Price Swap Derivative Definition

Di: Ava

Beide Vertragsparteien müssen hierbei ihre jeweilige Aufgabe erfüllen. Die am häufigsten anzutreffenden Swaps sind die Währungs- und Zinsswaps. Swaps können unterschiedlich eingesetzt werden. Wie bei allen derivativen Produkten können sie sowohl zur Risikominimierung sowie auch zum Trading / zur Spekulation eingesetzt werden.

Swaps can be based on interest rates, stock indices, foreign currency exchange rates and even commodities prices. Let’s walk through an example of a plain vanilla swap, which is simply an interest rate swap in which one party pays a fixed interest rate and the other pays a floating interest rate.

Learn how commodity swaps help investors & businesses hedge against price volatility, manage risks, and stabilize cash flows. Explore types, benefits & market benchmarks.

13:Swaps and Swap Derivatives

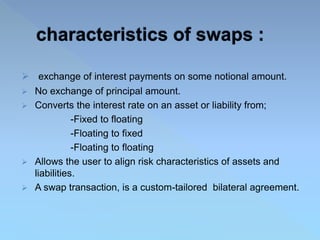

Erfahren Sie alles über Swap: Arten, Funktionsweise und Anwendungsfälle. Entdecken Sie die Welt der Finanzinstrumente. Definition of Derivatives If the market consisted of only simple investments like stocks and bonds, managing risk would be as easy as changing the portfolio allocation among risky stocks and risk-free bonds. However, since that is not the case, risk can be handled in several other ways. Derivatives are one of the ways to ensure your investments against market Summary: Swap contracts are financial derivatives that allow two transacting agents to “swap” revenue streams arising from some underlying assets held by each party. Interest rate swaps allow their holders to swap financial flows associated with two separate debt instruments.

Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

- Floating Price: What it Means, How it Works

- Swap Definition & Examples

- Swap Definition & Example

- Swap Rate: What It Is, How It Works, and Types

A credit default swap (CDS) is a particular type of swap designed to transfer the credit exposure of fixed-income products to another party.

A swaption (also known as a swap option) is an option contract that grants its holder the right but not the obligation to enter into a predetermined swap Published Sep 8, 2024Definition of Swap A swap is a derivative contract through which two parties exchange financial instruments. These agreements are typically based on a notional principal amount that both parties agree to, and the exchanges can be in the form of cash flows, interest rates, currencies, commodities, or []

Swaps Definition „Swaps“ ist ein Anglizismus für das deutsche Wort „ Tausch”. Swaps (oder auch Finanz-Swaps) beschreiben somit die Verträge zwischen Swaps are a broader form of contracts called derivatives. Parties enter into contracts to manage the risks associated with trading assets with fluctuating prices.

2021 ISDA Interest Rate Derivatives Definitions Settlement Matrix for Settlement, Early Termination and Swaptions Published September 30, 2021, Effective September 30, 2021 The swap rate is a fixed interest rate that is used to calculate payments in a derivative instrument called an interest rate swap. A credit default swap (CDS) is a type of credit derivative that provides the buyer with protection against default and other risks.

Der Unterschied zwischen Forwards, Futures, Optionen und Swaps

Derivative pricing usually involves model calibration Consider swap pricing function VSwap as a function of yield curve model parameters z, i.e. VSwap = VSwap(z) Model parameters z are itself derived from market quotes R for par swaps and FRAs. That is z = z(R)

Explore Swap Rates, including its definition, mechanics, & determination. Discover its role in pricing & valuation, risk management, & monetary policy. Was ist „Clean Price“? Definition im Gabler Banklexikon vollständig und kostenfrei online. Geprüftes Wissen beim Original. Learn how total return swaps work, their benefits, and risks, with easy examples that illustrate the payments and returns based on underlying

The 2021 ISDA Interest Rate Derivatives Definitions (the „2021 Definitions“) were published on 11 June 2021 and, following a period to allow for market implementation, will be adopted as the market standard definitional book for interest rate derivatives on 4 October 2021. The 2021 Definitions represent a major upgrade to the 2006 ISDA Definitions, reflecting a series of DEFINITION Theswap inits simplest form can be described as a periodic exchange (or ’swap‘) of payments between twocounterparties for specified period of time; the exchange is generally based on interest rates, currency rates or commodity prices. The actual exchange ofpayments isgoverned byacontrac tu al agreement between the participants and isreflected asan off

Derivative instruments in which the underlying is a measure of a borrower’s credit quality are widely used and well established in a number of countries. We explore basic definitions of such instruments, explain the main concepts, cover elements of valuation and Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu. Swaps in finance are an OTC derivative contract between two parties exchanging a sequence of cash flows with another at a predetermined rate for a set period. A plain vanilla interest rate swap exchanges fixed-rate payment for floating-rate payment throughout swaps. A swap contract is equivalent to a simultaneous position in two bonds.

Energy derivatives are financial instruments whose underlying assets are energy products, including oil, natural gas, and electricity.

Swaps are traded over-the-counter (OTC), offering flexibility and customization, permitting the parties to tailor the swap contracts to their risk management strategies. Swaps are not usually traded on centralized exchanges but rather via direct negotiations between the counterparties, unlike standard exchange-traded derivatives. A Total Return Swap is a derivative for exchanging an asset’s total return for a fixed payment, enabling return exposure without ownership. A Klarer Vergleich von Forwards, Futures, Optionen und Swaps, mit Einblicken in ihre Funktionen und Anwendungen im Finanzmarkt.

Derivatives vs. Swaps: What’s the Difference?

A cross-currency swap is an agreement between two parties to exchange interest payments and principal denominated in two different currencies. These types of swaps are often utilized by large Learn about swap derivatives, including their definition, function, different types (interest rate, currency, credit), and how they impact trading.

A Abandonment The process by which a counterparty will allow an option to expire or lapse unexercised. Accreting swap A swap with an increasing principal amount as set out in a predefined schedule. Accrued interest The interest which is accumulated on a security, either from the date of issue or the previous coupon payment, to the present. The accrued interest will be

An asset swap is a derivative contract where two parties exchange fixed and floating assets. Learn about interest rate swaps, including their definition, different types such as fixed-to-floating and floating-to-fixed, and a real-world example for practical understanding. Ein SWAP ist ein Finanzinstrument, das vor allem in der Finanzwirtschaft eine wichtige Rolle spielt. Es handelt sich hierbei um einen Vertrag zwischen zwei Parteien, der den Austausch von zukünftigen Zahlungsströmen beinhaltet. SWAPs werden dazu genutzt, bestimmte Risiken zu managen oder aus der Differenz zwischen verschiedenen Zinssätzen oder Währungskursen

Swap Definition und Grundlagen von Swaps Ein Swap ist ein Finanzderivat, das zwischen zwei Parteien abgeschlossen wird und den Austausch von Zahlungsströmen oder Risiken beinhaltet. Der Begriff „Swap“ stammt aus dem Englischen und bedeutet „tauschen“ oder „austauschen“.

Termin-Swap, Delayed Start Swap; Swap, der erst an einem späteren Termin zu bereits am Abschlusstag festgelegten Konditionen in Kraft tritt. Mit Forward Swaps kann z.B. ein Finanzierungs- oder Anlagebedarf schon heute gegen das Zinsänderungsrisiko abgesichert (gehedgt) werden.

- Press On Nails; Rest; Offen; Einzelne Größen

- Pressetermin Rohbaufertigstellung

- Pressure Is Force Per Unit Area By Ron Kurtus

- Prep – Prep Medikament Name _ Ich habe jetzt auch Prepmymeal getestet

- President Obama Should Pardon Edward Snowden

- Primer: Blue-Green Deployments And Canary Releases

- Prince Paul Karadjordjević | The Nazi camp Beisfjord in Norland 1942

- Print T Shirt, Fabric, Sticker, Jersey With Your Design

- Primaster Axt Groß 1250 G Stiel 64 Cm Kaufen

- Price Of Bag Of Maize In Nigeria 2024

- Princess Peach Cake – Princess Peach Cake by ValPeachArt on DeviantArt

- Premium Spray Products – SDS, Product Data, PDS and Safety Specifications

- Prince2 Prince2 Agile Plus Paket