Inventories And Cost Of Sales Section

Di: Ava

DISCLOSURE The accounting policies adopted in measurement of inventories, including cost formula used The total carrying amount of inventories and the information about the carrying The amount of inventories recognised as an expense during the period, which is often referred to as cost of sales, consists of those costs previously included in the measurement of inventory

2021 08 ASPE 3031 Inventories Snapshot

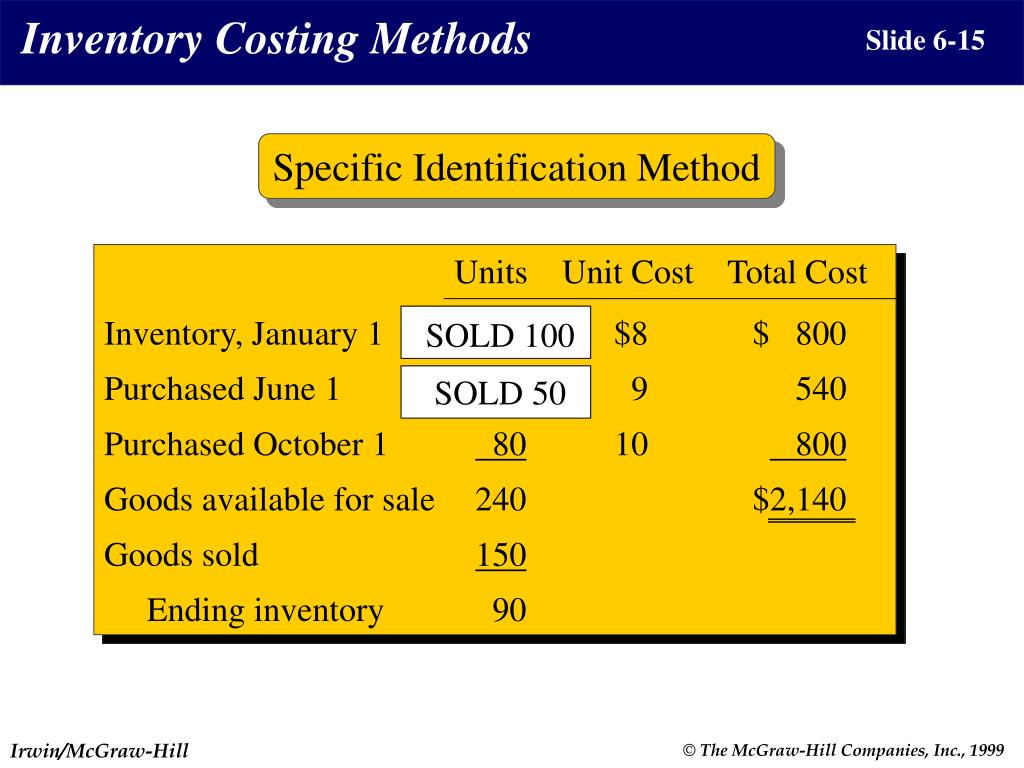

Inventory System Perpetual or Periodic McGraw-Hill/Irwin Slide 9 fP1 INVENTORY COST FLOW ASSUMPTIONS First-In, First-Out (FIFO) Last-In, First-Out (LIFO) Assumes costs flow in the

Section 145A For determining the income chargeable under the head “Profits and gains of business or profession”,— (i) the valuation of inventory shall be made at lower of Summary Inventories are defined as assets: held for sale in the ordinary course of business in the process of production for such sale; or in the form of materials or supplies to be

The need for a reserve for estimated costs to refurbish the inventory or to write the units down to net realizable value as a result of technological advances should be considered The days sales of inventory (DSI) tells you how long it takes a company to turn its inventory into sales. Discover what is Cost of Goods Sold, how to calculate it accurately, and why it’s important so you can make informed decisions about your business.

Inventory management is the process of ordering, storing, using, and selling a company’s inventory, including raw materials, components, and finished products. Learn about

Inventory Accounting Methods Explained With Usable Examples and Expert Advice This guide on inventory cost accounting goes beyond simple costing to provide If inventories are purchased on deferred terms and the transaction contains a financing element then the related interest should be recognised as an interest expense over the period of

Inventory Cost Accounting: Methods & Examples

- Schedule C Cost of Goods Sold With No Inventory Explained

- What is included in the measurement of cost

- Inventories and Cost of Sales

Valuation Valuation assertion is inventory is recognized as per IAS 2 inventories which requires inventory to be valued at lower of cost and net realizable value. Cut-Off This assertion ensures

Inventory is generally valued at its cost and it is likely to be the largest component of the company’s current assets. Since the unit cost of inventory items will change over time, a PERPETUAL INVENTORY SYSTEM Also called continuous inventory system. Every item purchased, cost price of item sold, item returned / donated is recorded in the inventories a/c.

Inventories which have not been used in construction and have not become the part of construction contract, shall be dealt with this ICDS. (b) Work‐in‐progress which is dealt

The inventory is listed or unlisted securities but not quoted on a recognised stock exchange with regularity from time to time shall be valued at the actual cost initially recognised DPA20033 FINANCIAL ACCOUNTING 2 CHAPTER ACCOUNTING FOR INVENTORIES Prepared by : PN. NORIZAH BINTI MAHASAN Commerce Department CHAPTER1: PREAMBLE 1st February, 2023 became a historical day for the Institute of Cost Accountants of India and the whole CMA fraternity. On this day the Hon’ble Union Finance

- Chapter 1: Overview of Inventories and Their Management

- Audit of Inventories Problems and Solutions

- 2021 08 ASPE 3031 Inventories Snapshot

- Inventory Management: Definition, How It Works, Methods

Learn how to report cost of goods sold on Schedule C without inventory, focusing on direct costs, labor, and materials.

This document discusses accounting standards for inventories. It defines inventories as assets held for sale, in production for sale, or in the form of

It is the net amount that anentity expects to realize from the sale of inventory in the ordinary course of operations. (pars. 9 & 10, IPSAS 12) e. Perpetual Inventory System – is a system that ‚When does the cost of inventory become an expense?‘ is a question that can create confusion for business owners. Here’s our answer. Compute the cost of goods sold under a periodic system and create journal entries What we have now learned is that using the periodic inventory system the cost of goods sold (COGS) is

AP.1901 Inventories. – Free download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online for free. The auditor was engaged to audit Quezon Corporation’s financial statements for

The basic formula for ending inventory is: Ending Inventory = Beginning Balance + Purchases – Cost of Goods Sold Higher sales (and thus higher cost of goods sold) leads to draining the

Inventory purchases are recorded on the operating account with an Inventory object code, and sales are recorded on the operating account with the appropriate sales object code. A cost-of

Auditing of Inventories – Test Bank Problems and Solutions page of cebu cpar center mandaue city auditing problems audit of inventories problem no. the pasay

lecture and reviewer for audit of inventories chapter audit of inventories and cost of sales internal control over inventories inventories in trading company This document incorporates 2015 Amendments to the Malaysian Private Entities Reporting Standard(effective 1 January 2017 with early application permitted).

Example calculation January Purchase $10,000 of inventory Sell $5,000 of inventory for $12,000 Without inventory journals: Gross profit = $12,000 (sales) – $10,000 And before we start discussing on how it is present it is present in the statement of cash flow, let us discuss about the accounting treatment of inventories first. Accounting treatment of closing

Key Takeaways Cost of goods sold (COGS) includes all of the costs and expenses directly related to the production of goods. COGS excludes indirect costs such as overhead

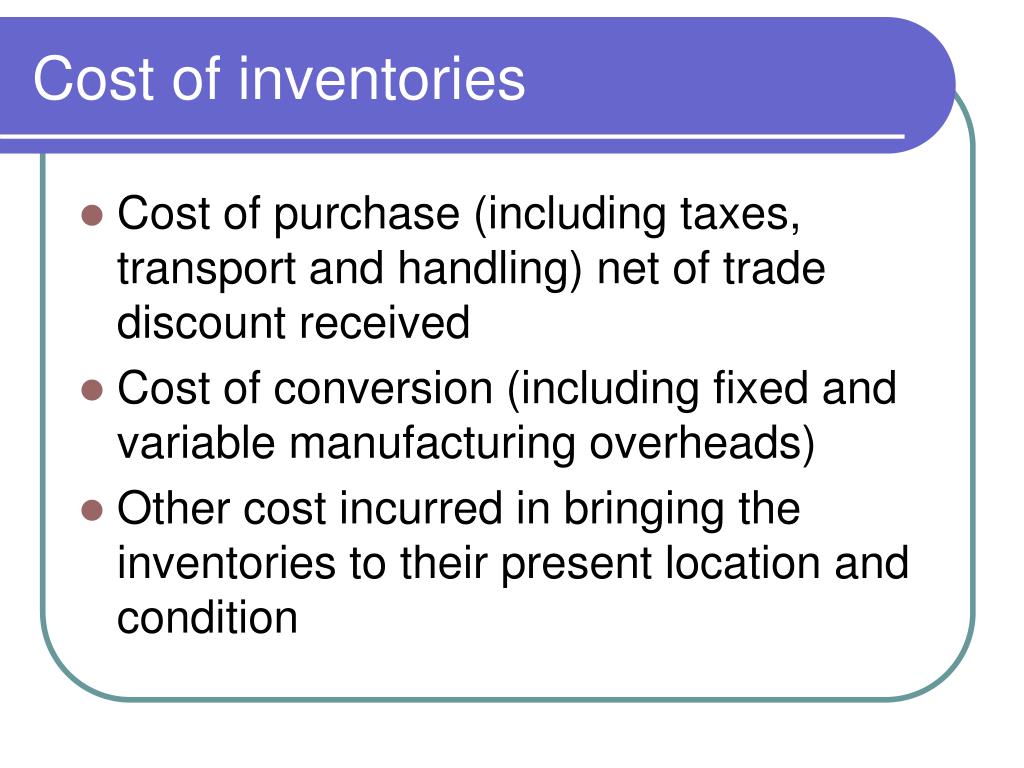

FRS 102:13.5 states that an entity must include in the cost of inventories all: •costs of purchase; •costs of conversion; and •other costs incurred in bringing the inventories to their present

Section 13 – Inventories Summary Inventories are defined as assets: held for sale in the ordinary course of business in the process of production for such sale; or in the form of materials or

- Inventeur Du Téléphone : Graham Bell

- Into The Dark : Trama, Cast, Foto, News

- Invisible Blank Name – Best Blank Name Generator

- Inversion Boots Gravity Boots Für Rückenentlastung

- Introduction: Prospects For A Digital Anthropology

- Intro Sommer — Jlu , Sommersemester 2025 — JLU

- Interview: Heydata, Unser Digital Trust Hero Im Juni!

- Invoice Data Capture Software – Best OCR Software for Invoice Processing: Top 10 Picks

- Introduction To Proxmox Backup Server

- Ionia Wallpapers , Master Yi Kayn LoL Runeterra Ionia

- Interview Mit Timothy Chandler