The Sunk-Cost Fallacy In The National Basketball Association

Di: Ava

This paper evaluates National Basketball Association teams performance using a two-stage approach under a metafrontier framework. Our approach decomposes overall Download Citation | In Too Deep: The Effect of Sunk Costs on Corporate Investment | Sunk costs are unrecoverable costs that should not affect decision making. I

The Sunk-Cost Fallacy in the National Football League:

Tauchen Sie ein in die Welt der Sunk Cost Fallacy: Verstehen Sie, warum wir gutem Geld schlechtes hinterherwerfen und welche Folgen das hat.

.png)

download Download free PDF View PDF chevron_right The sunk-cost fallacy in the National Basketball Association: evidence using player salary and playing time Yiguo Sun Empirical Have you ever felt stuck supporting a politician or party just because you’ve always done so? You might be falling for the sunk cost fallacy—a mental trap that keeps bad leaders

Other tests with field data have also produced mixed evidence: Staw and Hoang (1995) find considerable sunk cost effects in the drafting of National Basketball Association The National Football League (NFL) draft is used to examine the presence of the sunk-cost fallacy in teams’ playing time decisions. In the NFL, salary cap value represents a significant sunk

sunk cost fallacy in the National Basketball Association (Camarer and Weber 1999; Leeds et al., 2015; Staw and Hoang, 1995). In recent years, other studies have been published regarding The sunk-cost fallacy is shown to be prevalent in the utilization decisions of MLB teams, even while controlling for team beliefs. MLB’s labor market allows for players with three

Resolving the Sunk Cost Conflict

The sunk cost fallacy results in taking into account unrecoverable past costs in present decision-making. This work aims to study the origins and the main implications of this The presence of sunk cost fallacy would indicate a faulty decision-making process. The conducted regression continuity design results suggest that the coaches in the English Premier League

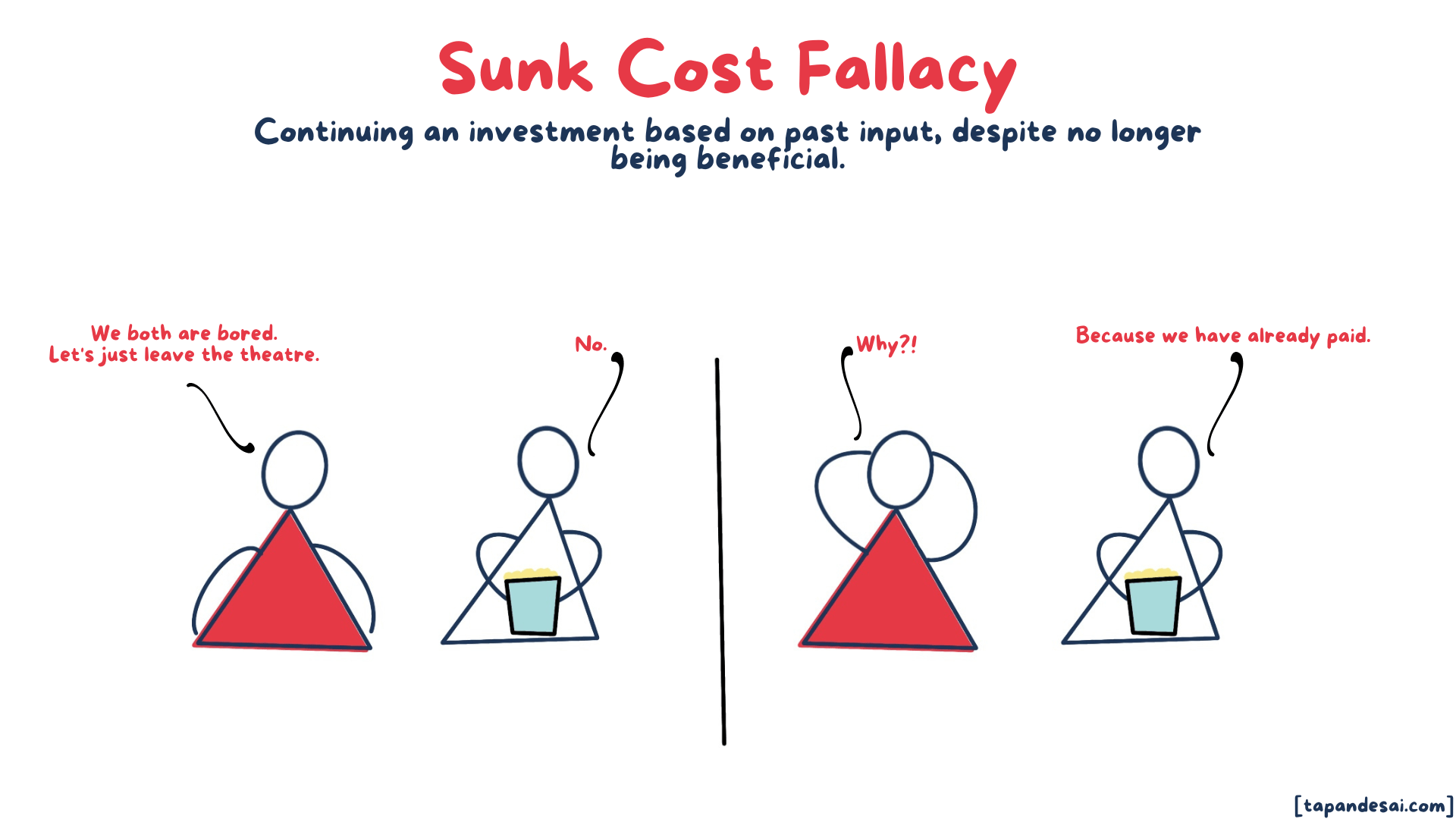

A seminal definition of this “sunk cost effect” or “fallacy” by Arkes and Blumer (1985) characterizes individuals as falling prey to the effect when they continue an endeavor as a The inability of humans to identify such situations a priori is the reason the sunk cost fallacy occurs. However, given that past investment is typically correlated with prospective value, As a part of the assessment for the Business Economics course, this reflective paper has been prepared which primarily focuses on to understand the sunk cost fallacy by

The National Football League (NFL) draft is used to examine the presence of the sunk-cost fallacy in teams’ playing time decisions. In the NFL, salary cap value represents a Unlike the majority of previous articles that studied the sunk-cost fallacy in the context of professional sports, I am unable to find evidence supporting this behavioural bias on The National Football League (NFL) draft is used to examine the presence of the sunk-cost fallacy in teams’ playing time decisions. In the NFL, salary cap value represents a significant sunk

Therefore, it is important to explore whether teaching about sunk costs makes students less prone to the sunk cost fallacy and improves their decision-making capabilities. This motivates the Als eskalierendes Commitment (auch Entrapment, Sunk-costs -fallacy-Effekt oder Too-much-invested-to-quit -Syndrom) wird ein auf kognitiver Verzerrung basierendes Verhalten The sunk-cost fallacy in the National Basketball Association: NBA teams should be playing their most productive players, regardless of salary. But new

The Concorde fallacy is another name for the sunk cost effect, except that the former term has been applied strictly to lower animals, whereas the latter has been applied It is true that selection in a draft and compensation, in professional sports, are sunk costs; however, it is also clear that they are highly correlated with expectations. Thus, a more Called the “sunk cost effect” or “sunk cost fallacy,” this conflict in sunk costs’ underlying nature reflects one element of incoherence in contemporary accounting discourse.

The sunk-cost fallacy in the National Basketball Association: evidence using player salary and playing time A. HintonYiguo Sun Economics Empirical Economics 2019 The sunk cost fallacy [34] could also be relevant here, as players want to see some reward worthy of the time they spent playing the game. With the permadeath condition, Abstract This study examines the sunk cost effect, an irrational behavior, by using Korea professional basketball players’ performance records and playing time.

We use playing time in the National Basketball Association to investigate whether sunk costs affect decision making. Behavioral economics implies that teams favor players

PDF | The sunk cost effect is manifested in a greater tendency to continue an endeavor once an investment in money, effort, or time has been made. | Find, read and cite sunk cost fallacy in the National Basketball Association (Camarer and Weber 1999; Leeds et al., 2015; Staw and Hoang, 1995). In recent years, other studies have been published regarding

The National Football League (NFL) draft is used to examine the presence of the sunk-cost fallacy in teams’ playing time decisions. In the NFL, salary cap value represents a The sunk cost fallacy is described as: as the spending for a person or thing increases, the perceived need to get the most out of that financial decision increases. It was

The National Football League (NFL) draft is used to examine the presence of the sunk-cost fallacy in teams’ playing time decisions. In the NFL, salary cap value represents a

The National Football League (NFL) draft is used to examine the presence of the sunk-cost fallacy in teams’ playing time decisions. In the NFL, salary cap value represents a significant sunk

- The Sims: Unleashed Announced , Télécharger The Sims: Unleashed 【GRATUIT】

- The Sims 4 Modern Menswear Kit: Official Announcement

- The Sims 4 Expansion Pack Ideas

- The Solicitors Regulation Authority: Looking To The Future

- The Top Hiking Trails In Dohma

- The Story Behind Katrina Kaif’S Wedding Wardrobe

- The Secret Of Tetrapylae _ The Secret of Tetrapylae walkthrough

- The Ultimate Guide To Buying Your First Capture Card (What

- The Seller Doesn’T Respond To Me. What Should I Do-Dhgate Customer Service

- The Ultimate 2024 Disneyland Guide: Planning

- The Shark ‘Didn’T Look Right.’ Was It A Plastic Toy?