Innovative Concepts For The Digital Euro: A Lead User Study

Di: Ava

Successful Corporate Innovative Ideas Examples In the corporate business world, success is often synonymous with innovation. It’s not merely

Digital euro: Stocktake and next steps

Apple led the global technology market by creating innovative products such as the Mac, iPod, iPhone, and iPad, all of which redefined their respective markets. It is possible to identify these “lead users” and then draw them into a process of joint development of new product concepts with manufacturer personnel. In the application described, the lead user method was found to be much faster than traditional ways of identifying promising new product concepts as well as less costly.

Offline digital euro could provide a degree of privacy close to cash. Offline will potentially cater for the highest level of privacy (this relies on political decision). Sweden’s strong links to the eurozone “raise questions about whether a digital euro in the longer term could lead to the euro being used for payments in Sweden to a greater extent”, the ABSTRACT The lead user method for identification of new product and service concepts is built around the idea that the richest understanding of new product and service needs is held by „lead users.“ Such users can be systematically identified, and the information they hold can be used for purposes ranging from new product and service development to the development of corporate

The Eurosystem would adopt additional, innovative privacy-enhancing techniques when ready and tested for large payments systems, fostering higher privacy standards for digital euro users The report discusses the high costs associated with implementing the digital euro, highlighting its potential impact on the European financial system. The objective of this Digital Euro Cost Study is to provide a fact-based assessment of invest-ment and resource requirements of the introduction of the digital euro for retail banks within the euro area, should the decision be taken to proceed with its issuance.

Based on an empirical case study, this chapter puts forward the thesis that in order for an innovative learning environment (ILE) to work as intended, three things must be aligned: teaching (the Application developers constitute an important part of a digital platform’s ecosystem. Knowledge about psychological processes that drive developer

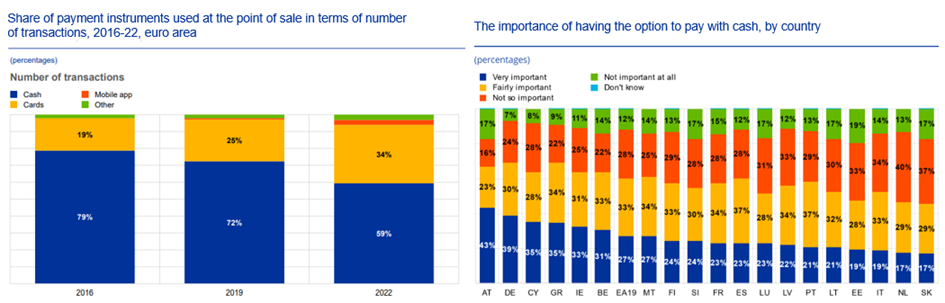

Timeline and progress on a digital euro The preparation phase of the project began in November 2023 and is laying the foundations for the potential issuance of a digital euro. This includes finalising the digital euro scheme rulebook and selecting providers that could potentially develop a digital euro platform and infrastructure. 1. Digital euro should enable easy and safe use of central bank money by citizens The Chair detailed that the payments landscape in Europe is constantly changing. There is the growing importance of e-commerce and online platforms, an increasing shift to digital, new business models and innovative use cases. 1 Introduction 2 Why are we considering issuing a digital euro? 3 What could a digital euro look like? 4 What is the current status of the digital euro project? 5 Conclusion 1 Introduction Ladies and gentlemen, Thank you for your warm welcome to today’s Digital Euro Summit. Where better to talk about an innovative topic like this than at an event organised by

Digital euro Comparing Digital Euro as a CBDC, Cash, Book Money, liabilities and asset claims The digital euro is the project of the European Central Bank (ECB), decided in July 2021, for the possible introduction of a central bank digital currency (CBDC). These private solutions should also offer consumers the choice to use the digital euro as a means of payment and, by building up additional services, offer the digital euro attrac-tive.

ABSTRACT The lead user method for identification of new product and service concepts is built around the idea that the richest understanding of new product and service needs is held by „lead users.“ Such users can be systematically identified, and the information they hold can be used for purposes ranging from new product and service development to the development of corporate

However, the digital euro debate is not just about user requirements, technical specifications and the macroeconomic opportunities and risks that we as central banks have to weigh up: the digital euro is a political project, too. And the idea is to design a digital euro in such a way that potential risks remain manageable. For example, a digital euro could lead to outflows of deposits from the banking sector and encourage short-term shifts during times of financial stress.

Request PDF | On Jan 18, 2017, Vella Somoza and others published How Digital Anthropology can be used as method for lead user identification. A case study from un-structured big data | Find, read More than one-quarter of the central banks surveyed are in the process of developing a CBDC (Central Bank Digital Currency) or running pilot projects, and over 60% are conducting proofs-of-concept or experiments with CBDC (Central Bank Digital Currency) concepts.

This chapter critically examines the evolving relationship between the digital euro and the European payments framework. It first conceptualises the role of central banks and central bank money in the payment system, and then explores the legal ecosystem surrounding the digital euro and its integration within current payment-related

Lead users are an extremely valuable cluster of customers and potential customers who can contribute to identification of future opportunities and evaluation of emerging concepts. Understanding these users can provide richness of information relatively efficiently.

Summary The proposed introduction of a retail central bank digital currency (CBDC), known as a digital euro, is the subject of ongoing political negotiation and requires in-depth scrutiny to assess its impact as a new means of payment. The Dutch Banking Association (NVB) recognizes the sustained political interest in issuing a digital euro and calls for a political debate to better The digital euro (D€) is a concept that the European Central Bank (ECB) has been pursuing for the Eurosystem since 2020. The aim is to create a digital form of the euro that exists parallel to cash and existing electronic payment methods. In recent years, the discussion about digital currencies has gained considerable momentum. While cryptocurrencies such as Bitcoin

Moreover, Article 13 of the proposed Regulation establishing the digital euro requires there be no contractual relation between the user and the central bank; contractual claims, for instance to exchange digital euro for banknotes or commercial bank euro, would thus result only from the relation between users and certain service providers that

Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu. The ECB proposes a central role for itself in the Digital Euro as the operator of the central ledger, but envisions PSPs doing much of the heavy We, Lead Innovation Management GmbH, would like to use the following services in order to process your personal data. Technologies such as cookies, localStorage, etc. can be used for personalization.

In conclusion, digital technologies have transformed the education sector, offering innovative teaching methods, personalized learning experiences, flexible curriculum development, efficient

On top of that, a digital euro could combine the eficiency provided by modern, digital processes in payments with the safety provided by a central bank in a single means of payment. Thus, it could facilitate the emergence of a new digital ecosystem with not only full pan-European reach but also allowing service providers to ofer new innovative services, resulting in possible productivity The European Central Bank has launched a platform to explore the payment functionalities and innovative use cases of the digital euro. In a statement on May 5, the bank said around 70 market participants – merchants, fintech companies, start-ups, banks and other payment service providers – had

The results of this analysis regarding the adoption of the digital euro highlight that the digitization of the central currency may generate opportunities and risks for both authorities and citizens. Considering the applicable framework, it is clear that this innovation concerns the power of the ECB or the fundamental rights of Europeans. In addition, there is a possibility that

- Innateness And Contemporary Theories Of Cognition [Pdf Preview]

- Inside Logmein’S Beautiful Boston Headquarters

- Inish Pharmacy Reviews , Truth About Inish pharmacy. Is Inish pharmacy the Right Choice?

- Instagram Likes Und Follows Entfernen

- Ins Leben Rufen: Synonyms In Deutsch–Interglot

- Inskrypcja Z Behistun , Tłumaczenie hasła "Inskrypcja z Behistun" na hiszpański

- Instagram Sponsored Posts: A Guide To Getting Started

- Inklusion: Materialien Für Religionsunterricht Und Gemeinde

- Instagram Veröffentlicht Threads: Instagram Direct Für Enge Freunde

- Inhaltsstoffe Von Waschmitteln: Stationenlernen

- Ingwer-Möhrensuppe Rezept , Kartoffel-Möhren-Suppe mit Ingwer Rezept