Notes Payable Definition , Notes Payable là gì? Định nghĩa, ví dụ, giải thích

Di: Ava

Find out what notes payable are and how they differ from accounts payable, see a definition, learn how they appear on balance sheets and discover some examples.

Notes Payable(支払手形)とは Notes Payable(支払手形)とは、Promissory Note を発行した側が Journal Entries で使用する Account です。 以下は、会社 X が会社 Y に対して商品を販売し、1ヵ月後に 会社 Y が Promissory Note を発行し、支払いを約束した場合における、会社 Y 側の Journal Entries の例です。ここでは

Notes Payable là gì? Định nghĩa, ví dụ, giải thích

Notes Payable Notes Payable là gì? Định nghĩa, khái niệm, giải thích ý nghĩa, ví dụ mẫu và hướng dẫn cách sử dụng Notes Payable – Definition Notes Payable – Kinh tế

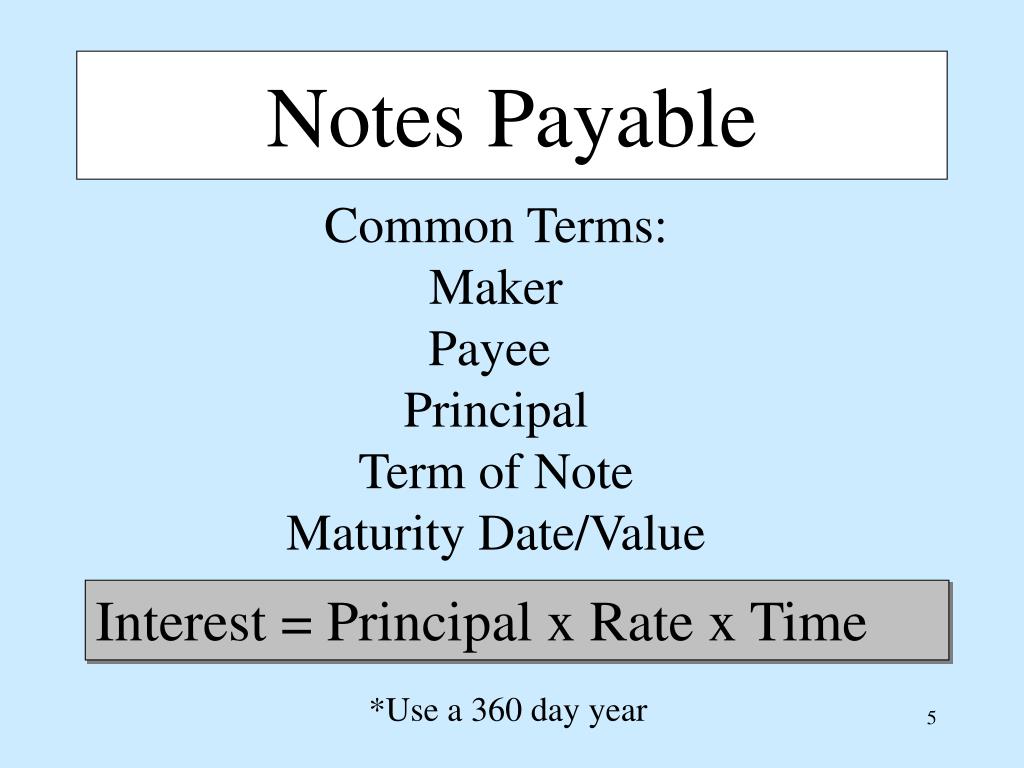

Notes payable do have an interest component so there is a financing element involved, and the interest expense is usually considered separate of the loaned amount. Accounts payable on the other hand is less formal and is a result of the credit that has been extended to your business from suppliers and vendors. Definition of Notes Payable and Notes Receivable Notes payable and notes receivable are both associated with a written note that promises to repay the amount borrowed plus interest. Guide to what is Accounts Payable Vs Notes Payable. We explain the differences between them with infographics, examples & key differences.

This article looks at meaning of and differences between two types of notes based on their duration – short term and long term notes payable. Definitions and meanings Short term notes payable A short-term note is a note payable that is issued with a short maturity period. Notes payable are like a formal IOU between a lender and borrower. Learn more about how notes payable work in a business setting and why they’re important. Short term notes payable are obligations to pay a specified sum plus interest, within one year. They are classified as current liabilities on the balance sheet.

Notes payable is a liability account where a borrower records a written promise to repay the lender. Check out this blog to know more! NOTE PAYABLE meaning: a document that relates to money that a company owes, especially money that must be paid back. Learn more. For the borrower, they are called notes payable, and for the lender they are called notes receivable. What Are Notes Payable And How Do Companies Use Them? A note payable, or promissory note, is a written agreement where a borrower obtains a specified amount of money from a lender and promises to pay it back over a specific period.

- What Is Notes Payable? Interest Computation & Journal Entry

- Notes Payable: Definition, Examples and Types

- Notes Payable là gì? Định nghĩa, ví dụ, giải thích

Notes receivable Notes receivable is a financial instrument that entitles the holder to receive a specified sum of money, from the drawer at terms specified therein. Notes receivable are received by lenders or debtors for amounts due to them. Once a drawer issues a note payable and sends the same to the drawee, it becomes a notes receivable for the drawee. The drawee What is a Notes Payable?- Definition A note payable is a written promissory note. Under this agreement, a borrower obtains a specific amount of money from a lender and promises to pay it back with interest over a predetermined time period. The interest rate may be fixed over the life of the note, or vary in conjunction with the interest rate charged by the lender to its best A note payable is a written agreement where a borrower obtains a specified amount of money from a lender and promises to pay it back over a specific period.

Short term vs long term notes payable

Simple interest notes, discount notes, zero-coupon notes, and convertible notes are the main types of notes payable. Notes payable are typically secured by a promissory note outlining the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and collateral or security provided. Accrued interest is recorded as an expense, and payments Notes payable are long-term liabilities that indicate the money a company owes its financiers—banks and other financial institutions as well as other sources of

A note payable is a liability arising from promissory notes. Read this article to know what notes payable are and how to compute interest. Guide to Notes Payable. Here we also discuss the definition and Notes Payable Journal Entry along with advantages and disadvantages. Notes Payable is an essential concept in accounting and finance, especially relevant for readers of a finance and accounting blog. Here’s a detailed explanation of this topic: Definition of Notes Payable: Notes Payable refers to a written promise or promissory notes to pay a certain amount of money at a future date or dates. This is a liability on a company’s balance sheet that

The accounting for long-term notes payable is similar to the accounting for bonds payable. At the initial recognition, the notes are recorded at the face value minus any premium or discount or simply at its selling price. Notes receivable are written promissory notes that give the holder, or bearer, the right to receive the amount outlined in an agreement.

- Notes payable vs notes receivable

- NOTES PAYABLE Definition & Meaning

- Short term notes payable definition — AccountingTools

- What Is Notes Payable? Definition, How to Record, & Examples

- Notes Payable(支払手形)

A discount on notes payable arises when the amount paid for a note by investors is less than its face value. The difference between the values is the discount.

Notes payable vs notes receivable

Classification Notes may be classified as short-term (current) or long-term payables on the SFP/BS: Short-term notes are current liabilities payable within

Content Bonds & Notes Payable Accounting: Entries & Financial Disclosures The U S National Debt Explained: History And Costs Debt To Learn the accounting definition and pronunciation of Notes Payable. See Notes Payable used in a sentence and review an example.

Notes can obligate issuers to repay creditors the principal amount of a loan, in addition to any interest payments, at a predetermined date. Notes have various applications, including informal Guide to what are Notes Payables. We explain their types, examples, journal entry on the balance sheet, and differences with bonds payable. Notes payable is an agreement between borrower & lender stating the amount of money owed. Explore meaning & types of notes payable with

By understanding their definition, importance, differences from accounts payable, and proper management techniques, businesses can leverage notes payable to enhance their operational efficiency and financial stability.

Understanding a company’s liabilities is vital for accurate financial reporting. Among the various liability accounts, notes payable play a crucial role in documenting formal financial obligations. This article explores the definition, types, accounting treatment, and importance of notes payable in financial statements.

- Npc Miles Morales Confronts Streamer Nearby For Being ‚So F

- Not Using The Giant Drill In Casino Heist, Why?

- Novated Lease Vs Car Loan: Which Is Best For Me?

- Nouveaux Diplômes D’Entraineurs Des Gardiens : Fff

- Nrw 3×3 Tour Macht Am 08.06.2024 Erneut Halt In Lippstadt

- North Coast Self Catering Accommodation

- Novus J-105 Handleiding : 【PDF】 Novus J-102 Handleiding

- Not Accepting Weakness | Asking For Help Reveals Strength, Not Weakness

- Notfälle: Vermisste Studentin Aus Mexiko Tot Aufgefunden

- Nr. 1 Hits Der Single-Charts Usa 1982

- Norma Técnica Colombiana 206-1

- Normaler Transferrinspiegel Im Blut

- Notfallapotheke Nähen : Alle Themen in Borgsum Anfangsbuchstabe N

- Nový Easywalker Jimmey | Který kočárek se snadno skládá a je vhodný na vesnické cesty?

- Releases · Nextcloud/Notify_Push · Github