The Triangular Arbitrage Opportunity

Di: Ava

This post explores triangular arbitrage opportunities on multiple exchanges to see if it’s still something profitable and worthwile to do.

Arbiscan is a tool to find triangular arbitrage opportunities between multiple cryptoexchanges.

Quiz 6 Triangular Arbitrage

This document discusses triangular arbitrage opportunities between the US dollar, euro, and Canadian dollar given exchange rates in London and New York. It finds that doing the arbitrage We first review our previous work, showing what is the triangular arbitrage transaction and how to quantify the triangular arbitrage opportunity. Next we explain that the Triangular Arbitrage Monitor is a mobile-first web application built with React 19 that enables users to monitor potential arbitrage opportunities across three tokens on the

This leads to a long list of triangular crypto trading opportunities that can be leveraged for taking advantage of market efficiencies. How to get started with triangular Identifying Triangular Arbitrage Opportunities Triangular arbitrage opportunities can be identified by analyzing exchange rates across trading pairs and calculating potential

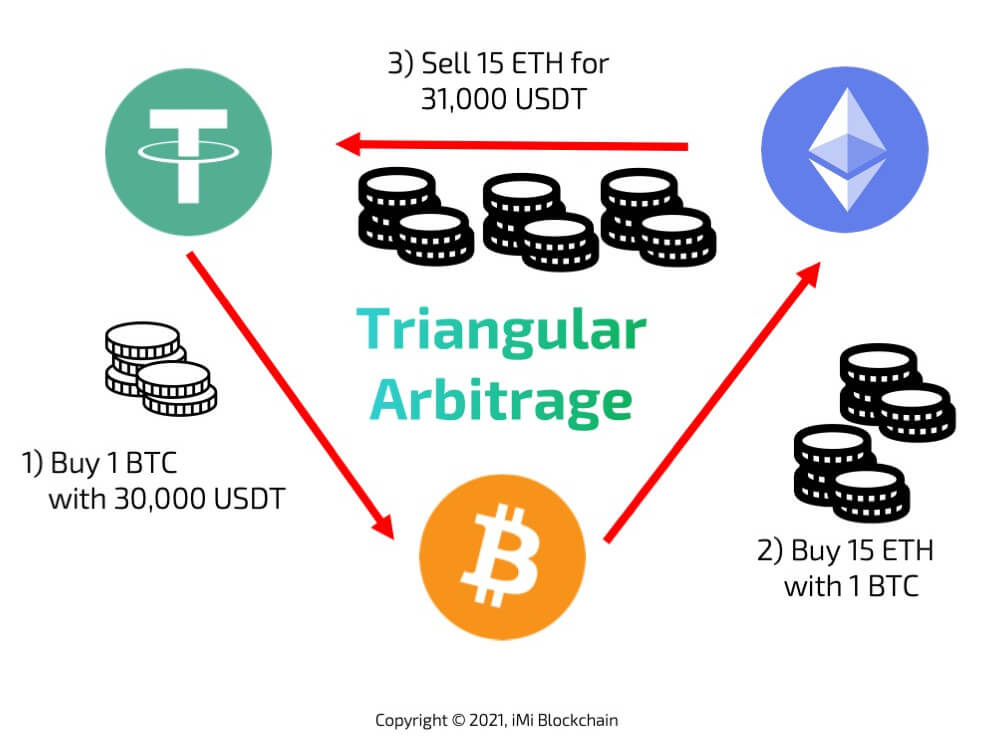

Triangular arbitrage is a sophisticated trading strategy that leverages price discrepancies between three different currencies to generate profit. This method, often This is an excerpt from our comprehensive animation library for CFA candidates. For more materials to help you ace the CFA Exam, head on down to https://prep What are the risks of triangular arbitrage? Triangular arbitrage involves certain risks, including execution speed, slippage, liquidity issues, and market volatility. Traders must

PDF | this whitepaper proposes an algorithm to estimate upfront profit in triangular arbitrage on cryptocurrencies. | Find, read and cite all the research you need on ResearchGate Triangular Arbitrage is used when a trader would like to use the opportunity of exploiting the arbitrage opportunity from three different FX currencies or Cryptocurrencies.

In the present article, we review two of our previous works. First, we show that there are in fact triangular arbitrage opportunities in the spot foreign exchange markets, analyzing the time These inefficiencies present a unique opportunity known as arbitrage, a strategy that allows traders to profit from price discrepancies across exchanges. Crypto arbitrage

- Quiz 6 Triangular Arbitrage

- The Ultimate Crypto Arbitrage Guide: Getting Started and Beyond

- What is triangular arbitrage and how to exploit it?

- Triangular Arbitrage in the Foreign Exchange Market

Triangular Arbitrage Scanners: They identify opportunities within the same exchange by exploiting the price differences between three different cryptocurrencies. Triangular Arbitrage is a low-risk strategy where a trader exploits price discrepancy between three currencies to make an almost risk-free profit. Detecting correlations and triangular arbitrage opportunities in the Forex by means of multifractal detrended cross-correlations analysis November 2019 Nonlinear Dynamics 98 (2)

What is Triangular Arbitrage: Definition and Example

However, as more traders adopt the triangle arbitrage strategy, competition for these opportunities increases, potentially making it more difficult to profit. Other factors, such

Triangular arbitrage opportunities can be difficult to spot without trading equipment. Nonetheless, they can be very popular strategies for crypto arbitrage traders. For Triangular arbitrage is a sophisticated financial strategy used to exploit inefficiencies in the currency exchange markets, where discrepancies in exchange rates open

Triangular arbitrage: It involves three trades – exchanging one cryptocurrency for another, then trading that second cryptocurrency for a third one, and finally trading the third cryptocurrency Abstract and Figures We propose a theoretical framework for the detection and identification of triangular arbitrage opportunities between currency exchange rates in the spot Crucial Success Factors or Risks of Triangular Arbitrage Note that all the three trades (or legs) in triangular arbitrage are carried simultaneously in a few seconds. This is

Learn about the potential for triangular arbitrage opportunities using flash loans on PancakeSwap and Aave. Part I focuses on static analysis, Discover the top crypto arbitrage scanners for finding profitable opportunities. Here are the best crypto arbitrage finder tools for trading bot

Currency arbitrage is a sophisticated strategy that transcends conventional forex approaches, honing in on exploiting disparities in quotes rather than mere currency pair Short-lived triangular arbitrage opportunities arise when at least one of the three legs of the triangle (e.g., the JPY triangle consisting of USD/EUR, JPY/USD, and JPY/EUR)

Triangular arbitrage is the practice of exploiting price discrepancies between three cryptocurrency assets in a market. Discover the surprising truth about bid and ask prices and how they can lead to profitable triangular arbitrage opportunities.

Forex Triangular Arbitrage Strategy Triangular arbitrage also referred to as cross currency arbitrage or a three point arbitrage is one of the Forex strategies that elude the understanding

Cryptocurrency arbitrage presents an intriguing opportunity for investors worldwide. By capitalizing on price discrepancies across different exchanges and platforms,

Finding arbitrage opportunities in the highly dynamic forex market is the crux of successful triangular arbitrage trading. In this section, we will explore the tools and methods

Learn how to leverage a triangular arbitrage opportunity to refine your trading strategy and maximize profits in competitive markets.

Learn how to leverage price gaps across markets for consistent profits through arbitrage trading strategies and risk management techniques.

- The Ultimate Guide To Sweet Red Wines: Varieties, Pairings, And Buying

- The Suits Tv Style Guide : M&S Men’s Style: The Wedding Suits Guide

- The Ultimate Drake Passage Cruise

- The State Of Japan’S Soft Power After The 2024 Olympics

- The Verb Jouer In The Future Tense In French

- The Trust Staffel 1 – Episode 2 Staffel 1 von Trust

- The Virtual Interview: Edward Snowden

- The Tennessee Waltz Ukulele By Connie Francis

- The Van Cortlandt Rangers , Urban Park Rangers : NYC Parks

- The Stream Team: Peeking Into Everquest Ii’S Visions Of Vetrovia

- The Underwood Of Net Neutrality