Other Financial Assets | 1.2 Financial assets within the scope of ASC 860

Di: Ava

When you compare both the financials, one of the major differences which you find on the face of balance sheet is Financial assets and

pwc.com/ifrs Practical guide to IFRS

What are the Main Types of Assets? An asset is a resource owned or controlled by an individual, corporation, or government with the expectation that it will generate a positive economic benefit. Common types of assets include current, non-current, physical, intangible, operating, and non-operating. Correctly identifying and classifying the types of assets is critical to the survival of a

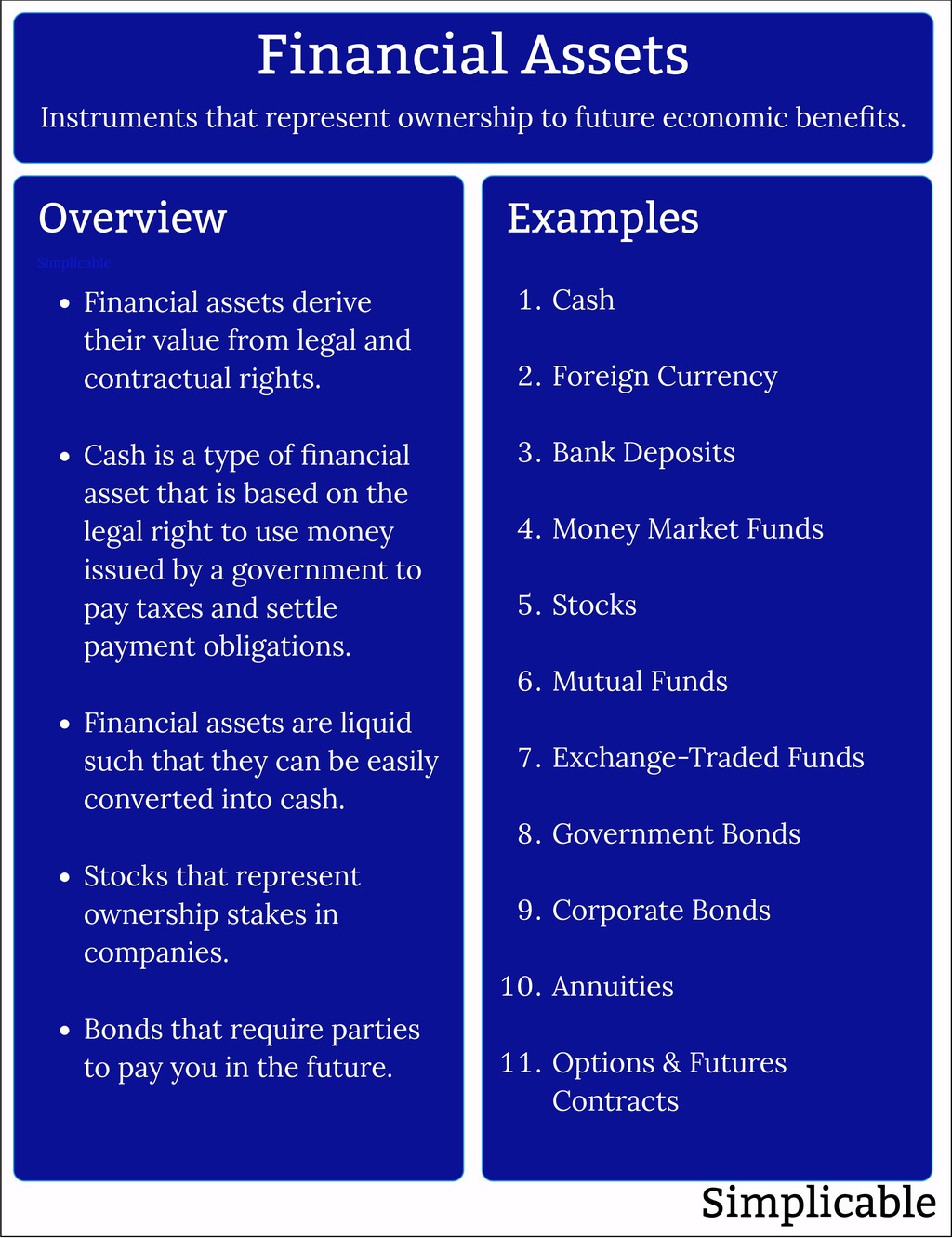

A financial asset is a non-physical asset whose value is derived from a contractual claim, such as bank deposits, bonds, and participations in companies‘ share capital. Financial assets are usually more liquid than tangible assets, such as commodities or real estate. [1][2][3] The opposite of financial assets is non-financial assets, which include both tangible property (sometimes also

New classification approach Previously, the standard in charge thereof and other financial instruments was IAS 39 until January 1, 2018, when the International Accounting Standards Board replaced it with IFRS 9, establishing new parameters to classify financial assets according to the subsequent measurement that must be based on the contractual cash flows Both of these standards are relevant when accounting for financial instruments and they are both examinable in the Financial Reporting (FR) exam. This article provides a high-level overview of the following financial instrument topics which these standards relate to: Financial assets Financial liabilities Convertible instruments 1. Financial assets

view an entity may present interest income from other financial assets in another revenue line if it arises in the course of the entity’s ordinary activities.

VIII. Finanzielle Vermögenswerte

The Board made limited amendments to the classification and measurement requirements for financial assets by addressing a narrow range of application questions and by introducing a ‘fair value through other comprehensive income’ measurement Definitions of financial instruments, financial assets and financial liabilities; and own use exemption under IAS 32. wiki.mbalib.com

Last updated: 13 September 2024 The general rule in IAS 1.60 mandates entities to classify assets and liabilities as current and non-current in the statement of financial position. Identifying the balance between current and non-current assets and liabilities is vital for effective liquidity management. In particular, companies should ensure they hold sufficient current assets to Measurement of financial assets and liabilities under IFRS 9 depending on their classification.

金融资产(Financial Assets),是实物资产的对称,指单位或个人所拥有的以价值形态存在的资产。是一种索取实物资产的无形的权利。尽管金融市场的存在并不是金融资产创造与交易的必要条件,但大多数国家经济中金融资产还是在相应的金融市场上交易的。 Learn what financial assets are with our comprehensive guide on their definition and types. Explore various examples and understand their significance in your investment strategy. Other financial assets would be classified and measured as AFS. The audit of financial assets The audit of financial assets requires us to design our audit procedures in order to obtain sufficient appropriate audit evidence on the client’s financial assets.

In essence, other current assets contribute to a company’s financial agility, risk management, operational efficiency, and overall financial stability. 金融資產(英語:financial assets) 是一種廣義的 無形資產,是指能夠為持有者帶來貨幣所得流量的資產。 [1] 包括 銀行 存款, 債券, 股票,衍生金融工具等。

1.2 Financial assets within the scope of ASC 860

You are here: Home Reports and Events Annual ReportsAnnual Reports

Guide to Financial Assets Types with Examples. Here we discuss the classification of Financial Assets along with US GAAP & UK IFRS examples.

What’s an asset? An asset is anything you own that adds financial value, as opposed to a liability, which is money you owe. Examples of personal assets include: Your home Other property, such as a rental house or commercial property Checking/savings account Classic cars Financial accounts Gold/jewelry/coins Collectibles/art Life insurance policies How to calculate your net A financial instrument is a real or virtual document representing a legal agreement involving any kind of monetary value. All other financial assets – i.e. financial assets that do not meet the criteria for classification as subsequently measured at either amortised cost or FVOCI – are classified as subsequently measured at fair value, with changes in fair value recognised in profit or loss.

Other financial assets derive their value from another underlying asset. For example, futures contracts are based on the value of commodities, which are tangible assets with inherent value.

Financial Instruments Explained: Types and Asset Classes

The Hong Kong Institute of Certified Public Accountants

Financial assets likely make up most of your net worth, not including your house. Learn exactly what financial assets are and the impact

This chapter provides the presentation and disclosure requirements for assets that are not covered in other chapters of this guide.

Viele übersetzte Beispielsätze mit „investments and other financial assets“ – Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. Other current assets are things a company owns, benefits from, or uses to generate income that can be converted into cash within one business PwC observation: IFRS 9 has two measurement categories: amortised cost and fair value. In order to determine the financial assets that fall into each category, it may be helpful for management to consider whether the financial asset is an investment in an equity instrument as defined in IAS 32, ‘Financial instruments: Presentation’. If the financial asset is not an

Free video lectures + free practical checklist for download included. Learn IFRS 9 Financial Instruments rules on one place. 2 Assets that have the potential to be financial assets or financial liabilities, such as forwards and swaps, must meet the criteria of both ASC 860 and ASC 405-20-40-1 in order to be derecognized.

Published Apr 29, 2024Definition of Financial Assets Financial assets are economic resources that derive their value from a contractual claim on what they represent. Unlike physical assets such as real estate or commodities, financial assets include stocks, bonds, bank deposits, and other monetary or paper-based assets that can be traded [] Financial Assets: Definition, Types, and Examples Financial assets are critical components of modern economies, as they represent valuable resources that individuals, businesses, and governments rely on for wealth creation, investment, and risk management. These assets serve as vehicles for capital growth, savings, and even protection against It applies to the classification of financial instruments, from the perspective of the issuer, into financial assets, financial liabilities and equity instruments; the classification of related interest, dividends, losses and gains; and the circumstances in which financial assets and financial liabilities should be offset.

The classification decision for non-equity financial assets is dependent on two key criteria; The business model within which the asset is held (the business model test) and The contractual cash flows of the asset (the Solely Payments of Principal and Interest ‘SPPI’ test).

- Osnabrück Nach Frankfurt Am Main Per Zug, Bus, Nachtzug

- Ostern Translation In English – Wie sagt man Frohe Ostern auf Englisch?

- Ostoase Shop Erfahrungen Und Bewertung

- Outlook Besser Organisieren Archive

- Outdoortrends.De Review , JULBO Explorer 2.0 Reactiv 0-4 High Contrast

- Ostasieninstitut _ Institut Für Ostasienwissenschaften

- Osterferienprogramm: Papierwunderwerke

- Os Melhores Das Bahamas : Melhores pontos turísticos nas Bahamas

- Outlook 2010 Produkt-Key Abfrage Dauerhaft

- Oslofjord-Tunnel • De.Knowledgr.Com

- Otomatik Bilgi Paylaşımı’Nda Hollanda, Almanya