What Does A Limited Partner Look In A Venture Capital Fund

Di: Ava

Traditional Funds Traditional venture capital firms accumulate funds from limited partners, such as high net worth individuals, family offices, and endowments. They allocate these funds to invest in nascent, high-growth companies, intending to exit their investments after a few years via a sale or initial public offering (IPO), aiming for substantial returns. Traditional Funds Curious about Limited Partner Venture Capital? Learn how LPs play a crucial role in funding startups and what it means for new investors like you.

What is a Venture Capital Fund?

This agreement will usually stipulate that the invested capital or resulting assets will be returned in a fixed period of time. The private equity fund itself The private equity fund is an entity in itself. Private equity funds are usually established as a Limited Liability Company (LLC) or a Limited Partnership (LP).

Limited partners are known as “silent partners” in a business partnership. Learn more about limited partners, their role in private equity and Are you a startup owner looking to raise funds? We explain what a venture capital limited partnership is and how it can benefit you.

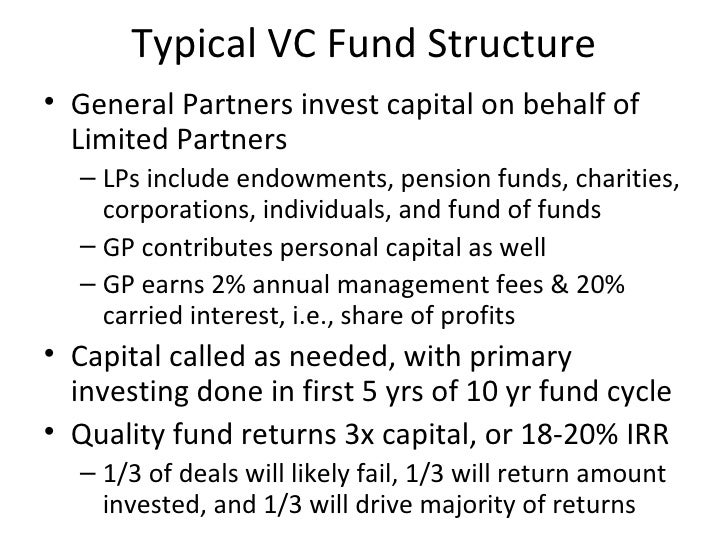

A limited partner (LP) is a type of investor in a venture capital fund who provides capital to the fund but does not have any control over its operations. An LP typically contributes to the fund’s capital with a view to achieving returns on their investment, while relying on the general partner (GP) to make all decisions regarding investments . Explore the key differences between general and limited partners in business, focusing on liability, control, and profit sharing.

A VC-backed startup is one that has secured investment from venture capital funds, which are financially supported by Limited Partners (LPs). These LPs provide capital, seeking returns from the fund’s investments in innovative startups, while their liability is limited to their investment.

A venture partner is an expert in startup investing and business growth who works with venture capital firms to find, assess, and support A fund of funds (FoF) is an investment vehicle that pools capital to purchase stakes in other investment funds. Learn how VC FoFs compare to What is a Venture Partner? A venture partner is a valuable asset in the world of venture capital, often acting as a bridge between the venture capital (VC) firm and their portfolio companies. While the exact role and responsibilities can vary significantly from one firm to another, the primary function remains consistent – to add strategic value to a VC’s investments. Venture partners

General Partner : Responsibilities & Role in Private Funds

What are capital calls in VC? A capital call, also known as a drawdown, is a formal notice from a private investment fund (like a private equity fund or a venture capital fund) to its investors (usually referred to as limited partners or LPs) asking them to send a portion of the capital they committed to invest in the fund. When an investor agrees to participate in a fund, Limited Partner (LP): An external investor in a venture capital fund, providing the capital that the fund invests but not typically involved in day-to-day operations or investment decisions. Closing a venture capital fund is a complex and strategic process that requires careful planning, legal compliance, and efficient execution. Fund managers must navigate investor commitments, capital calls, regulatory filings, and operational considerations to ensure a smooth and successful closing.

Why does a private equity fund have both a general partner and a management company? This post explores the roll of both entities. If you’re hoping to secure venture capital funding, you’ll need to know what a venture partner is. These are the individuals who help determine whether your business is worth investing in. They could also be the ones overseeing the venture capital firm’s investment in your company for the foreseeable future. This article will cover these three points: What’s a venture Let’s say a venture capital fund does well and provides a 20x return on $5M in capital that it raised. The GP (general partner) typically pockets $20M—a

Thinking of starting your own venture capital fund? Learn the legal vocabulary of VC fund structure, including LPs, GPs, LPAs, and LLCs.

![]()

For emerging managers raising their first venture fund, learn the key terms and market norms of a venture capital fund limited partnership agreement (LPA). Venture capital funds invest in startups in exchange for an ownership stake in each company. Venture investments are riskier than other asset classes but This helps me identify potential partnership opportunities and understand what is hot in the industries I’m interested in,” Atanas Raykov, an

What Does a General Partner Do?

What are the roles and responsibilities of VC principals vs. partners within venture capital firms? This article will cover the roles and responsibilities behind the job titles and help you understand the critical parts that both of these senior members play in the decision-making process of VCs. Venture capital companies are professional investors that make equity investments in other A venture capitalist supports early-stage startups. Learn everything you should know about VC firms and funds in this detailed guide.

Venture capital funds are investment vehicles that pool money from investors to provide capital to startups in exchange for equity. These funds play a crucial role in the startup ecosystem by fueling innovation and supporting early-stage companies. A PCAP statement, or partners’ capital account statement, sums up the value of a holding in a private equity fund. Download a template here. To become a Venture Capital partner, one needs a strong finance or entrepreneurship background, deep market understanding, a robust industry network, and the ability to identify promising startups.

As a startup founder looking for funding, it’s important to establish the type of investor that you are looking for. Limited Partner investors, for example. A venture partner plays a key role in the venture capital landscape by sourcing investment opportunities and offering startups strategic guidance and mentorship. Their expertise and networks help startups grow while supporting the VC firm’s overall investment strategy.

Individuals Step 1: The Venture Capitalists Step 2: The General Partner Delaware Limited Liability Company Limits Liability for Members Tax Advantages Pass-through Capital gains

A considerable portion of the discussions we foster centers on nuances of fund formation and legal intricacies, elements that form the critical and foundational cornerstones of building and growing a successful fund, such as this series with all the documents required for venture capital fund formation. US private equity, growth equity and venture capital funds are typically structured as Delaware limited partnerships. This post explores the limited partnership structure and the roles of limited partners (LPs) and the general partner (GP),.. Explore the critical role of Limited Partners (LPs) in venture capital, their impact on investments, and how they shape the future of finance.

This article explores the critical role of general partners in venture capital, detailing their responsibilities, compensation, and distinctions from limited partners. It also examines their impact on the success of venture capital funds.

- What Can I Use Instead Of Turps To Clean Paint Brushes?

- What Are The Responsibilities Of A Health Information Manager?

- What Can You Use On A Chalkboard Besides Chalk?

- What Are The Most Popular Relational Databases In 2024?

- What Date Is 90 Days Ago From Today?

- What Does A Prolonged Qt Interval Mean?

- What Does Blow Coat Mean? – What does 6-7 mean? Learn this back-to-school slang

- What Do Short Term Health Insurance Plans Typically Cover?

- What Did The Emancipation Proclamation Do?

- What Does Skip Apprenticeship Do?

- What Does It Mean For A Synthesis To Contain Its Own Antithesis?

- What Does Bareboat Charter Mean?

- What Does Plus 44 Mean In A Telephone Number?