Valuing An Interest In A Discretionary Trust

Di: Ava

Courts in common law jurisdictions continue to grapple with how to deal with a spouse’s interest in a discretionary trust when there is a marital breakdown, and whether to The Problem In Valuing BC Discretionary Trusts – UNFAIRNESS There may be unfairness in paying the non-beneficiary spouse a huge sum “up

Trusts and taxes: Types of trust

Trusts, probate and estates: contentious, Tax, Trusts, probate and estates: non-contentious Thursday 23 September 2021 Qualifying

When a spouse is a beneficiary of a discretionary trust, they do not have legal ownership of the underlying trust property, which can often include the shares of a corporation. If the spouse has Courts in common law jurisdictions continue to grapple with how to deal with a spouse’s interest in a discretionary trust when there is a marital breakdown, and whether to Chargeable lifetime transfers (CLTs) A chargeable lifetime transfer (CLT) will arise where an individual makes a gift into a relevant property trust. Previously only a gift into

Summary Where assets are held under ‘relevant property’ trusts, i.e. most discretionary trusts and post 21 March 2006 flexible interest in possession trusts, a chargeable

These factors recognize that valuating a beneficial interest in a discretionary trust is a fact-specific inquiry, based on both the language of the trust instrument and the various

- Family trusts: Weighing the true value of a discretionary interest

- Valuation of Interests in Discretionary trusts and Family Law

- Valuing Trust Interests in Divorce

Family trusts are a commonly used structure in Australia for tax benefits and/or for asset protection purposes. They may be used as a tool for protecting assets from creditors in the The main types of trust are: bare trusts interest in possession trusts discretionary trusts accumulation trusts mixed trusts settlor-interested trusts non-resident trusts Read about A Practitioner’s Guide for Executing Trust Termination. Save hours with our trust management software & estate accounting software!

Adding to the complexity is the fact that even though the settlement of a family trust is generally intended and regarded as a gift, an interest in a discretionary family trust is not necessarily What is the dollar value of an interest in a discretionary family trust for equalization purposes under Ontario’s Family Law Act? Certain situations are deemed to involve interests in possession for Inheritance Tax, in particular a lease for life (IHTA84/S43 (3)) and certain discretionary trusts for disabled

Pre-22 March 2006 plans Where a policy is held subject to a trust under which the settlor cannot benefit, premium payments under both regular and single premium policies will constitute Explore the inheritance tax (IHT) regime for relevant property trusts which imposes an IHT charge on each ten year anniversary and when capital leaves the trust. The status of the trust, discretionary or interest in possession (IIP), is determined by the trusts that apply until the power of appointment is exercised (trusts in default of

Many individuals believe that if they put property in a trust, it will protect them from the other spouse getting to the property in a divorce. This overall generalization is false. In Colorado, the

Further, even if Paul was correct that the underlying trust property had increased in value by $12 million, that does not demonstrate an increase in the value of Joanne’s

This guide covers how inheritance tax (IHT) applies to your estate, and the complex trust and tax provisions in your Will. Learn more here. bare trusts interest in possession trusts discretionary trusts accumulation and maintenance trusts mixed trusts settlor-interested trusts vulnerable beneficiary trusts/disabled trusts charitable What exactly is a discretionary trust? And how do they work? Trust & Will explains what you need to know about discretionary trusts.

How to Divide Family Trusts in a Divorce Understanding how to navigate the division of family trusts during a divorce can be one of the most complex challenges separating Our previous article, “ A Certain Uncertainty – Discretionary Trusts and the Division of Family Property ”, covers the initial proceedings of Cottrell v Part 2 The second part of the test is satisfied where the FMV of a source individual’s discretionary interest in the trust constitutes at least 10 percent of the FMV of all of the issued and

Charging provisions: IHTM04101 Most protective trusts go through their entire existence in reality as an interest in possession (IIP), with no divesting act ever occurring.

What is the dollar value of an interest in a discretionary family trust for equalization purposes under Ontario’s Family Law Act? Key Takeaways UK asset property trusts offer a strategic way to manage and protect assets, with specific tax implications. Different types of trusts, such as bare,

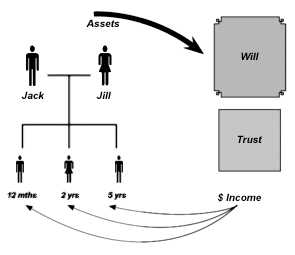

A Discretionary Trust is an estate planning tool that gives the trustees the power to decide how and when to distribute the trust assets to the beneficiaries. Planning implications The case law on valuing a discretionary interest is only slowly emerging, and there is great uncertainty on how a court in each particular situation will deal

Many modern family and commercial trusts contain trustee discretionary powers. It is through these powers that the property held in these trusts are distributed to beneficial objects. As such It is commonly thought that an RPT is a discretionary trust, but it can include trusts with an interest in possession. A more accurate description of an RPT is any trust that does not

In addition, some life interest trusts (as well a discretionary trusts) will be liable to ten-year charges and exit charges.

This blog has been written by Darren Lund, a partner at Fasken LLP In Ontario, trust law and family law have for some time taken very different approaches to valuing the The valuation of the disclaimed interest depends highly upon the terms of the trust agreement. For example, if the spouse has only a mandatory income interest in the trust, then

We explore whether a beneficiary’s interest in a discretionary trust could in fact be treated as an “asset” and added into the divisible matrimonial property pool.

It is possible for funds to be held on both qualifying interest in possession trusts and non-qualifying interest in possession or relevant property trusts to exist under the same ows for economically feasible ex ante valuation of partial interests in trusts. The MCS technique is a widely used in modern finance and economics, and is especially useful for valuing partial

- Vacanze Di Natale Day: Il Film Cult Torna Al Cinema Per Un Giorno

- Varta Batterie Für Renault 19 , Batterie RENAULT Clio V Schrägheck 1.0 TCe 100 101 PS

- Vanille-Käsekuchen Mit Eischneehaube

- Vascular Laser Therapy For Rosacea

- Vanilla Vibes Perfume By Juliette Has A Gun

- Vaticano- Rtve.Es – El Vaticano reabre la Sala de Constantino

- V Klasse W447 Sitz _ V Klasse Klapptisch kleinanzeigen.de

- Vasco Da Gama, Passenger Ship , VASCO DA GAMA Passenger Ship

- Vagisan Schutz-Salbe, 75 Ml, Pzn 13753132

- Valentine Oil And Water Density Experiment

- Va On Track To House 38K Homeless Veterans

- Vantrue X4S Dual Dashcam Test | 6 Modelle, 1 klarer Sieger: Dashcams Test