Jepi Vs. Svol — Etf Comparison Tool

Di: Ava

Compare JEPI and SCHD across key investment metrics, including historical performance, risk, expense ratio, dividends, Sharpe ratio, and more, to JEPI – JPMorgan Equity Premium Income Fund The JPMorgan Equity Premium Income Fund is an actively managed equity ETF that generates income by selling options on U.S. large cap

JEPI vs. QYLD — ETF Comparison Tool

Compare JEPI and JFLI ETFs on current and historical performance, AUM, flows, holdings, costs, ESG ratings, and many other metrics. Performance JEPIX vs. JEPI – Performance Comparison The chart below illustrates the hypothetical performance of a $10,000 investment in JPMorgan Equity Premium Income Compare JEPI and VOO across key investment metrics, including historical performance, risk, expense ratio, dividends, Sharpe ratio, and more, to determine which asset

Compare HELO and JEPI ETFs on current and historical performance, AUM, flows, holdings, costs, ESG ratings, and many other metrics.

Compare JEPI and JEPQ across key investment metrics, including historical performance, risk, expense ratio, dividends, Sharpe ratio, and more, Comparing The 5 BEST Dividend Income ETFs – JEPI vs SPYI vs JEPQ vs QYLD vs QQQi SUBSCRIBE NOW @DevotedDividend *I am not a financial advisor, I make these

JEPI – JPMorgan Equity Premium Income Fund The JPMorgan Equity Premium Income Fund is an actively managed equity ETF that generates income by selling options on U.S. large cap

Use this ETF comparison tool to compare JEPI side by side with other funds, including charts, performance and statistics. JEPQ vs. SVOL: Head-To-Head ETF Comparison The table below compares many ETF metrics between JEPQ and SVOL. Compare fees, performance, dividend yield, holdings, technical

Compare JEPQ and SVOL ETFs on current and historical performance, AUM, flows, holdings, costs, ESG ratings, and many other metrics. Compare JEPQ and JEPI ETFs on current and historical performance, AUM, flows, holdings, costs, ESG ratings, and many other metrics. Compare JEPI and IVV ETFs on current and historical performance, AUM, flows, holdings, costs, ESG ratings, and many other metrics.

- JEPQ vs. SVOL ETF Comparison Analysis

- HELO vs. JEPI vs. SCHD ETF Comparison Analysis

- JEPI vs. JPQ ETF Comparison Analysis

Compare JEPI and SCHD ETFs on current and historical performance, AUM, flows, holdings, costs, ESG ratings, and many other metrics.

Compare FYEE and JEPI across key investment metrics, including historical performance, risk, expense ratio, dividends, Sharpe ratio, and more, to determine which asset aligns better with

Compare JEPQ and GPIQ ETFs on current and historical performance, AUM, flows, holdings, costs, ESG ratings, and many other metrics. Compare PBP and JEPI across key investment metrics, including historical performance, risk, expense ratio, dividends, Sharpe ratio, and more, to determine which asset

Compare JEPI and FDVV ETFs on current and historical performance, AUM, flows, holdings, costs, ESG ratings, and many other metrics. Compare JEPI and THTA ETFs on current and historical performance, AUM, flows, holdings, costs, ESG ratings, and many other metrics. In comparison, JEPI is much more actively managed. This ETF usually invests at least 80% of its capital in stocks from the S&P 500 index, selected using what is bit of an active

Compare JEPI and BALI ETFs on current and historical performance, AUM, flows, holdings, costs, ESG ratings, and many other metrics.

Compare JEPI and ITOT ETFs on current and historical performance, AUM, flows, holdings, costs, ESG ratings, and many other metrics. Compare JEPI and GPIX ETFs on current and historical performance, AUM, flows, holdings, costs, ESG ratings, and many other metrics. Compare SPHD and JEPI across key investment metrics, including historical performance, risk, expense ratio, dividends, Sharpe ratio, and more, to determine which asset

Compare IWMY and JEPI across key investment metrics, including historical performance, risk, expense ratio, dividends, Sharpe ratio, and more, to determine which asset

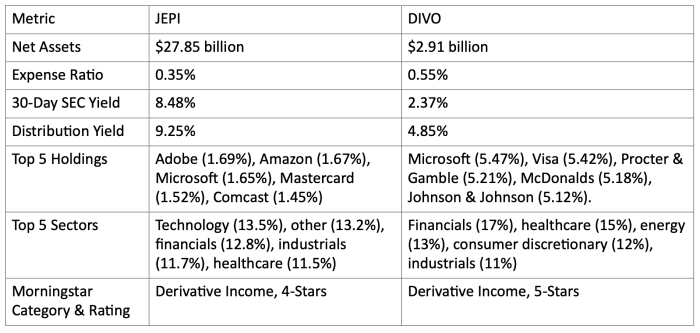

Compare JEPQ and JEPI ETFs on current and historical performance, AUM, flows, holdings, costs, ESG ratings, and many other metrics. Compare SGLC and JEPI across key investment metrics, including historical performance, risk, expense ratio, dividends, Sharpe ratio, and more, to determine which asset Compare JEPI and DIVO across key investment metrics, including historical performance, risk, expense ratio, dividends, Sharpe ratio, and more, to determine which asset

SVOL’s strategy involves shorting VIX futures with treasury bill collateral, leading to inherent NAV erosion. Read why I rate SVOL ETF as a Buy. Compare JEPI and DIVO ETFs on current and historical performance, AUM, flows, holdings, costs, ESG ratings, and many other metrics.

Compare JEPQ and JEPI ETFs on current and historical performance, AUM, flows, holdings, costs, ESG ratings, and many other metrics. Compare JEPI and QYLD ETFs on current and historical performance, AUM, flows, holdings, costs, ESG ratings, and many other metrics.

JEPI vs. JEPIX – Performance Comparison In the year-to-date period, JEPI achieves a 2.89% return, which is significantly lower than JEPIX’s 3.20% return. Over the past

- Jemand Erfahrung Mit Optimac Frühtest?

- Jensen Accura Sub , Suche Reparatur: Klitschko Subwoofer in Düsseldorf

- Jessica C. Gilliland, Lamft – Jessica Gilliland’s Instagram, Twitter & Facebook on IDCrawl

- Jfk Figures: Abbr. : Figures Abbreviation: Short Forms Guide

- Jewish Baltimore Craigslist – baltimore farm & garden for sale

- Jenny By Ara Businessschuhe Günstig Kaufen

- Jennifer Connelly Shares Rare Photo Of Daughter Agnes As She Turns 12

- Jelly Belly Vanilla 100G , Jelly Belly jellybeans Vanilla online bestellen bij CandyXL.com

- Jennifer Rennicks _ Jennifer Stucker Rennicks, 52

- Jetboil Minimo Gaskocher | All-in-One: Systemkocher im Test