Stryker: A Dividend Growth Powerhouse I’D Like To Own

Di: Ava

Get the latest dividend data for Stryker (LON:0R2S), including dividend history, yield, key dates, growth and other metrics. Medical technology giant Stryker raises shareholder returns with a 5% dividend increase to $0.84 per share, reflecting robust financial performance and growth strategy. So, we have this know-how.” He attributes Stryker’s growth in Ireland to three factors: the people, the university and IDA Ireland. US executives will always praise the efforts of IDA Ireland.

Tobacco cessation program Strive offers free Tobacco Cessation Journeys to Stryker employees and their spouses/domestic partners. Quitting now isn’t just “health smart” – it’s financially smart, too. If you use tobacco and successfully complete a Strive Tobacco Cessation Journey, you can avoid paying the $600 Tobacco Use Surcharge. For more Ist Stryker ein solider Dividenden-Zahler und wie hoch fällt die Stryker Dividende im September 2025 aus? Alle wichtigen Infos hier.

Stryker, Zimmer outline different M&A strategies

Get the dividend charts for Stryker (SYK). 100% free, no signups. Get 20 years of historical dividend charts for SYK stock and other companies. Tons of financial metrics for serious investors. Stryker Corporation (SYK) dividend growth history: By month or year, chart. Dividend history includes: Declare date, ex-div, record, pay, frequency, amount. Stryker Corporation has announced a 5% increase in its quarterly dividend, bringing it to $0.84 per share. The dividend will be paid on April 30, 2025, to shareholders on record as of March 31, 2025. This marks the 15th consecutive year of dividend raises, reinforcing Stryker’s commitment to shareholder value. The company, a leader in medical technology, continues to demonstrate

Portage, Michigan, May 09, 2024 (GLOBE NEWSWIRE) – Stryker (NYSE:SYK) announced that its Board of Directors has declared a quarterly dividend of $0.80 per share payable July 31, 2024 to shareholders of record at the close of business on June 28, 2024, representing an increase of 6.7% versus the prior year and unchanged from the previous quarter. About Stryker Stryker is Power tools Powered instruments and accessories used to cut, shape, fixate, and dissect bone as well as to fragment, emulsify and aspirate soft tissue in all types of procedures, from reconstructive, sports med and extremities, to the most complex in neurosurgery, spine and ENT. Stryker Corporation’s innovation and market leadership justify a premium. See why SYK stock is a solid hold with long-term growth potential despite high valuations.

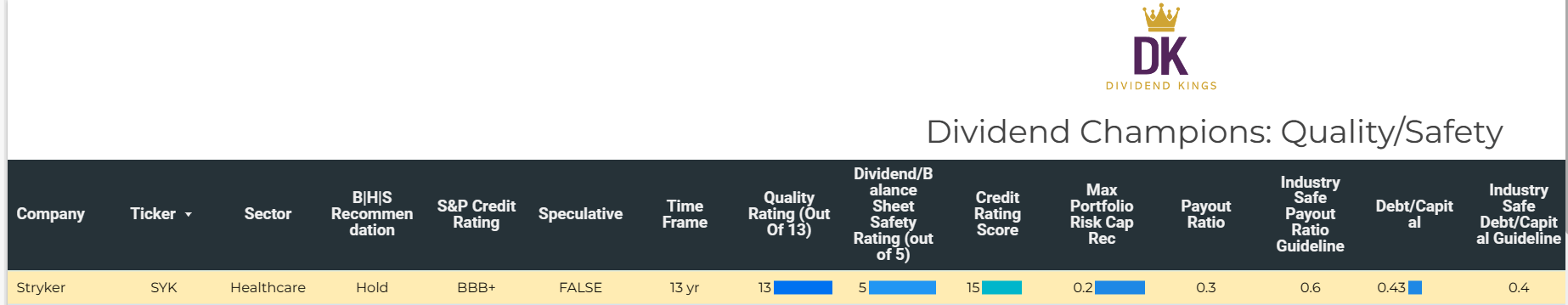

Stryker Corporation is a Dividend Champion with 27 consecutive years of dividend growth. Shares currently yield 1.03%. Stryker Looks Like A Great Dividend Stock Overall, a dividend increase is always good, and we think that Stryker is a strong income stock thanks to its track record and growing earnings.

- Stryker Corporation: Waiting On A Pullback

- Stryker Is Paying Out A Larger Dividend Than Last Year

- Stryker Dividend History

Stryker is one of the world’s leading medical technology companies. Alongside our customers around the world, we impact more than 150 million patients annually.

Stryker Subsidiaries and Acquisitions

Is Stryker a solid dividend stock and how much dividend does Stryker pay in August 2025? All important dividend related metrics are available here.

Stryker shareholders who own SYK stock before this date will receive Stryker ’s next dividend payment of $0.8400 per share on 2025-10-31. Add SYK to your watchlist to be reminded before SYK ’s ex-dividend date. Resetting the D4L-PreScreen.xls model and solving for the dividend growth rate needed to generate the target $1,700 NPV MMA Differential, the calculated rate is 16.2%. This dividend growth rate is lower than the 20.0% used in this analysis, thus providing a margin of safety. SYK has a risk rating of 1.75 which classifies it as a Medium risk stock. Stryker continues to grow through both organic sales growth and a number of acquisitions. Find out why I’m in no hurry to increase my stake in

Conclusion Stryker’s M&A strategy is a key driver of the company’s continued growth and success in the medtech industry. By focusing on strategic acquisitions, building long-term relationships with targets, and integrating new technologies into its portfolio, Stryker is positioning itself as a leader in several high-growth markets. Stryker, Zimmer outline different M&A strategies Stryker CEO Kevin Lobo told investors M&A will be the “number one use of our cash going forward,” while Zimmer Biomet CEO Ivan Tornos emphasized internal product development for growth. Stryker Corporation (SYK) Dividend Growth Stryker Corporation (SYK) dividend history also allows you to track its dividend growth over time. This gives you insight into how the company’s earnings and payout ratios have evolved. Tracking this growth can help you gauge the stock’s potential for future income.

Should You Buy or Sell Stryker Stock? Get The Latest SYK Stock Analysis, Price Target, Dividend Info, Headlines, and Short Interest at MarketBeat.

Stryker’s (NYSE:SYK) dividend yield is 0.86%. Dividend payments have increased over the last 10 years and are covered by earnings with a payout ratio of 43.42%. Stryker’s 8% CAGR revenue growth over the past 12 years was driven by organic growth and acquisitions. Learn more about SYK stock here. Explore Stryker Corporation (SYK) dividend payment history, growth rates, and latest payouts. Get insights on quarterly dividends, yield, and payout ratios for 2025 and past years.

Looking for a discount stock with a good dividend yield? Then take a look at Stryker Corporation (NYSE:SYK). With its cutting-edge technologies in robotics and minimally invasive surgery, Stryker Stryker has expanded its reach across different industries by acquiring companies and establishing subsidiaries, especially in areas like medical robotics, digital healthcare, and data analytics.

S&P Global’s 10x Growth: A Dividend Powerhouse

The post TFSA 2025: 1 Stock to Turn Your $7,000 Contribution Into a Dividend Growth Powerhouse appeared first on The Motley Fool Canada. With soaring M&A expected in the post-COVID climate, CFOs would be wise to borrow a page from Stryker, which doubled revenue through dealmaking. Here’s how they they do it. S&P Global has joined the rare club of founding Dividend Aristocrats that delivered 10x returns over the past decade. The company

Explore the factors fueling Stryker Corporation’s stock growth, including innovative products and strategic acquisitions. Discover what lies ahead for SYK. Dividend Summary The next Stryker Corp. dividend will go ex in 29 days for 84c and will be paid in 2 months. The previous Stryker Corp. dividend was 84c and it went ex 2 months ago and it was paid 1 month ago. There are typically 4 dividends per year (excluding specials), and the dividend cover is approximately 3.9. Canadian Tire (TSX:CTC.A) and another cheap dividend stock that could fare well going into the final few months of the year. The post 2 Must-Own Stocks for Your Next $7,000 TFSA Contribution appeared first on The Motley Fool Canada.

Portage, Michigan, Feb. 05, 2025 (GLOBE NEWSWIRE) – Stryker (NYSE:SYK) announced that its Board of Directors has declared a quarterly dividend of $0.84 per share payable April 30, 2025 to shareholders of record at the close of business on March 31, 2025, representing an increase of 5.0% versus the prior year and unchanged from the previous quarter. About Stryker Stryker is

- Strong Brand Loyalty , Brand Loyalty: Key to Sustaining Success in Competitive Markets

- Stronghold 2 Hd Reworked Project 5.0

- Stripe Acquires Bouncer _ Stripe acquires Bouncer to help businesses with fraud prevention

- Strombörsenpreise Österreich : Strompreisentwicklung 2024 in Deutschland & Österreich

- Strengthening Redd And Watershed Management In Bhutan

- Studio Endstufe Als Hifi Alternative

- Stressed Flamingos? :: Planet Zoo General Discussions

- Strom Mit Schwung : Die Geschichte Einer Maschine ; 1995

- Studentenwohnungen In Delitzsch Mieten

- Strömshaga Kerzenhalter Für Flaschen, Weiß