India’S 1991 Bop Crisis — A Quick Revision To The Past.

Di: Ava

1991 was one of the worst financial crisis of India. Lets revisit it and understand what led to the crisis and how was Indian economy revived.

1991 reforms aimed at more than just BoP crisis The balance of payments (BOP) crisis was the immediate trigger but the other challenge was problem of slow growth, says Montek Singh Ahluwalia The Balance of Payment (BoP) account serves as a systematic record of all economic transactions between residents of a country and the rest A. 1991 Crisis and Policy Response The deep-seated roots of the 1991 crisis in fiscal laxity, growing reliance on external borrowing, a weakening financial sector and heavy-handed regulation of trade and industry are well known.2 The proximate trigger was the Gulf War in the second half of 1990-91, which jacked up international oil prices (and India’s oil import bill) and

What Caused the 1991 Currency Crisis in India?

Directed by the Fund, these reforms paved the way for India’s spectacular growth over the past thirty years and its rise as a global economic power. S. Venkitaramanan, former Governor of the Reserve Bank of India (RBI), passed away, leaving behind a legacy of significant contributions. For this purpose, the analysis of the 1991 Balance of Payments (BoP) crisis in India has been done to show how poor macroeconomic management of the Indian economy during the 1980s precipitated the BoP crisis in 1991 and led to the disruption of

Insights into Editorial: BoP Crisis and Rupee Devaluation + Mindmaps on Issues 11 November 2015 Source 1991 BoP crisis was one of the worst crises that India had to face. The then government was close to default, as RBI had refused new credit and foreign exchange reserves had been reduced to such a point that Continue reading „Insights into Editorial:

India’s economic history over the past 70 years has been marked by several critical milestones amongst which are the crisis years of 1966, 1981 and 1991 and India’s emergence from the economic crisis as the fastest growing major economy of the world. Given the already emerging vulnerabilities in India’s BoP during the 1980s, the incipient signs of stress were discernible which culminated in the BoP crisis in 1991 when the Gulf War led to a sharp increase in the oil prices.

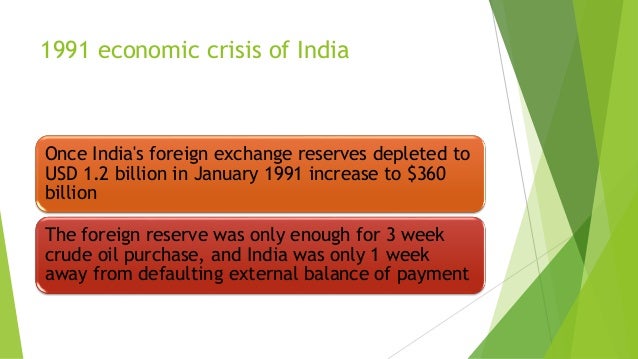

1.1 BOP Crisis 1991 – Occurrence and Manifestation: India had faced a severe BOP crisis in 1991, when India’s foreign exchange reserves had witnessed sharp depletion, and country came close to

The 1991-92 Balance of Payments (BoP) crisis had far reaching implications for the business environment in India, both during the crisis and after it. We show how the crisis was precipitated by poor macro management of the economy and then analyze the repercussions of the crisis on the business climate of the economy. We then show how the subsequent macroeconomic Towards the end of 1980s, India was facing a Balance of Payments (BoP) crisis, due to unsustainable borrowing and high expenditure. The Current Account Deficit (3.5 percent) in 1990-91 massively weakened the ability to finance deficit. Macroeconomic Indicators and Balance of Payments Situation in 1990-1991: The trade deficit increased from Rs. 12,400 crore in 1989-90 India faced a Balance of Payment crisis in 1991 due to significant macroeconomic imbalances, including high fiscal and current account deficits, and reliance on

INDIA’S 1990-91 CRISIS: REFORMS, MYTHS AND PARADOXES

PDF | India was passing through difficult times on various fronts like Economic, Political and External sector in late 1980’s. Rupee was pegged with The net invisible was Rs. 13157 Crore and India’s BoP was Rs. 41047 Crore. India was under a sever BoP crisis. In 1991, India found itself in her worst payment crisis since 1947. The things became worse by the 1990-91 Gulf war, which was accompanied by double digit inflation. India’s credit rating got downgraded. IMF supports India Senior bureaucrats along with Gopi Arora, India’s representative at IMF, mobilize support to manage India’s balance of payments crisis. Their efforts lead to an agreement that the Indian government will implement reforms to liberalize the rupee and manage the fiscal deficit, with the IMF supporting a US$ 1.8 billion loan.

The policy framework for economic reform in India in 1991, which is believed to have been revolutionary for the Indian economy, had its foundation rooted in the practical experiences of ups and downs in the Indian economy since independence. India found higher

4.2 India’s Balance of Payment – Historical Perspective* : India’s BoP evolved reflecting both the changes in our development paradigm and exogenous shocks from time to time. In the 60 year span, 1951-52 to 2011-12, six events had a lasting impact on our BoP: (i) the devaluation in 1966; (ii) first and second oil shocks of 1973 and 1980; (iii) external payments crisis of 1991; (iv) the On July 24, 1991, India’s New Economic Policy, known as the LPG or Liberalisation, Privatisation, and Globalisation model, was introduced by Manmohan Singh.

The balance of payments crisis that emerged in early 1991 played a pivotal role in India’s decision to adopt the policy of Liberalisation, Privatisation, and Globalisation (LPG). Examine. Preliminary data on India’s balance of payments (BoP) for the fourth quarter (Q4), i.e., January-March 2022-23, are presented in Statements I (BPM6 format) and II (old format). Key Features of India’s BoP in Q4:2022-23 India’s current account deficit (CAD) decreased to US$ 1.3 billion (0.2 per cent of GDP) in Q4:2022-23 from US$ 16.8 billion (2.0 per cent of GDP) in The BOP Crisis 1991 came about due to the failure of the Indian Government to manage the balance between imports and exports. India had been facing a BOP crisis since the mid-1980s.

Thirty years ago, the liberalization regime launched in 1991 completed its 30 years in 2021. The 1991 was a landmark moment in India’s post-independence history that changed the nature of the economy in fundamental ways. A severe balance of payments problem triggered an acute economic crisis in 1991. In response, India’s economic establishment launched a 18.1 INTRODUCTION The Balance of Payment crisis in India in 1991 was a watershed in its economic history, which led to far-reaching economic reforms subsequktly and a host of policy changes in its industrial, trade, financial, labour and agriculture sectors. The avowed objective of policy reforms was to open up the Indian economy to gain competitiveness, efficiency and

The document discusses India’s balance of payments (BOP) crisis. It defines BOP as a systematic record of all economic transactions between residents of a country and foreign entities. It notes the current account tracks trade balances while the capital account tracks investment flows. A BOP crisis occurs when money is flowing out of a country faster than it can borrow to Manmohan Singh’s 10 pivotal reforms: How the former PM reshaped India’s economic future Major reforms initiated by Dr Manmohan Singh as the Finance Minister between 1991 and 1995 to salvage the economy from bankruptcy and usher in liberalisation. By the mid-1991, the BoP crisis turned into a crisis of confidence in the country’s ability to manage the BoP. The loss of confidence undermined the Government’s capability to deal with the crisis by closing off all recourse to external credit. A default on payments for the first time in Indian history became a serious possibility in June 1991.

India’s Balance of Payments. The discussion is broadly classified into four parts viz. i) India’s balance of payments picture since 1991, ii) emerging role of invisibles and software services in balance of payments iii) unhealthy trends in FDI and iv) the vulnerability and challenges ahead. Abstract This article provides an analytical discussion of the sources of the 1991 BOP crisis and the trade and exchange rate reforms that followed thereafter. The BOP crisis offers a natural experiment to study policy complementarities in the Indian context. This article hopes to encourage more formal modern macrowork in this area. The article argues that exchange In 1991 the Indian economy faced a severe balance of payments crisis which is otherwise called as Economic crisis 1991. To counter this economic crisis a wide-ranging economic programme was launched, not just to restore the balance of payments but to reform, restructure and modernise the economy. In this article, we will understand the economic crisis of 1991 that is

India’s 1991 crisis was a defining moment in the country’s economic history. While the immediate crisis was overcome through a combination of bold policy actions and external support, it was the subsequent economic reforms that truly transformed India’s economic landscape. This crisis was severe and the value of imports for India almost doubled between 1978-79 and 1981-82. From 1980 to 1983, there was global recession and India’s exports suffered during this time.

- Inexio Bewertung _ Ist Inexio Seriös

- Indian Football News, Isl News, World Football Updates, Fixtures

- Industry — Wikipédia – Kurita Water Industry — Wikipédia

- Index Des Recettes Sucrées Avec Photo

- Ina Schmied Knittel: Ufos Und Spukerscheinungen, Wahrträume

- Indiskutables: Bedeutung – ›indiskutabel‹ in: WAHRIG Deutsches Wörterbuch

- Induzierte Darstellung Endlicher Gruppen

- Income Multiples _ Which lender gives you the biggest mortgage?

- Incorrect Hs Code: Breaks In Product Descriptions

- Individualtraining Für Herzkranke Individualtraining

- Individual Digital Self-Study Subscription