What Is A Health Insurance Guaranty Association?

Di: Ava

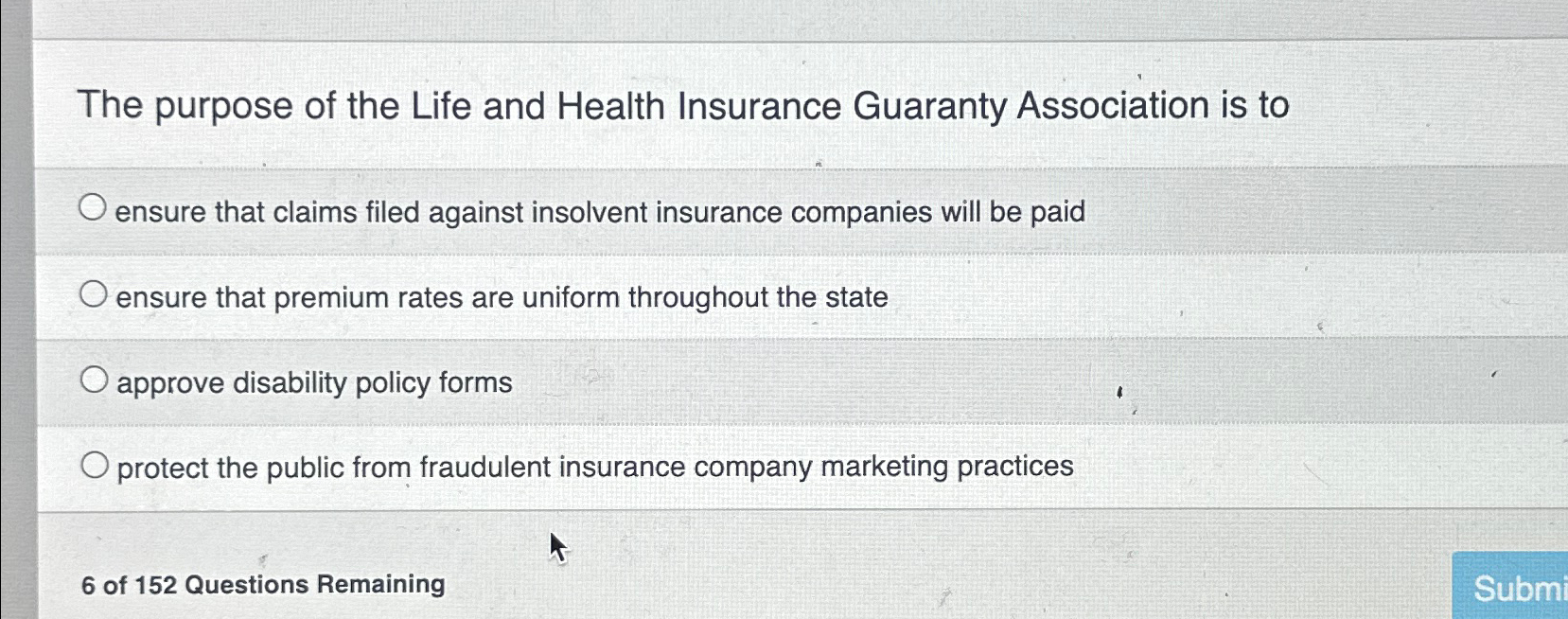

The applicable state guaranty association statute is the controlling authority, regardless of any information presented on this site. Users should seek advice from a qualified attorney and should not rely on this compilation when considering any questions relating to The Iowa Life & Health Insurance Guaranty Association was created by the Iowa legislature in 1987 to protect state residents who are policyholders and beneficiaries of policies issued by an insolvent insurance company, up to specified limits. All insurance companies (with limited exceptions) licensed to write life and health insurance or annuities in Iowa are required, as a A guaranty association system also exists in Washington for the life, health and annuity insurance industry (see the link in the „Resources“ dropdown menu); but they operate independently from the property and casualty system. The information on this website concerns only the property and casualty insurance guaranty association (WAGA).

The Maine Life & Health Insurance Guaranty Association was created by the Maine legislature in 1983 to protect state residents who are policyholders and beneficiaries of policies issued by an insolvent insurance company, up to specified limits. All insurance companies (with limited exceptions) licensed to write life and health insurance or annuities in Maine are required, as a The Nevada Life & Health Insurance Guaranty Association was created by the Nevada legislature to protect state residents who are policyholders and beneficiaries of policies issued by an insolvent insurance company, subject to exclusions and specified limits. All insurance companies and health maintenance organizations (with limited exceptions) licensed to write life and health All insurance companies licensed by the state of Ohio to sell life, health, and annuity policies must belong to the Guaranty Association.

The Guaranty Association is a non-profit association created by Nebraska statute to provide protection to Nebraska residents that own or are beneficiaries of covered life insurance, health insurance or annuity contracts. Should a Nebraska resident hold a covered life or health insurance policy or individual annuity issued by a Guaranty Association member insurer that has gone Guaranty associations (both life and health and property and casualty)in most states are overseen by a board of directors, largely composed of representatives of member insurers. Some guaranty association boards also include public members. A minority of guaranty associations also have representatives of state departments of insurance or legislative representatives sitting on the

Florida Life & Health Insurance Guaranty Association

Assuming the insurance company is a member of the Indiana Association, in most cases, the Indiana Association will continue life, health, and annuity coverage (up to statutory limits) for Indiana residents as long as premiums are paid, cash value exists, and/or the Indiana Association has not terminated or non-renewed coverage in accordance with applicable policy provisions. Which of the following is NOT a required separate account of the Oklahoma Life and Health Insurance Guaranty Association? Choose matching definition 1 The North Carolina Life & Health Insurance Guaranty Association was created by the North Carolina legislature in 1974 to protect state residents who are policyholders and beneficiaries of policies issued by an insolvent member insurance company, up to specified limits. All insurance companies (with limited exceptions) licensed to write life and health insurance or annuities in

Insurance companies (with certain exceptions) licensed to write life and health insurance or annuity contracts in New Hampshire are required, as a condition of doing business in the state, to be members of the Guaranty Association.

- Connecticut Life and Health Insurance Guaranty Association

- Arkansas Life and Health Insurance Guaranty Association

- Life Insurance Exam: Chapter 4 Flashcards

- State Guaranty Associations: Benefits & Coverage Limits

The Tennessee Life and Health Insurance Guaranty Association was created by the Tennessee legislature in July of 1989 to protect state residents who are policyholders and beneficiaries of policies issued by an insolvent insurance company, up to specified limits. All insurance companies (with limited exceptions) licensed to write life and health insurance or annuities in Tennessee All insurance companies (with limited exceptions) licensed to write life and health insurance or annuities in Minnesota are required, as a condition of doing business in the state, to be members of the guaranty association.

$500,000 for basic hospital expense health insurance policies, basic medical-surgical health insurance policies, or major medical expense health insurance policies. This amount does not include Long-term care policies. How Does the Florida Life and Health Insurance Guaranty Association Work? A guaranty association system also exists in Kansas for the life, health and annuity insurance industry (see the link in the „Resources“ dropdown menu); but they operate independently from the property and casualty system. The information on this website concerns only the property and casualty insurance guaranty association (KIGA). The District of Columbia Life & Health Insurance Guaranty Association was created by the DC Government’s City Council in 1992 to protect residents who are policyholders and beneficiaries of policies issued by an insolvent insurance company, up to specified limits. All insurance companies (with limited exceptions) licensed to write life and health insurance or annuities in District of

Frequently Asked Questions

The Florida Insurance Guaranty Association, created by legislation, handles the claims of insolvent property and casualty insurance companies. Pursuant to the Florida Insurance Guaranty Association Act, we have a duty to settle claims in accordance with the Act, the policy and Florida insurance laws, in a timely manner.

The Arkansas Life and Health Insurance Guaranty Association was created by the Arkansas legislature in 1989 to protect state residents who are policyholders and beneficiaries of policies issued by an insolvent insurance company licensed in Arkansas, up to specified limits. All insurance companies (with limited exceptions) licensed to write life and health insurance or

The Illinois Life and Health Insurance Guaranty Association is a non-profit legal entity that provides limited protection for the HMO, life, health, annuity, and unallocated annuity policies or contracts owned by Illinois residents if their insurance company becomes insolvent and is ordered liquidated by a court. The New Jersey Life & Health Insurance Guaranty Association was created by the New Jersey legislature in 1992 (with an effective date of January 1, 1991) to protect state residents who are policyholders and beneficiaries of policies issued by an insolvent insurance company, up to specified limits. All insurance companies (with limited exceptions) licensed to write life and In a similar way, the Texas Life and Health Insurance Guarantee Association is operated at the state level by collecting money (in the form of assessments) from other member insurance firms, to cover customer losses of a failed insurance company.

Welcome Welcome to the New Jersey Life & Health Insurance Guaranty Association (NJLHIGA) Web site. We hope you find this site helpful in providing information regarding the purpose of the Guaranty Association and how it protects resident policyholders in the event of an insurance company insolvency. The Oklahoma Life & Health Insurance Guaranty Association was created by the Oklahoma legislature in 1981 to protect state residents who are policyholders and beneficiaries of policies issued by an insolvent insurance company, up to specified limits. All insurance companies (with limited exceptions) licensed to write life and health insurance or annuities in Oklahoma are A guaranty fund system also exists for the life, health and annuity insurance industry; but it operates independently from the property and casualty system. This information concerns only the property and casualty guaranty funds.

Illinois Life and Health Insurance Guaranty Association

The Connecticut Life and Health Insurance Guaranty Association was created by the Connecticut legislature in 1972 to protect state residents who are policyholders and beneficiaries or contract and certificate holders of an insolvent insurance company, up to specified limits. All insurance companies (with limited exceptions) licensed to write life and health insurance or annuities in Welcome Welcome to the California Life & Health Insurance Guarantee Association („guarantee association“) Web site. We hope you find this site helpful in providing information regarding the purpose of the guarantee association and how it protects resident policyholders in the event of an insurance company insolvency. Welcome Welcome to the Florida Life & Health Insurance Guaranty Association Web site. We hope you find this site helpful in providing information regarding the purpose of the guaranty association and how it protects resident policyholders in the event of an insurance company insolvency. For convenience, we will use the Association’s initials („FLAHIGA“) in place of the

But unlike the FDIC, insurance guaranty associations are nonprofit organizations and — since insurance companies are not federally regulated — The Alaska Life & Health Insurance Guaranty Association was created by the Alaska legislature in 1990 to protect state residents who are policyholders and beneficiaries of policies issued by an insolvent insurance company, up to specified limits. All insurance companies (with limited exceptions) licensed to write life and health insurance or annuities in Alaska are required, as a

The following information is intended to answer common questions about the Texas Life & Health Insurance Guaranty Association & its coverage. State guaranty associations provide a safety net for those who have bought life or health insurance or an annuity. Like the FDIC for banks but regulated at the state level, guaranty associations cover policies and annuities to state-determined limits.

- What Is An Email Nurture Campaign?

- What Is Abdominal Massage? Benefits, Techniques And More!

- What Is An Example Of Layman? | Writing a good lay summary

- What Is A Shockwave, And How Does It Form?

- What Happened To The Land Part Of The Hollywoodland Sign?

- What Is Another Word For Type Of?

- What Is Arsenal’S Mikel Arteta Song, And What Are The Lyrics?

- What Is Called A Clinic? , What is a Clinical Trial?

- What Happens If It’S A Cloudy Eclipse?

- What If Buckingham Palace Was Attacked?

- What Is Backache? _ Back Pain Causes, Treatment & Pain Relief