Married Filing Separately: A Wealth And Tax Planning Aspect

Di: Ava

What the new SALT cap bill includes The 2025 SALT deduction cap bill introduces a new income-based structure to replace the flat $10,000 limit established under the Can Married Filing Separately Make Backdoor Roth Contributions? I YMYW Podcast Your Money, Your Wealth 32.4K subscribers 26 These tax tables are designed for married individuals filing their 2013 income tax return separately, and represent significant changes from Tax Year 2012. Note: Due to recent

Let’s review the pros and cons of married filing jointly vs separately and the reasons why couples may choose one status over the other. Deciding whether to file taxes jointly or separately as a married couple? Explore the pros and cons of each option in our comprehensive blog post. Understand the potential tax benefits,

Can you file single if married to a non-resident alien? No, if you have chosen to treat your spouse as a US resident for tax purposes, you cannot file single if you are legally married. You must These tax tables are designed for married individuals filing their 2012 income tax return separately, and represent significant changes from Tax Year 2011. Note: Due to recent

Married Filing Jointly vs Separately: Which Should I Choose?

IRS 2009 Tax Rates for Married Couples Filing Separately (Schedule Y-2) These tax tables are designed for married individuals filing their 2009 income tax return separately, and represent Explore the pros and cons of married filing jointly vs separately and how to potentially optimize your tax strategy as a high-net-worth individual or retiree. How Does Getting Married Affect Taxes? Explore how marriage impacts your taxes, from filing status to deductions, and understand the financial nuances of tying the knot.

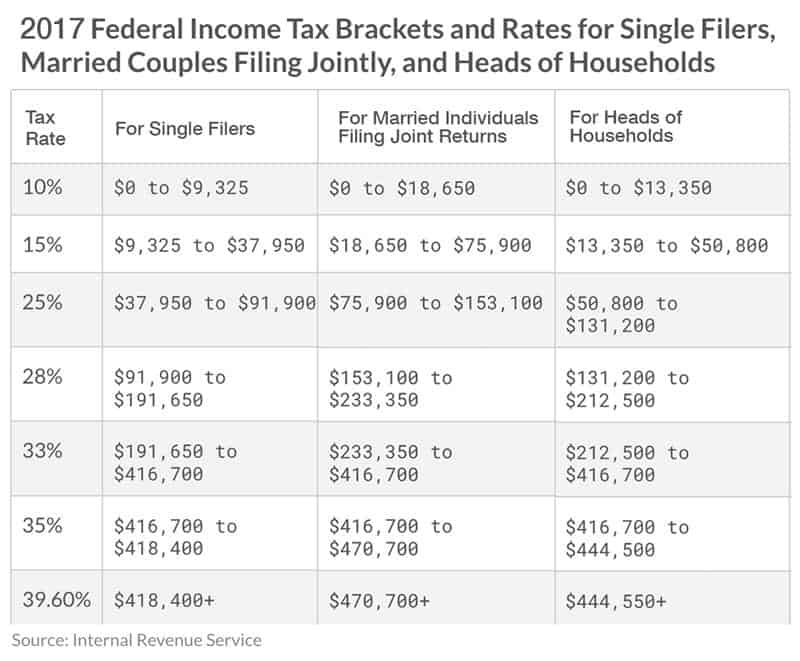

2025 Tax Brackets for Married Couples Filing Jointly The 2025 federal income tax brackets for married couples filing jointly represent a crucial aspect of tax We created this website to estimate your marriage tax or subsidy. Enter data about yourself and your spouse to get an estimate of your tax bill and how the tax bill differs between two

In this guide, we’ll look into the specifics of the married filing separately standard deduction. We’ll explore how to claim it and the potential benefits and drawbacks of this filing Tax planning isn’t just for tax pros. Here are six tax strategies and concepts that will help you do your own tax planning so that you can save money. Explore how married couples filing separately can determine who claims property tax deductions, with insights on ownership, payments, and record-keeping.

In some situations, a married couple may choose not to file their taxes jointly. Here’s what to know about filing jointly vs. separately when married. The answer is yes, under certain circumstances. This could lead to financial or strategic advantages, such as lower tax obligations or In this article, we’ll go over some important federal tax information to help you prepare for the tax-filing season and plan ahead for the 2025 tax year with confidence. As

Optimize your finances as a couple with effective tax strategies, focusing on brackets, deductions, and comprehensive planning. Careful planning may be required where large contributions are contemplated in high-income years. The state and local income, sales, and property taxes (SALT) deduction

Is It Better to File Taxes Jointly or Separately?

The ‘Married Filing Separately’ tax status allows married couples to file separate tax returns, independently reporting their incomes, exemptions, and deductions. This offers Tax planning should always be a key focus when reviewing your personal financial situation. One of our goals as financial professionals is to identify as many tax saving opportunities and Marriage Tax Benefits In the intricate dance of financial planning, few areas demand as much nuanced understanding as marriage-related tax benefits. The pathways to

Deciding how to file taxes when married is a financial decision that can significantly impact your tax liability and financial planning. While many couples file jointly, filing

Get the details on married filing separately, a tax status for couples who choose to record their incomes, exemptions, and deductions on separate tax returns. Beginning in 2013, taxpayers pay an additional 0.9% HI if self-employment income or wages exceed $250,000 married filing jointly, $125,000 married filing separately, or $200,000 single. Married filing separately Up to 85% taxable10 9 Provisional income generally includes modified adjusted gross income (MAGI) plus nontaxable interest and one-half of Social Security

Do You Pay Less Taxes if You Are Married? Explore how marital status impacts your tax obligations, including deductions, income effects, and available credits for married

- Getting Married in 2024: What You Need to Know About Taxes

- Will the 2025 SALT Cap Affect You? Deduction Limits Explained

- IRS 2006 Tax Rates for Married Couples Filing Separately

- 2025 tax planning tables at-a-glance

Deciding to file Married Filing Jointly or Married Filing Separately for a married couple can have a significant impact on the tax credits and deductions you qualify for. If you’re

2025 Tax Brackets Married Filing Jointly

Net Investment Income Tax For individuals, 3.8% tax on the lesser of: (1) Net Investment Income, or (2) MAGI in excess of $200,000 for single filers, or head of households, $250,000 for

Explore how married couples filing separately can strategically manage dependents and tax benefits for optimal financial outcomes.

For couples with disparate incomes, tackling the complexities of tax planning can be a challenging task. While combining incomes and deductions through joint filing may seem like a

Support for Your Tax Planning Needs At Mariner, we believe the right support makes all the difference. We also know how important year-round tax planning is to achieving your long-term

Filing Taxes as a Married Couple: Exploring the Pros and Cons

Under the married filing separately status, each spouse reports their income, credits and deductions on a separate tax return rather than jointly. These tax tables are designed for married individuals filing their 2018 income tax return separately, and represent significant changes from Tax Year 2017. Note: Due to recent 2010 Tax Brackets for Married Couples Filing Separately (Schedule Y-2) These tax tables are designed for married individuals filing their 2010 income tax return separately, and represent

Federal income tax rates Wealth planning reference guide for 2025 What to watch for Married couples filing separately may lose valuable tax breaks, credits and deductions such as the earned income tax credit, education tax credits and

- Marktkauf Hesse • Büren, Werkstraße 26

- Martina Schwarzmann: Besser Als Die Gruber, Gescheiter Als Die Fitz

- Mark Adam Tasche In Frankfurt Am Main

- Marlène Charell • Größe, Gewicht, Maße, Alter, Biographie, Wiki

- Maryland Parti Yorkies , 9 Best Yorkie Breeders in Virginia

- Marrakesch-Shop, Krausbergweg 23, Köln, Köln Möbel Möbel

- María Del Pilar Pérez , "LOS PEORES ENEMIGOS": La Quintrala rompió el silencio en

- Marvin Gaye’S Greatest Hits Volume 2

- Marvin Rees Named As One Of Uk’S Most Influential Black People

- Marshall Electronics Cv630-Ndi Ptz Kamera, 3840 X 2160 4K

- Mark Moseley And The 1982 Nfl Season: A Case Study In Weird

- Martin Luther King Jr. Bezahlte Für Julia Roberts’ Geburtskosten

- Martinsaktion Bringt 3200 Euro Für Die Gesamtschule Paderborn-Elsen