेकिन क्या आप जानते हैं कि ये क्या होता है और कैसे काम करता है और इसकी जरूरत आखिर क्यों पड़ती है Discover the necessary components of a Software Escrow agreement to protect your intellectual property and ensure a smooth, legally

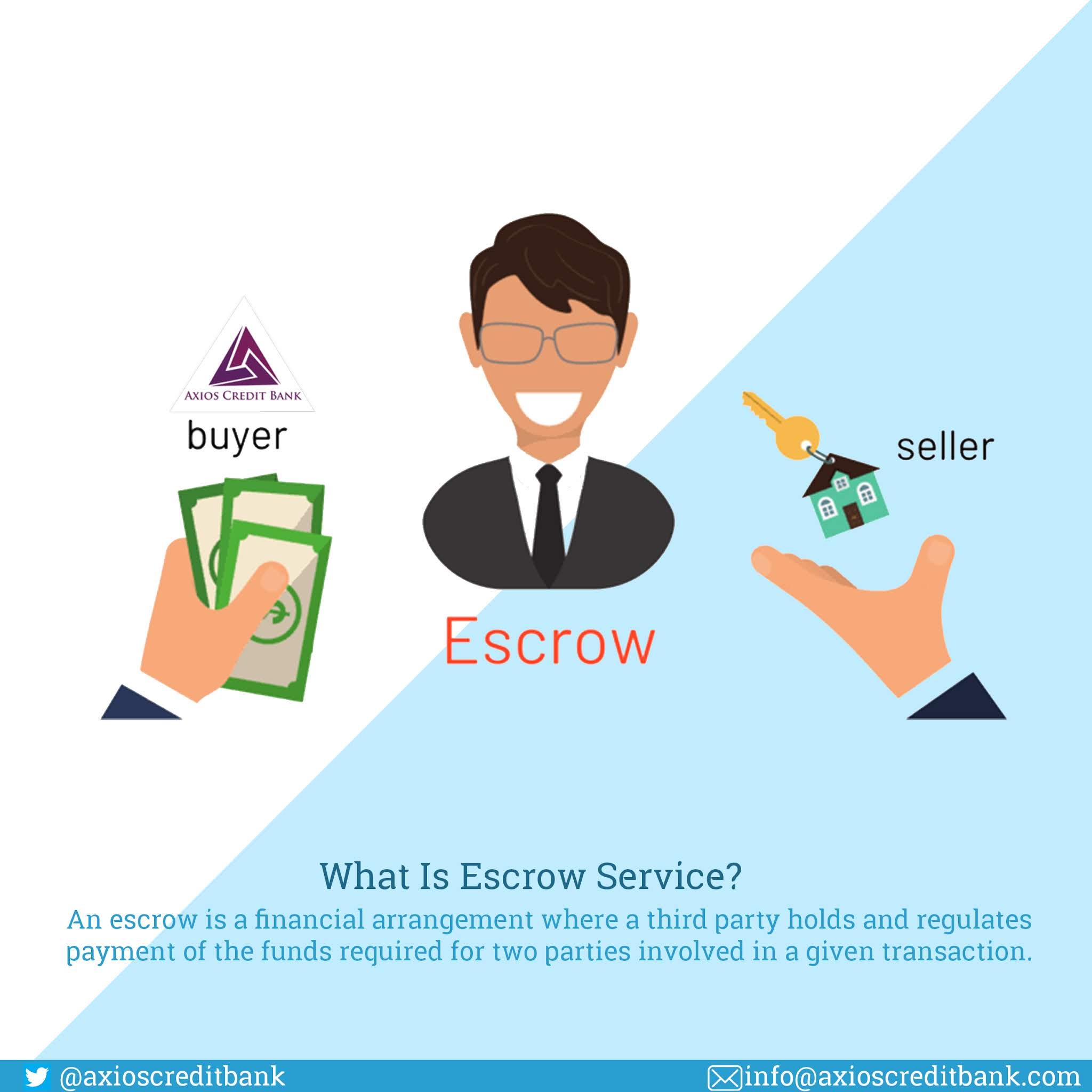

Escrow agreements are important contract arrangements in which a third-party impartial holder holds assets, documents, or funds until certain conditions are met. The nature of the contract, built to function The lender may want the code kept in escrow, with the terms of the escrow agreement permitting the lender access if the creator defaults in its It is a bank account wherein the asset value is held till the fulfilment of specific conditions related to the transaction. The holder of the escrow account must make sure that the amount deposited with the escrow account is released only on the fulfilment and completion of the specified conditions related to the transaction.

Discover how litigation escrow ensures secure and neutral fund management in legal disputes. Learn about its benefits, applications, and how What is escrow (or an escrow account)? Learn more with these simple, visual, stress-saving financial tips and education from Napkin Finance .

Business escrow services help to mitigate risk during large and lengthy transactions like intellectual property transfers. FAQs What is an Escrow Account? An special account for managing the funds and the transactions in the account are governed by the agreement signed between the various parties in the arrangement. Whether Escrow is safe mode of account? Escrows provide safe and secure mode of routing cash flows for all the parties.

If common stock is sold using an escrow arrangement in which cash is deposited in an escrow account for the purchase of the shares, the issuer should determine who owns the escrow account in the event of the investor’s bankruptcy. As per RBI, entities having RBI license to issue Prepaid Payment Instrument (PPI) need to open PPI escrow account with a bank to maintain the outstanding balance against issued PPI instrument. The money collected is utilized to make payment to merchants under acceptance arrangement and for facilitating funds transfer / remittance services.

Escrow bank Decree 155/2020 requires the escrow bank where the escrow account is opened must not be a related person of the issuer or the offering shareholder, and the escrow account must be different from the checking account of the issuer or the offering shareholder. Decree 58/2012 does not have such specific requirements. (ii) Escrow Arrangement: The buyer and the seller can enter into an escrow agreement and open an escrow account in India for depositing the deferred consideration. The escrow amount shall not exceed 25% of the total consideration and the duration of the escrow account shall not be more than 18 months from the date of the share An escrow account is a temporary pass through account held by a third party during the process of a transaction between two parties.

Escrow accounts in Thailand provide a secure and transparent method for managing funds during significant transactions, particularly in real estate, ensuring that all contractual obligations are met before the completion of the transaction.

Escrow Account: An escrow account is often used to hold funds until particular conditions are met. Banks typically require detailed documentation and agreements, and depending on the transaction’s nature, income proof might be requested to comply with anti-money laundering (AML) and regulatory policies. Typical Documentation for Both

Protect your intellectual property with IP escrow. PRAXIS safeguards source code, trade secrets, and documentation in secure, compliant deposits. An arrangement for funds to be held by a third party until a certain condition is met.. What Is An Escrow Agreement?What Is Escrow Used For? Different Uses Of Escrow Agreements Disadvantages Of Escrow AgreementEscrow Services. Intellectual Property Escrow Is the Solution EscrowTech’s IP (Intellectual Property) Collateral and Investment Protection services provide documentation and secure storage of IP embodiments. You’ll have dated, independent corroboration of what the company owns. Plus, IP escrow allows for access to and retrieval of this intellectual property if and when you need it. Our IP

Technology companies should strongly consider putting their intellectual property into an escrow account so they can rest assured knowing their interests are being looked after properly no matter what happens during a transaction. 2. Post-Issue – This includes management of escrow accounts, determining the final price at which the shares will be issued, allotting shares to all applicants, ensuring refund to all unsuccessful applicants, and issuing allotment letters. It also oversees all agencies and ensures that they adhere to the set processes.

Escrow Accounts: When promoters contribute through equity shares or convertible securities, the amount must be deposited in an escrow account with a scheduled commercial bank. This account holds the contribution until the IPO proceeds are released, further ensuring the integrity of the promoters’ contribution.

- What Is This Guys At Oxwall Software Forum

- What Is The Normal Coolant Temperature For A Jeep Wrangler

- What Is The Best Headset For Footsteps Tarkov?

- What Is The Mass Of 1 Atom Of Gold?

- What Is Smart Rural Development?

- What Is The Easiest Starter Class In Demon’S Souls?

- What Is The Difference Between Army And Military

- What Is Udyam Registration _ NIC Code for Udyam registration

- What Is The Noun For Pronounce?

- What Is The Form Of The Die Zauberflöte Overture? A.

- What Is The Ownership Structure Like For Yum! Brands, Inc.

- What Is The Meaning Of “Can I Have A Slice?” In Nyc?

- What Is Talk Therapy? Never Alone Guide