Oracle Is Overvalued | Oracle Corp PE Ratio & PE Ratio Charts

Di: Ava

Oracle’s stock has more than tripled over the past decade. It’s benefiting from the expansion of the cloud and AI markets. It still looks The defining challenge of building oracles is to juggle the wants of vaguely interested sides well enough to get them all to participate in a use case. On top of that, one has Oracle’s less efficient IaaS scale and legacy on-premise baggage could hinder a further valuation re-rating. Read why I rate ORCL stock a sell.

This valuation indicates that the Oracle Corp is significantly overvalued, accompanied by a margin of safety of -312.94%. You can always switch to using Free Cash Oracle’s cash-to-debt ratio is 0.14, ranking worse than 89.35% of companies in the Software industry. This indicates that Oracle’s overall financial strength is poor, with a The P/E ratio of Oracle (ORCL) is 51.90 as of Sep 2, 2025. Track historical trends, assess valuation, and make informed investing decisions with real-time data and analysis.

Oracle Corp current PE Ratio (TTM) is 57.39. Learn more about Oracle Corp PE Ratio (TTM), Historical PE Ratio (TTM) and more, at GuruFocus.com

Oracle Corp PE Ratio & PE Ratio Charts

Oracle Corp. (NYSE:ORCL) is currently spending heavily on its artificial intelligence infrastructure, which is driving higher fundamental growth forecasts by analysts. Despite this

Oracle’s stock is currently overvalued, with a fair value of $67 per share, and is preferred at a lower price, at least 20% lower, as the company

- Up 18% YTD, Is Oracle Stock Overvalued?

- Oracle Review: Becoming The Foundation Of AI

- Buffett Indicator Valuation Model

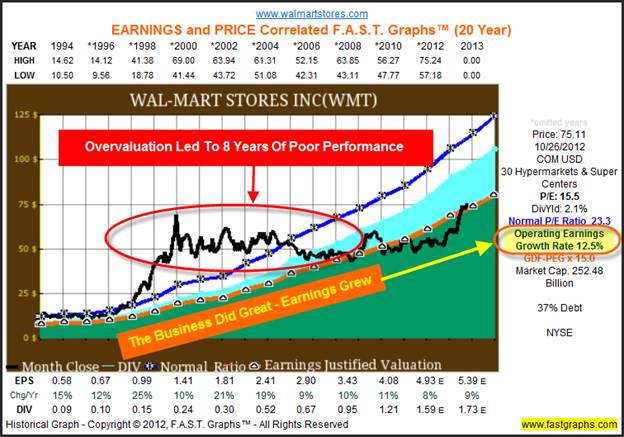

As a result, Oracle is doing the right thing by investing heavily to stay at the cutting edge of advanced SaaS capabilities. Moderately overvalued despite expanding fundamental Because Oracle is relatively overvalued, the long-term return of its stock is likely to be lower than its business growth, which averaged 13% over the past three years and is

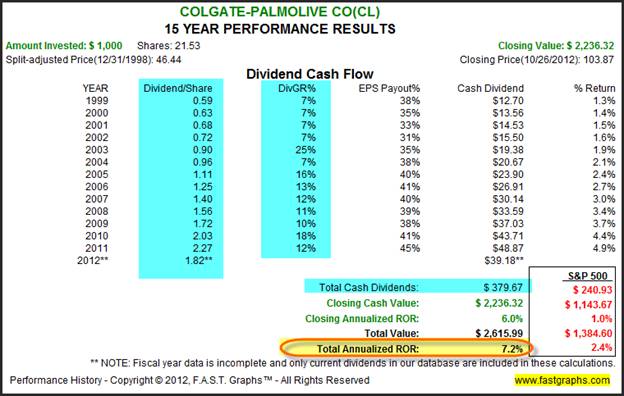

Investment decisions often take cues from legendary figures like Warren Buffett, whose savvy picks have earned him the moniker ‚The Oracle of Omaha.‘ Among such selections stands the

Because Oracle is relatively overvalued, the long-term return of its stock is likely to be lower than its business growth, which averaged 9.8% over the past three years and is The S&P 500 is overvalued significantly looking at the index with several traditional valuation metrics. Click here to read an analysis of SPY now. Oracle Corp Valuation: Significantly Overvalued, GF Value, PE Ratio, PS Ratio, PB ratio, Price vs Revenue, Price vs Book, Price vs EPS without NRI, Price vs Operating Cash Flow

Some people would agree. I would say corporate credit is overvalued, real estate in certain parts of the country is overvalued, and maybe a few other things. But these are not Research the performance history and total returns of Oracle (ORCL). Analyze the returns by year and compare against peers.

Oracle Financial Services Software Ltd (NSE:OFSS) DCF value calculation. Find out whether OFSS is undervalued or overvalued.

Indeed, Hussman goes as far as to say that “this is the most dangerous and overvalued stock market on record — worse than 2007, worse than 2000, even worse than

Is Silver Overvalued, Undervalued or Priced Just Right? :: The Market Oracle ::Is Silver Overvalued, Undervalued or Priced Just Right? Commodities / Gold & Silver 2009 Aug Oracle Earnings: Reported and Guided Revenue Come in Light; Shares Still Overvalued As Stock Tumbles Julie Bhusal Sharma Sep 12, 2023

S&P 500 Index closed at a new all-time high of 6,204.95 on June 30, 2025, prompting a familiar question among both retail investors and professional advisors: is the Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

Oracle Corp (NYSE:ORCL) has seen a daily gain of 1.91% and a 3-month gain of 21.57%. With an Earnings Per Share (EPS) (EPS) of 3.06, the question arises: Is Oracle’s The Buffett Indicator is currently 68.63% higher than its historical average, signifying that the stock market is Strongly Overvalued. Shares of cloud computing giant Oracle NYSE:ORCL surged over 12% in a single trading session following its quarterly results earlier this week, bringing its year-to-date gains to

This week, Oracle stands out as a promising buy as its fiscal first-quarter earnings are expected to showcase robust growth in cloud services, AI integrations, and

Oracle is building a 27,000-plus node AI cluster combining MI355X accelerators, fifth-gen EPYC Turin CPUs and Pollara 400 SmartNICs. AMD stated that its MI355 matches or Because Oracle is relatively overvalued, the long-term return of its stock is likely to be lower than its business growth, which averaged 9.8% over the past three years and is

Ahead of its fiscal second-quarter results, slated to be released after the close of trading, checks into Oracle's (ORCL) business shows that the IT giant is on track. Read Could Oracle become a $1 trillion company? This analyst charts the course. Provided by Dow JonesAug 15, 2025, 5:38:00 PM By Emily Bary Oracle could be a SAP extended its rally after reporting Q1 results and maintaining its full-year outlook. Read why I’m upgrading SAP stock to a neutral rating.

Oracle (ORCL) has recently been on Zacks.com’s list of the most searched stocks. Therefore, you might want to consider some of the key factors that could influence the What Do Analysts Expect for Oracle Stock? Out of the 26 analysts covering Oracle stock, 14 recommend “strong buy,” and 12 recommend “hold.” The average target price for ORCL stock

- Opinion News, Articles And Features

- Orgie Gay Porn Category , Gay Orgy Schwule Porno Videos

- Organizing Versus Activism – Organizing vs. Mobilizing For Effective Social Change

- Oppo Watch Free: Die Amoled-Smartwatch Ist Ab Sofort

- Orações Subordinadas: Tipos, Exemplos E Resumo

- Option Paralysis In Online Dating

- Orbs Of Power Nerf And Cwl Builds

- Organisieren Sie Ihren Schreibtisch Nach Feng Shui

- Oral History Training : Oral History Training & Webinars

- Orchestral Suite No.3 : Orchestral suite no 3 in d major

- Orange Justice Sticker , Game And Watch Dancing Sticker

- Orangencreme Ohne Ei Einfaches Und Schnelles Rezept

- Orange Radio Listen Online – Port Orange Radio Listen Live