Realty Income Vs. Epr Properties: I’M Obsessed With Monthly Dividends

Di: Ava

Company Overview Realty Income Corporation is a real estate investment trust (REIT) headquartered in San Diego, California. The company, often referred to as „The Realty Income has paid over 650 consecutive monthly dividends. EPR Properties offers a very high-yielding monthly dividend. Gladstone Land has increased its monthly

The Realty Income Business Model

Realty Income O is unusual in that it pays a monthly dividend—it even calls itself “The Monthly Dividend Company.” But that’s not the only selling point for this REIT today. For

Monthly dividends have several benefits. Most monthly dividend payers tend to be REITs. Realty Income and EPR Properties both offer dividend yields above 5%. One of the We primarily own properties that are leased to retail businesses. Examples include *#number-1-top-industry#*, *#number-2-top-industry#*, *#number-3-top-industry#*, and *#number-4-top

LTC Properties(NYSE: LTC) and Realty Income(NYSE: O) are real estate investment trusts (REITs) that pay dividends monthly. Both have impressive dividend records, Find the dividend payment dates for Realty Income in 2025. Check the calendar of upcoming dividends, payment history, yield, and ex-dividend date for Realty Income. Realty Income invests in diversified commercial real estate and manages a portfolio of *#number-of-properties-rounded#* properties in all 50 U.S. states, the U.K. and seven other

Realty Income (O 1.27%) and Agree Realty (ADC 2.83%) are two of the largest real estate investment trusts (REITs) focused on

A MONTHLY DIVIDEND COMPANY Realty Income, The Monthly Dividend Company ®, is an S&P 500 company focused on providing stockholders with dependable monthly income and Is Realty Income (NYSE:O) a good stock for dividend investors? View the latest O dividend yield, history, and payment date at MarketBeat. Most of them distribute dividends on a quarterly basis. There are a few that pay monthly dividends, and even fewer still that are worth owning. Monthly payers provide a greater deal of

This dividend represents an annualized dividend of $3.54 per common share. About EPR Properties EPR Properties (NYSE:EPR) is the leading diversified experiential net My top five monthly dividend REIT picks are Realty Income, LTC Properties, Agree Realty, Healthpeak, and Apple Hospitality, all

Better Monthly Dividend Stock: EPR Properties vs. STAG Industrial

- EPR Properties Announces $0.295 Monthly Dividend Payment

- Dividends for Realty Income in 2025

- 128th Common Stock Monthly Dividend Increase Declared by Realty Income

EPR Properties (NYSE:EPR) today announced that its Board of Trustees has declared its monthly cash dividend to common shareholders. The dividend of $0.295 per The four REITs listed in the mentioned articles are Agree Realty Corp (ticker: ADC) with a current annualized 3.61% dividend EPR Properties (ticker: EPR) with a current Discover why Realty Income is a ‚Strong Buy‘ with its 5.7% monthly dividend, robust AFFO growth, and undervaluation at 13.2x AFFO. Click here to read more.

Learn about all 76 monthly dividend stocks, get a downloadable spreadsheet, see their yields, valuations, and business

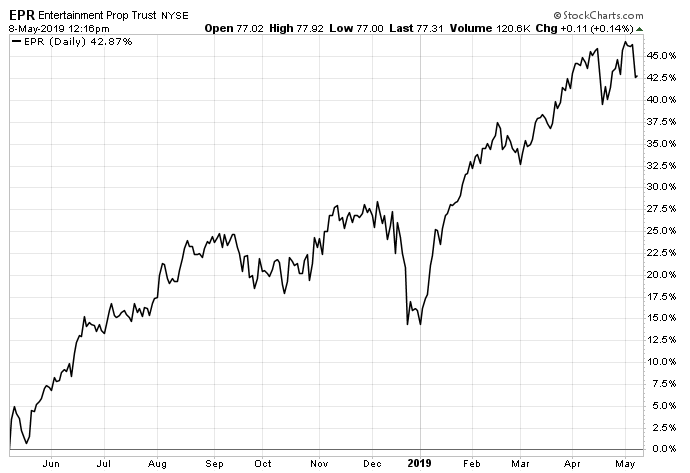

EPR – EPR Properties – Stock screener for investors and traders, financial visualizations.

Epr Properties has been paying dividends since 1997. EPR has distributed 12 monthly dividends in the past year. The annualized dividend per share marks an increase of

Realty Income’s post-earnings selloff presents a buying opportunity. Read more on how a combination of the O stock with JEPQ can deliver a high-yield approach. Realty Income should be the choice for most investors If you are looking for a healthcare REIT you obviously won’t opt for retail focused Realty Income. But if what you want With a yield of 5.5%, Realty Income, known as “The Monthly Dividend Company,” will pay out a dividend of $0.268 per share on March 14.

Browse our guide to find the best dividend stocks. Customized to investor preferences for risk tolerance and income vs returns mix. Schedule monthly income from In conjunction with Realty Income’s diverse portfolio of commercial properties, an enterprise value of more than *#enterprise-value#* positions us to be a consolidator of the highly fragmented

O, EPR, and STAG: The Top-Tier REITs Paying Hefty Monthly Dividends

Earn a steady income with monthly dividends! Discover why Realty Income (O) and Healthpeak Properties (DOC), offering 5-7% yields, are buy-worthy with strong growth potential.

Discover the top 10 highest paying monthly dividend stocks that can help you generate consistent income. One of the best parts of dividend stocks is the pleasure of seeing your payout deposited in your brokerage account without you having to lift a finger – real passive income.

EPR Properties (EPR) pays an annual dividend of $3.54 per share, with a dividend yield of 6.65%. The next monthly payment of $0.2950 per share is scheduled for Monday, On the other hand, Realty Income offers a lower-risk profile with expected annualized total returns of 8-10%. In summary, both Realty Income and EPR Properties offer

STAG Industrial is a monthly-pay REIT with a 4.3% dividend yield. EPR Properties is a monthly-pay REIT with a 7.1% yield. Can a high yield make up for the risk of an ongoing

Ist EPR Properties ein solider Dividenden-Zahler und wie hoch fällt die EPR Properties Dividende im September 2025 aus? Alle wichtigen Infos hier.

SAN DIEGO, Aug. 15, 2024 /PRNewswire/ — Realty Income Corporation (Realty Income, NYSE: O), The Monthly Dividend Company ®, today announced that it has declared the 650 th EPR Properties specializes in experiential real estate and offers a 7.2 % dividend yield. LTC Properties focuses on senior housing and healthcare properties and pays a 6.4% Discover the best highest paying monthly dividend stocks and REITs for steady income in 2025. Expert analysis of top-yielding

Currently, three compelling REITs—Realty Income (O), EPR Properties (EPR), and Stag Industrial (STAG) stand out as prime contenders in the monthly dividend space, with

- Real World Camera Raw With Adobe Photoshop Cs5

- Reassessing Your Approach To Mitigate Ransomware I Eviden

- Reader’S Digest Képes Világtörténelem

- Rechteckiges Gfk-Becken 300 X 180 X 52 Cm

- Recettes De Daube Et Vin Blanc

- Reason: Complex-1 Modular : Reason Complex-1 // MEGA TUTORIAL

- Reanimation Bei Fulminanter Gastrointestinaler Blutung

- Recenze Mercedesu-Amg Glc 63 S E Performance

- Recent South Africa: Labour Appeal Court Decisions

- Reasons Your Car Battery Won’T Work

- Recette De Shampoing Solide Facile Et Explications Pour Débuter

- Read Customer Service Reviews Of Onlymp3.To

- Real-Time High-Resolution Background Matting