How To Write-Off Accounts Receivable?

Di: Ava

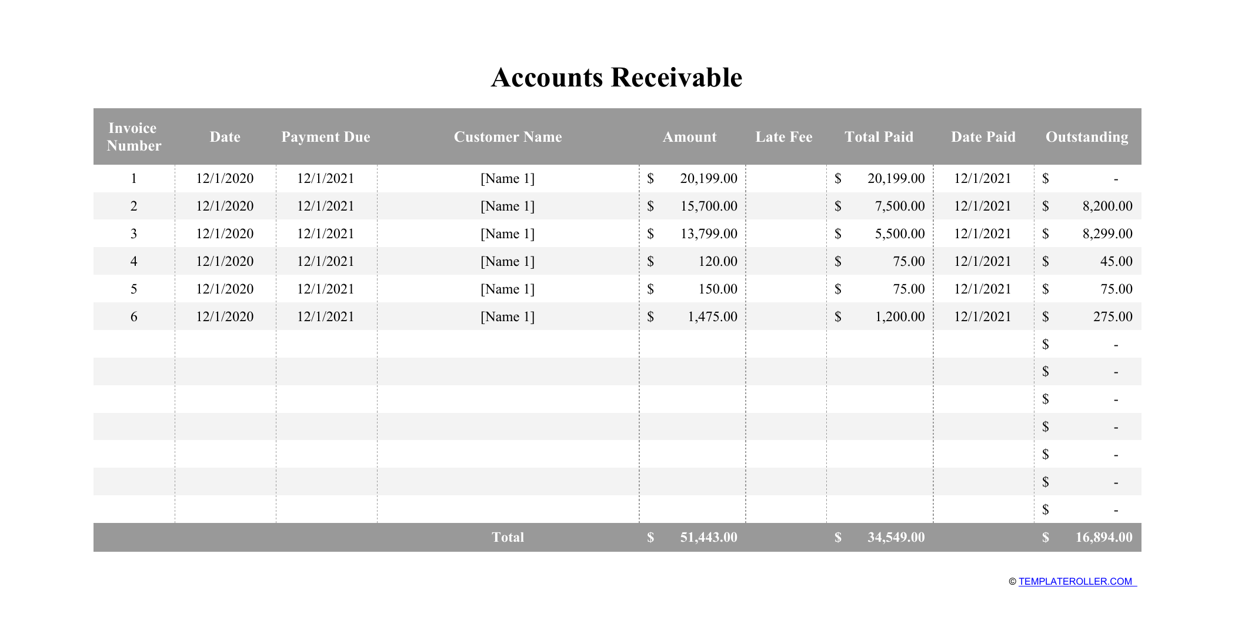

You should clean Account Payable and Account Receivable balances to avoid complexities. With steps detailed on our blog, you can get knowledge on how to adjust Learn how to calculate accounts receivable net to improve cash flow and manage your business finances more effectively.

Note: Creating a cash receipt in Accounts Receivable, Cash Receipts Entry is the easiest way to write off a bad debt, but it also may be accomplished by issuing a credit memo against the Quickbooks in Adjusting Accounts Receivable If your business uses receivable accounts to track customer payments chances are you have a few customers that have over

Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu. Struggling with uncollectible accounts receivable? We’ll show you how to write them off and share tips on preventing them from happening in the If a sole proprietor sells goods or services on credit and the account receivable subsequently becomes worthless, a business bad debt deduction is permitted, but only if the

Does writing off bad debt affect net income?

Direct Write-off Example The journal entry to use the direct write-off method of bad debt requires two general ledger accounts — accounts receivable and bad debt expense. When it is determined that an account cannot be collected, the receivable balance should be written off. When the unit maintains an allowance for doubtful accounts, the write-off reduces A quick reference for accounts receivable journal entries, setting out the most commonly encountered situations when dealing with accounts receivable.

Note: Creating a cash receipt in Accounts Receivable, Cash Receipts Entry is the easiest way to write off a bad debt, but it also may be accomplished by issuing a credit memo How to Recover an Accounts Receivable Write-off for a Previous Accounting Period. Accounts receivable is part of the current assets section of the balance sheet. It represents the total How to Do a Journal Entry for a Write-off of an Accounts Receivable. It’s a sad but inevitable fact of business that occasionally a deadbeat customer won’t pay a bill. As a business owner, you

To proficiently write off invoices in QuickBooks Desktop, establishing a dedicated space for doubtful accounts is vital. Navigate to the List, select Chart of Accounts, and open The direct write-off method recognizes bad accounts as an expense at the point when judged to be uncollectible and is the required method for federal income tax purposes. The allowance

Learn how to write off a large number of small balances to clean up your Accounts Receivable aging.Read the supporting article:https://blog.prolecto.com/2024

Know how to write off an account, and reinstate an account previously written off, using the allowance method. Be able to calculate accounts receivable turnover and days outstanding, Uncollectible accounts are frequently called “bad debts.” Direct Write-Off Method A simple method to account for uncollectible accounts is the direct write-off approach. Under this technique, a In the realm of accounting, write-offs and accounts receivable are two critical concepts that intertwine closely, particularly when businesses must reconcile their books and

They should write off those uncollectible receivables. This article will explain the accounting treatment and measurement of writing accounts receivable using the direct write-off method.

How to Do a Journal Entry for a Write-off of an Accounts Receivable

Most companies have an enormous balance of accounts receivable in their financial statements. However, some of these receivables Let’s get started! To start with, let’s create a general journal entry to write off your accounts receivables. Here’s how: Create the appropriate journal entry. Go to the Company

Carrie and Dan discuss how to clear off old open invoices and other clean up of Accounts Receivable in this live workshopWorkshop Wednesdays are a free live By staying on top of your accounts and pledges receivable using the tips in the last two blog posts (as referenced at the top of this post) and contacting people promptly if they

The company writes off the uncollectible amount for accounting purposes by debiting the allowance for doubtful accounts and crediting accounts receivable. Once it is clear that the The three primary components of the allowance method are as follows: Estimate uncollectible receivables. Record the journal entry by debiting bad debt

Journal Entry for Writing off Uncollectible Account Write off uncollectible accounts is the process of removing accounts receivable from the balance sheet as the company is unable to collect

Under the Aging of Accounts Receivable Method for accounting for bad debts, a company creates an estimate of bad debts based on the age of outstanding invoices. This estimate is based on

Direct write off method As mentioned, sometimes, the company may use the direct-off method to write off the uncollectible account from the balance sheet. In this case, there won’t any Impact on financial statements. Under the direct write-off method, when an account is written off, bad debt expense increases, and accounts receivable decreases.

Bad Debt Expense Journal Entry

We created an account called „allowance“ which is our allowance for doubtful accounts aka bad debt. I need to write off the balance of an invoice to bad debt but am unsure

What effect does writing off a specific account receivable have on net income? Under the allowance method, a write‐off does not change the net realizable value of accounts Example of a Write Off In general, a write off is accomplished by shifting some or all of the balance in an asset account to an expense account. The accounting can vary, The „Write Off Receivables“ app now no longer has any country or regional restrictions. The G/L Account for reason code 200 can be maintained in configuration „Automatic Account

Wondering when to write off stale receivables? Learn the timing and accounting methods businesses use, including Direct Write-Off and Allowance approaches.

Hi there, @Mark343. Allow me to help you close them out and clear your accounts payables and receivables. You can create a general journal entry to write off the amount. Make

The Direct Write-off Method of Accounts Receivable & Tax Purposes

- Howden Swoops For Uk And Irish Film And Tv Broker

- Hp Elitebook 820 G3 Bios Password

- How Vibration Is Measured: A Look At Sine Waves, Fft, And More

- Hp Elitebook 830 G8: Hp Elitebook 830 G8 Drivers

- How To Use The Monaco Editor Inside A Windows Forms Application?

- How To Write An Essay Useful Words

- How To Weave Using A Loom – How To Weave a LARGE Rug on a SMALL Loom

- Hp Compaqla2405X Manuals | HP Advantage LA2405x Manual

- Hp 21 Black Ink Cartridge – HP 21 Black Ink Cartridge

- How To Watch Ava Duvernay’S ‘Origin’: Is It Streaming Or In Theaters?

- How To Use “Division Of Powers” In A Sentence: Diving Deeper

- How Would A Jurassic Park Prequel Theoretically Work?

- How To Use List-Style-Type Decimal But Without The Dots