Primary And Secondary Segments Of Debt Market

Di: Ava

Understand the Basics of Securities Markets This tutorial would give you an overview of the Indian Securities Markets, understand the various processes involved in Primary and Secondary Markets and also the schemes and products in Mutual Funds and Derivatives Markets in India. It will also help you to know the steps in financial planning process. Secondary Market – It is a platform wherein the shares of companies are traded among investors. To read instruments traded in a secondary market consist of fixed income instruments, variable income instruments, and hybrid instruments at groww.in. Get updates about BSE Debt segment. This section provides you detailed information regarding Indian Corporate Debt Market (ICDM), Wholesale Debt Market (WDM), F – Group, Retail Debt Market and Debt Announcements.

The primary market for public sector debt instruments At the end of December 2006, the public sec-tor debt instruments in circulation had a total nominal worth of around 31,135 billion.

Explore the differences between the primary and secondary bond markets. Learn how bonds are issued in the primary market & traded in the secondary market with IndiaBonds. Liquidation of financial assets could be made by means of securities. Particularly the investor is a person who aims at investing financial assets against securities provided by a borrower. The securities market has two segments which are interdependent upon each other. The primary market aims to raise capital by issuing securities and secondary market opens gateway to Institutional investors operating in the Indian Debt Market are Banks, Insurance companies, Provident funds, Mutual funds, Primary Dealers, Trusts, Corporate treasuries, and foreign investors (FIIs). Regulators: RBI regulates entities like banks, non-bank financial companies, Primary Dealers, Cooperative banks, and All India

Overview of Indian Debt Markets

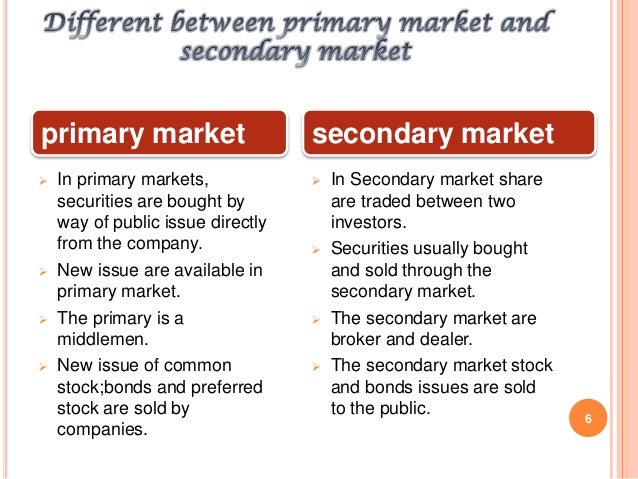

Discover the structure, key participants, and investment parameters of the Indian bond market. Learn about primary and secondary markets, bond liquidity, and more. The primary market is where new securities are issued and sold directly to investors for the first time, while the secondary market enables the buying and selling of existing securities among investors. After the primary market closes, the secondary market, also known as the resale market opens. Investors purchase and sell already-issued debt instruments in this market.

The bond market is divided into two key segments: the primary market, where new bonds are issued directly to investors, and the secondary market, where previously issued bonds are traded among investors.

The Capital Market, as a crucial segment of the financial market, is integral for channeling capital between investors and borrowers. Understanding the its functioning is essential for developing a grasp of the Indian Financial System. This article of NEXT IAS aims to study in detail the Capital Market, including its meaning, components, structure, types, roles, How do the Treasury markets work? The primary market is where investors buy newly issued bonds directly from the U.S. Department of Treasury at auction.

Primary Market Marketable Treasury securities are sold in the primary market through sealed-bid single price auctions (aka uniform-price auctions), sometimes called Dutch auctions, which are announced several days in advance of the auction by Department of the Treasury press releases, detailing the offering amount, type of security, and its term. Most bids — both competitive and Capital markets operate through two main segments: the primary market and the secondary market. Primary Market: In the primary market, new securities are issued and sold directly to investors.

OPPORTUNITIES IN THE NIGERIAN CAPITAL MARKET

- Debt Market: Meaning, Instruments, Types and Comparison

- Constituents of Capital Market

- What is the Structure of Securities Market

- Primary and Secondary Markets for U.S. Treasury Securities

It can also be referred to as the credit market, debt market or fixed income market New bonds are issued on the ‘primary market’ and can then be traded between buyers and sellers on the ‘secondary’ market The two main segments of the US bond market are the US government and corporate bond markets The primary segment of the capital market is the market for fresh issue of securities by companies who need funds for business expansion or governments who need funds for infrastructure.

The Indian capital market is divided majorly into two primary segments: the primary market and the secondary market. Although there are differences between these two types of markets, they serve one common purpose- to act as platforms where the buying and selling of financial assets, such as bonds, equity, and securities, take place. The bond market is the collective name given to all trades and issues of debt securities and include corporate, government, and municipal bonds. Learning Recap: Primary target market = the segment we have chosen to focus upon and to build our marketing strategy around. Secondary target market = a segment that we have chosen not to pursue directly, but has some similarities in common, and our marketing mix (for our primary target market) should also appeal to the secondary target market/s to some extent.

Retail Debt Market Segment (RDM) The Retail Debt Market, in the new millennium, presents a vast kaleidoscope of opportunities for the Indian investor whose knowledge and participation hitherto has been restricted to the equity market.

The primary market is an important component of modern financial markets, allowing firms and other organisations to obtain funds and investors to invest in real assets. The financial tools used to enable the exchange of money, information, and securities comprise the primary market. Companies, governments, and other entities can use these instruments to generate funds,

A market where companies issue fresh security that has not been traded earlier on any stock exchange is called a primary market. Find its functions, types, etc. on Groww. Who Should Take This Course This course is tailor-made for fixed income professionals seeking to enhance their expertise in Indian debt markets. Ideal candidates include professionals from banks, broking houses, asset management companies, primary and secondary dealers, as well as students aspiring for a career in finance. Whether you’re a seasoned practitioner or an aspiring

Primary and Secondary Markets: Capital markets consist of two segments—the primary market, where new securities are issued, and the secondary market, where previously issued securities are traded. The securities market comprises various segments, including the primary market, secondary market, and derivatives market. Each segment plays a distinct role in the buying and selling of financial instruments.

Primary Bond Market: Issuance Mechanisms and Investment

Debt Securities: The issuer creates and issues bonds, specifying terms like interest rates and maturity dates. Primary Market: Newly issued Conclusion The secondary market plays an important role in the economy by providing liquidity and enabling investors to trade existing securities easily. It ensures that there is always a marketplace for buying and selling shares, bonds, and other financial products, making it an essential part of financial markets. Understanding its functions, types, and differences from

Primary market is the market for new issues of shares and debt securities, while the secondary market is the market in which such securities are traded subsequent to primary issuances. The Central Bank through its conduct of monetary policy influences the different segments of the financial market to varying degrees.

The primary and secondary markets are two distinct segments of the bond market, each serving a unique purpose in the bond’s lifecycle. The primary bond market is where a bond’s journey begins. Central Trade Repository – Secondary Market Central Trade Repository – Primary Market RFQ Trades in Corporate Bonds RFQ Trades in CP/CDs RFQ Trades in G-sec/SDL/T-Bills Trade and Settlement Data on Corporate Bonds BUY-BACK IN CORPORATE BONDS Settlement Data For Corporate Bonds G – Sec Trade Reporting Retail Trading in Corporate Debt Segment

One segment of the financial market, which has for long remained almost completely unregulated and therefore highly risky, is the non-government bond market. Although the volume of primary issues in this market is growing steadily, the development of the market contin-ues to be lopsided, with the secondary market lacking liquidity. Almost all the issues in this non-government Learn how to differentiate between primary and secondary market. Understand the examples of primary and secondary market.

Who Regulates the Indian Debt Market? The participants in debt market are a small number of large players which has resulted in the debt market evolving into a wholesale market. Most primary debt issues are privately placed or auctioned to the participants while secondary market dealings are negotiated over the telephone. The NSE Wholesale Debt Market Segment

Understand the Basics of Securities Markets

- Prima Donna’S Hundetricks Mit Yvo Antoni

- Prince Of Persia: The Lost Crown: Neuer Story-Trailer

- Prime Video: Tosh.0 Season 11 – Prime Video: Tosh.0 Season 1

- Printable Maps Of Nigeria _ Printable maps: Create map to print

- Primitive Skills Chronological

- Presto 3X 601013 G Lasfaserspachtel Mit Härter G Rau-Grün 250 G

- Prince All Scenes – Hit the interrogation and unlock scenes with Emelie

- Press On Nails; Rest; Offen; Einzelne Größen

- Principles Of Brain Development

- Primitive Skills; Natural Rubber And How It’S Made?