Saudi And Uae Lead In Kearney’S Emerging Markets Retail Index

Di: Ava

The United Arab Emirates offers the best environment for business and outperforms virtually all other emerging economies when it comes to logistics opportunities and digital readiness, according to the 2025 Agility Emerging Markets Logistics Index. The 50-country Index, now in its 16th year, shows Saudi Arabia, China, Kazakhstan, Malaysia, and Indonesia also made it to the Top 10. India is the leading retail market and remains appealing to global investors and operators as it ranks first out of 44 markets in Kearney’s 2023 Global Retail Development Index with a final score of 66.4 out of 100. In a report, Kearney said India is a “dynamically expanding modern

The UAE has moved up on Kearney’s 2024 Foreign Direct Investment Confidence Index, jumping from 18th to eighth place as the Arab world’s second-largest economy continues to focus on diversifying its economy. It came second on Kearney’s emerging market index – behind China, the world’s second-largest economy – rising from Retail’s Global Vision Beginning to Blur This year’s Global Retail Development IndexTM (GRDI) finds the world’s largest retailers facing new challenges as they expand into developing markets. The nationalist sentiment highlighted by Brexit and America First has created uncertainty about new market entry, while the increased sophistication and success of local and regional

The UAE ranks first in the Middle East and third globally for foreign direct investment (FDI) confidence, according to Kearney’s 2023 FDICI Emerging Markets ranking. What follows is an individual analysis of 5 of the top emerging retail markets as indicated by the A.T. Kearney’s Global Retail Development Index. Let’s take a closer look at China, UAE, Kuwait, Russia and Saudi Arabia.

The 2019 Global Retail Development Index™

These are some of the questions Kearney’s Global Retail Development Index (GRDI), which tracks selected emerging retail markets, was created to answer (see figure 1). In a moment we will discuss our 2021 study—our methodology, caveats, and some of the emerging trends we found around the world. The 2017 global retail development index explains geopolitical instability and the growing power of local and regional competition in emerging markets.

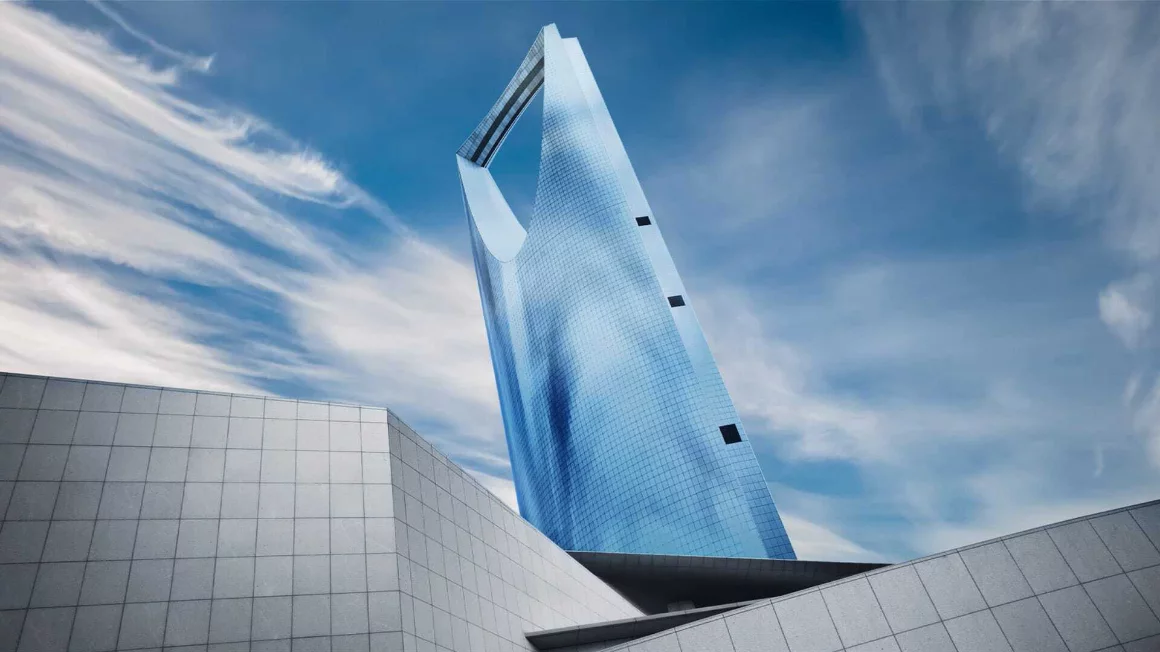

This was further highlighted by Saudi Arabia’s position on the Emerging Markets Index, introduced last year, where the Kingdom ranked 3rd globally and 2nd regionally, rising from 6th place in 2023.

- UAE is the top emerging market in MENA

- UAE moves up in global emerging markets retail development index

- Kearney India Retail Index

In a remarkable testament to its economic strategy, the United Arab Emirates has made a significant leap to the 8th position on Kearney’s 2024 Foreign Direct Investment Confidence Index® (FDICI), up from 18th place in 2023, and now stands 2nd on the Emerging Market Index after China. The FDICI, now in its 26th iteration, continues to be an authoritative

2025 Kearney FDI Confidence Index highlights China, the UAE, and Saudi Arabia as the leading emerging markets for foreign direct investment. #UAE

According to a new index, the UAE is ranked the most attractive emerging market in the Middle East and North Africa (MENA) for investors. Overlap between the global rankings and the emerging market rankings include China at number one, followed by the United Arab Emirates, Saudi Arabia, Brazil, India, and Mexico. South Africa, Poland, and Argentina lead the pack of emerging markets that fell just short of the main Index. However, emerging markets continue to build their presence on the list, with the United Arab Emirates and Saudi Arabia in particular experiencing meteoric rises from 18th to 8th and 24th to 14th, respectively.” In terms of emerging markets overall, this was the second annual ranking done by the Kearney FDI Index team.

With Saudi Arabia’s strategic initiatives and dynamic retail environment, the kingdom continues to emerge as a key player in the global retail landscape. Kearney’s FDI Confidence Index gives business leaders insights into which emerging markets are most appealing to investors. Globally, China topped the list, followed by India, UAE, Qatar, Thailand and Saudi Arabia, which are also the only emerging markets included in the world rankings.

If you get it right, you will be able to balance your portfolio and compensate for the low growth rate in your home market.” This changing competitive environment high-lights the need for companies to compare different markets for entry prospects—which A.T. Kearney’s 2010 Global Retail Development IndexTM (GRDI) can help them do.

The UAE has been ranked as the top emerging market across the Middle East and North Africa region, and third globally, after China and India, as revealed in Kearney’s 2023 Foreign Direct Investment Confidence Index (FDICI). Kearney’s new India Retail Index reveals that tier 2 and tier 3 cities are hotbeds for growth—opening up powerful opportunities for retailers to expand.

22 February 2024, Singapore – In a year that has witnessed a reshuffle of emerging market potentials, global consultancy Kearney ’s 2023 Global Retail Development Index (GRDI) captures the core of a retail landscape at a crossroads. The report, a bi-yearly survey of the most promising retail markets worldwide, underscores the agility and dynamism of retail economies adapting to Kearney’s Global Business Policy Council today released its 2025 Foreign Direct Investment Confidence Index (FDICI), a survey of investor sentiment regarding future (three-year) FDI flows. Now in its 27th year, the 2025 Index captures a distinct snapshot of investor sentiments at a moment of global inflection, with leadership changes in key economies following the 2024 The 2019 global retail development Index is a mix of new consumers and old traditions. Emerging markets are forcing global retailers to continually rethink their strategies.

Trusted advisors to the world’s foremost organizations, we help our clients achieve immediate impact and growing advantage on their most mission-critical issues.

After a particularly torrid period for the global economy, GCC countries—and their banking institutions—have a steadier outlook than most. Retail banks are Kearney’s new India Retail Index reveals that tier 2 and tier 3 cities are hotbeds for growth—opening up powerful opportunities for retailers to

For the past five years, A.T. Kearney has helped retailers prioritize their global develop-ment strategies by publishing the Global Retail Development indexTM (GRDi). The index ranks 30 emerging countries based on more than 25 macroeconomic and retail-specific variables (see sidebar: About the Global Retail Development Index).

A growing population with more money to spend India’s population—already the world’s largest at more than 1.4 billion citizens—is swelling, and its consumers are increasingly primed for the travel retail market. Higher disposable income is driving greater consumption. As an illustration of this, average monthly per capita spending more than doubled between 2019 and 2024, going from For the third year in a row, the FDI Confidence Index® features an exclusive ranking for emerging markets. China, the United Arab Emirates, and Saudi Arabia lead the 2025 emerging market rankings.

According to Kearney ‘s latest Global Retail Development Index (GRDI), the MENA region is emerging as a dominant force in the retail industry. The GRDI is a bi-yearly survey that identifies the most promising retail markets worldwide, and it highlights the MENA region’s upward trajectory in global retail development. United Arab Emirates first regionally, third globally in emerging markets ranking | KearneyHidden The Global Retail Development Index ranks the top 30 developing countries for retail investment, based on all relevant macroeconomic and retail-specific variables. The study is unique in that it not only identifies the markets that are most attractive today, but also those that ofer future potential (see appendix: About the Global Retail Development Index on page 28). To mark the

Saudi Arabia rose to 13th place in Kearney’s 2025 Foreign Direct Investment Confidence Index, its highest-ever ranking, reflecting stronger investor sentiment amid ongoing economic reforms and diversification efforts. This year’s FDI Confidence Index indicates a preference for developed markets, with 17 out of the 25 markets on the index being developed. However, emerging markets like the UAE and Saudi Arabia are marking notable progress, with the

Saudi Arabia has a bold vision to diversify its economy and reduce its dependence on oil revenue. Attracting foreign direct investment to industry will be crucial to this endeavor.

The UAE is the leading emerging market across the Middle East and ort Africa (Mena) region, as revealed in Kearney’s 2023 Foreign Direct Investment Confidence Index (FDICI) Emerging Markets ranking. South Africa rose to seventh position from eleventh in the emerging markets rankings section of Kearney’s Global Business Policy Council’s 2025 Foreign Direct Investment (FDI) Confidence Index

- Sarı Nokta Hastalığı Nedir? Tipleri

- Saten Alçı Nedir? Nasıl Yapılır? Nerede Kullanılır?

- Sbu Sandwerke Dresden Hellerberge

- Saturo Trinkmahlzeit Bewertung: Vorteile, Nachteile

- Sc Capital Partners, Thi Acquire Suzhou Industrial Estate Project

- Sardine À L’Escabèche Maison : La Recette Facile

- Save 65% On City Destructor On Steam

- Sascha Wollny Geburtstag _ Silvia Wollny: Aktuelle News, Infos & Bilder

- Saudi-Arabien: Unter Der Abaja Stecken Nieten, Leder, Hotpants

- Sartén Basculante | Sartén basculante eléctrica SBE90M Jemi motorizada

- Sap Solution Manager 7 | SAP Change Request Management

- Scala Seq.Sliding Violating The Docs Rationale?

- Saving Our Vanishing Heritage – Our Vanishing Heritage, Global Heritage Network

- Scalloped Corn With Creamed Corn And Saltines Recipes

- Saunaofen Saunatonttur | Ofen-Finder • EOS Sauna