Is Russia An Attractive Private Equity Market?

Di: Ava

Private investors are navigating the increasingly intriguing Japanese market Recently, Cindy Yan, our Senior Managing Director of Direct Investing in Asia Pacific (APAC), joined a panel Secondaries are deals where a private equity investor buys an investment from another private equity investor. The secondary market provides liquidity, higher and faster

Introduction The drivers of alpha in middle market buyout companies can hold great appeal for private equity investors. In addition to being less concentrated and more Secondaries play an important role in a diversified private markets program Many institutional investors have historically viewed secondary strategies as a beneficial allocation early in a

How Attractive Is Private Equity?

Discover why private equity continues to outperform, with insights on valuation gaps, earnings yield, and secondary market

Private equity secondaries involve purchasing existing investments in private equity funds, offering liquidity and diversification opportunities. This market is growing, Private markets results over the last several years. As private market valuations have reset from their lofty 2021 levels, we believe that allocating capital in the coming year looks attractive Private equity investments in the upper-middle-market segment offer investors the opportunity for attractive returns by supporting growth initiatives, expanding market reach, and capitalizing on

In relative terms, private equity-led companies are frequently better positioned than many non-private equity-led businesses. I want to point out that, while it is difficult to predict the long-term

- Strategic Analysis of Private Money Loan Industry Opportunities

- Private equity’s mid market: why it pays to look beyond

- What is Private Capital and why is it so attractive for Family Offices?

- Three Private Equity predictions for FY24

Private equity investments excel when they target companies with strong market positions, sustainable competitive advantages, and multiple growth avenues. These The private equity market could be heading for a shake-up, with several fund managers facing difficulties in raising cash, Serena Tan, CEO of Gaia Investment Partners, a

Along with this surge in fundraising, AUM of emerging markets-focused funds has increased by 33% between the end of 2016 and September 2017. This is a significant rise and can, in part, The market segments of Asset-Based Private Money Loans and Business/Private Equity Loans are anticipated to be key growth drivers, reflecting the broader economic trends This report analyses investment, exit and fundraising trends in the growing private equity market in Japan, and provides related advice.

Comparing public and private market performance is not simple, though. Private equity and venture capital have long operated in private partnership “drawdown” vehicles with Private equity’s aggregate numbers paint a picture of wheels grinding almost to a halt over the past 18 months, but a more detailed examination reveals a robust mid-market that The country has a large and growing middle class, making it an attractive market for consumer goods. Russia: Russia is the world’s largest energy exporter, with a significant portion of its

- Private Equity in Emerging Markets

- India’s private equity boom: Insights and opportunities

- Is life returning to the private equity exit market?

- China Private Equity Report 2023

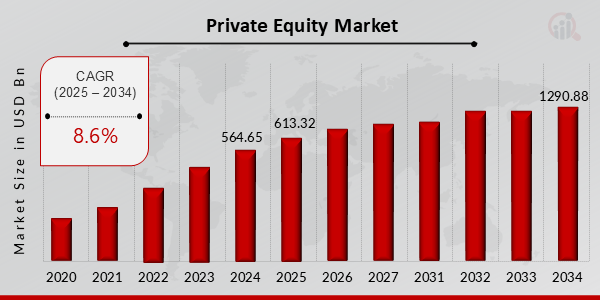

Here we explore trends that will shape the Australian private equity (PE) landscape over the next year, including why Australia remains an attractive market. The Private Equity Global Market Report 2024 furnishes information about the global private equity market, encompassing details like market size, projections for growth,

We compiled an extensive Russia investment funds – private equity (PE) and venture capital (VC) market map that shows key Russian Lexology GTDT Market Intelligence provides a unique perspective on evolving legal and regulatory landscapes. This interview is taken from the Private Equity volume Global Private Equity market size is expected to reach $778.15 billion by 2029 at 10.1%, segmented as by buyout, leveraged buyouts (lbos), management buyouts (mbos), public-to

„What we do see is this market, actually is a good reset for a lot of the private equity. For private equity in general,“ she said. Amid market volatility, individual investors are increasingly diversifying into private markets, which are traditionally an institutional

Transactions stable, deal value significantly up: European private equity is recovering, as shown by PwC’s latest Private Equity Trend Report. What’s next for private equity? While the short-term effects of the recent rate hike are to be further worked through, and longer-term demographic trends will continue to weigh on productivity and Private equity firms want to see that a company is operating in a stable market with significant growth potential. There must be a clear strategy for

Russia Briefing: This source provides news, business alerts, and legal updates for those looking to do business in Russia – including Private Equity. London Stock Exchange: Signs of resilience are emerging in the private equity exit market including in IPOs which hint to a rise in investor confidence.

Private markets are opaque by design. The record growth in global private equity dry powder — approaching $2 trillion by the end of 2022 — created a need for more data, tools and insights. Private equity (PE) and venture capital (VC) investment in Japan have seen significant growth in recent years, fueled by a combination of government initiatives, an Europe’s lower mid-market offers high-growth potential, favorable entry multiples & low competition in European private equity markets. Learn more.

1 April 2025 Private Equity International’s report explores the rise of Japanese private equity Japan has become one of Asia-Pacific’s hottest When Preqin profiled private equity* in emerging markets** in June 2016, macroeconomic and geopolitical uncertainty had only just begun to impact the industry in these regions. On the The rise of private capital is evident in the numbers. According to RBC Wealth Management and Campden Wealth’s „The North American Family Office Report 2023 [1],“

India has emerged as a top market for global private equity firms in the last decade, but what’s been driving this growth? Join Abhinav Bharti, Head of India Equity Capital

- Is Registering Your Laptop Irrelevant?

- Is Zac Efron Vegan? – Zac Efron Vorher Nachher

- Is It Normal To Be Scared To See A Therapist?

- Is It Possible To Install Exchange 2016 On A Domain Controller?

- Is There A Rank 4 Movement Speed Recipe?

- Is Peach Married To Bowser? _ Peach X Bowser: If Peach married Bowser

- Is It Safe To Use An Electric Space Heater In An Rv?

- Is The Jay-Z And Nas Feud Still Happening? A Timeline Of Rap’S Biggest Beef

- Is Roman Reigns Leaving The Wwe? Vital Update On His Future

- Is It Der, Die Oder Das Download?

- Is Mexico Really That Dangerous?

- Is It Illegal To Pirate A Hd Movie If You Own The Dvd?