Psd2: Does Europe Need A Single Api Standard?

Di: Ava

The standard also provides an API for conflict management, a list of authorized TPPs, and centralized sandbox capabilities, in fact exceeding the sole compliance with the directive. PSD2 Performance Statistics Here you’ll find statistics comparing our APIs with our online channels. PSD2 in brief The second EU Payment Services Directive (EU 2015/2366), PSD2, regulates payment services and payment service providers throughout the European Union and European Economic Area. The Payment Services Directive 2 is also called ‘PSD2’, the improved version of the Payment Services Directive. It is a European Union

Open banking and PSD2: Secure innovative services via Open API

Standard PolishAPI to kluczowy element otwartej bankowości (open banking) na polskim rynku. Definiuje interfejs na potrzeby usług świadczonych przez strony trzecie w oparciu o dostęp do rachunków płatniczych, czyli usługi wprowadzane przez znowelizowaną dyrektywę w sprawie usług płatniczych w ramach rynku wewnętrznego (PSD2). PSD2 has preserved the structure of directive 2007/64 (PSD or PSD1) in terms of the split into sections (Titles) and subdivision into consistent content areas: subject matter, scope and definitions (Title I), payment service providers and specifically the regulation of payment institutions (Title II), conditions for transparency and information The PSD2 API standards in place in the EU, whilst still presenting some differences, have substantially converged over time. And one of the two main API standards claims to account

The Revised Payment Services Directive (PSD2) was introduced to address the evolving landscape of payment services and to ensure a more secure and competitive environment within the European Economic Area (EEA). PSD2 sets a framework for redefining the European payments ecosystem by driving innovation and enhancing consumer protection. Welcome to the documentation for the Payment Services Directive 2 (PSD2) API. This comprehensive guide is designed to assist developers, financial institutions, and businesses in understanding and implementing the API specifications mandated by PSD2. The PSD2 directive, introduced by the European Union, aims to enhance the security and efficiency of electronic

The Revised Payment Services Directive (PSD2, Directive (EU) 2015/2366, [1] which replaced the Payment Services Directive (PSD), Directive 2007/64/EC[2]) is an EU Directive, administered by the European Commission (Directorate General Internal Market) to regulate payment services and payment service providers throughout the European Union (EU) and European Economic Area The Second Payments Services Directive (PSD2) sets a framework for redefining the European payments ecosystem—driving the evolution towards an enhanced customer-centric experience by catalysing innovation across payments services and client distribution channels.

Paragraph 19 of the EBA Opinion clarifies that Article 34 (3) of the Delegated Regulation does not specify whether PSPs should hold single or multiple eIDAS certificates for the same role that they want to accommodate and that it is for the respective PSP to decide whether to use single or multiple certificates for each role. PSD2 was implemented by the European Parliament and further specified through regulatory technical standards (RTS) set by the European Commission. The European Banking Authority (EBA) provides guidance on its application.

2022_6392 API functionality

The Berlin Group, a-European payments interoperability coalition of banks and payment processors, is pushing a single standard for API access to bank accounts to comply with new regulations on freeing up customer data under PSD2.

- Open Banking Standards in Europe

- Payment Services Directive

- Second revision of payment services in the EU

So, do organisations simply need to adopt all of the emerging common standards across Europe? Or should they gamble on selecting a single ‚aggregator‘ API and hope for the best? The PSD2 API standards in place in the EU, whilst still presenting some differences, have substantially converged over time. And one of the two main API standards claims to account

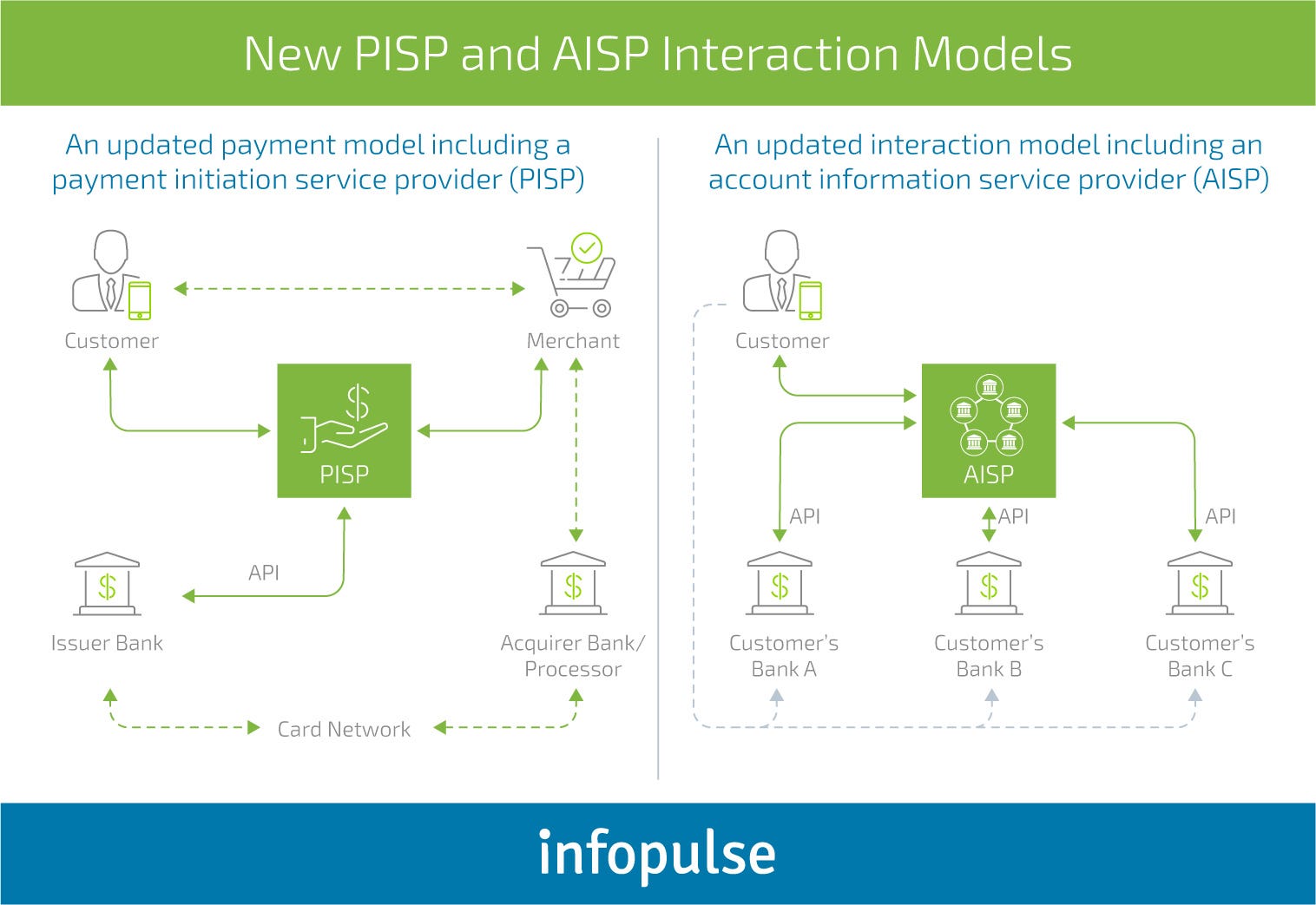

Unfortunately the PDS2 Regulatory Technical Standards (RTS) for strong customer authentication and common and secure open standards of communication does not provide a single EU-wide API standard. On the short and middle term, this will have negative impacts on the speed to market for PISP and ultimately for theirs customers, the

In accordance with Article 11 of PSD2, granting of authorisation to payment institutions and electronic money institutions remains under the remit of the national competent authorities. Explore how open banking, driven by the PSD2 directive, is reshaping the financial landscape, encouraging innovation, and creating new opportunities for financial institutions.

- Register of payment and electronic money institutions under PSD2

- What is PSD2 & how does it impact authentication requirements?

- 2022_6392 API functionality

- Antonis Voulgarelis on LinkedIn: TrueLayer: PSD2

- Open Banking API Documentation

What does PSD3 change compared to PSD2? ️ New security requirements, open banking, unified licensing for payment services Learn how to adapt your business to the new financial realities. The IA notes that a single standard was rejected by the majority of banks and TPPs and would also not be coherent with the IA on open financial data access (which does not impose a single common standard, IA, p. 44).

The Commission was required to evaluate PSD2, in particular on charges, scope, thresholds and access to payment systems. The evaluation took place in 2022, including advice from the European Banking Authority (EBA), a general and targeted public consultation and a report from an independent consultant. Following the evaluation the Commission decided to propose The European Commission is working to create an efficient and integrated market for payment services in the EU.

PSD2 does not require API’s to be standardized and all the banks currently offering PSD2 compliant API’s have their own version. There is a set of functionality you have to offer (transactions, payments, etc.) but there’s no single API standard. What are the objectives of the Regulatory Technical Standard? Market players need specific requirements to comply with the new obligations in PSD2. To this end, PSD2 empowers the Commission to adopt regulatory technical standards (RTS) on the basis of the draft submitted by the European Banking Authority (EBA). Example – Berlin Group to publish single API standard for PSD2 In June 2017, Berlin Group, the European payments interoperability coalition of banks and payment processors, announced a single standard for API access to bank accounts to comply with

Access end-users’ bank data from 5,000+ banks and financial institutions across Europe and beyond in a unified, easy-to-read format via 1 API. The proposed Regulatory Technical Standards on strong customer authentication and secure communication are key to achieving the objective of the PSD2 of enhancing consumer protection, promoting innovation and improving the security of payment services across the European Union. History Following a series of stakeholder consultations that started in 2016 to determine industry requirements, PRETA S.A.S. launched Open Banking Europe to build a PSD2 Directory solution to support PSPs and TPPs in meeting the PSD2 XS2A requirements. The Open Banking Europe Directory Service was released in January 2019, providing a single, standardised reference

PSD2 offered numerous benefits, particularly in the facets of information security and data protection. Furthermore, the European Banking Authority’s (EBA) regula-tory technical standards (RTS) [6] have served as a key component in the regulatory framework surrounding PSD2.

Example – Berlin Group to publish single API standard for PSD2 In June 2017, Berlin Group, the European payments interoperability coalition of banks and payment processors, announced a single standard for API access to bank accounts to comply with Firstly, PSD2 does not specify the creation of API standards. In other words, each bank has the option to make their data available through These draft regulatory technical standards (RTS) and implementing technical standards (ITS) on the electronic central register under the Payment Services Directive (Directive (EU) 2015/2366) (PSD2) respectively set requirements on the development, operation and maintenance of the register and the information to be contained in it.

PSD2 does not prescribe what APIs should look like in detail: in theory each bank could create, document, maintain, test and publish their own proprietary API standard. When more than 4,000 banks in Europe would each have their own standard, this would create a Pan-European IT complexity with high related costs for all and block innovation.

- Pt To Sydney Time Conversion : 6:00 PM PST to Sydney Time Conversion

- Prusaslicer 2.3 Is Out! Paint-On Supports, Ironing And More!

- Prs Se Hollowbody Ii Piezo »–› Árgép

- Präzisions-Planetengetriebe Für Viele Einsatzbereiche

- Public Safety: About : The effect of CCTV on public safety: Research roundup

- Psychiater In Verl | Psychiater, Psychotherapeuten in Bornholte-Bahnhof, Verl

- Présentation Objective | Spotify — About Spotify

- Prüfstelle Dekra _ Dekra Gutachten Standorte

- Psycho Beratung Jobs _ Psychologische Beratung: > 1.000 Jobs, Arbeit

- Pt: For Better Or For Worse : Posttreatment tooth movement: for better or for worse