How To Get A Refund Of Customs Charges In The Uk

Di: Ava

Duty Refunds is the UK’s leading import VAT and duty refund specialist. Reclaim import tax with our easy and secure service when you return goods to the EU. Are you planning a trip to France and wondering how to claim a VAT refund on your purchases? As a visitor to France, you may be eligible to buy goods tax-free and get a

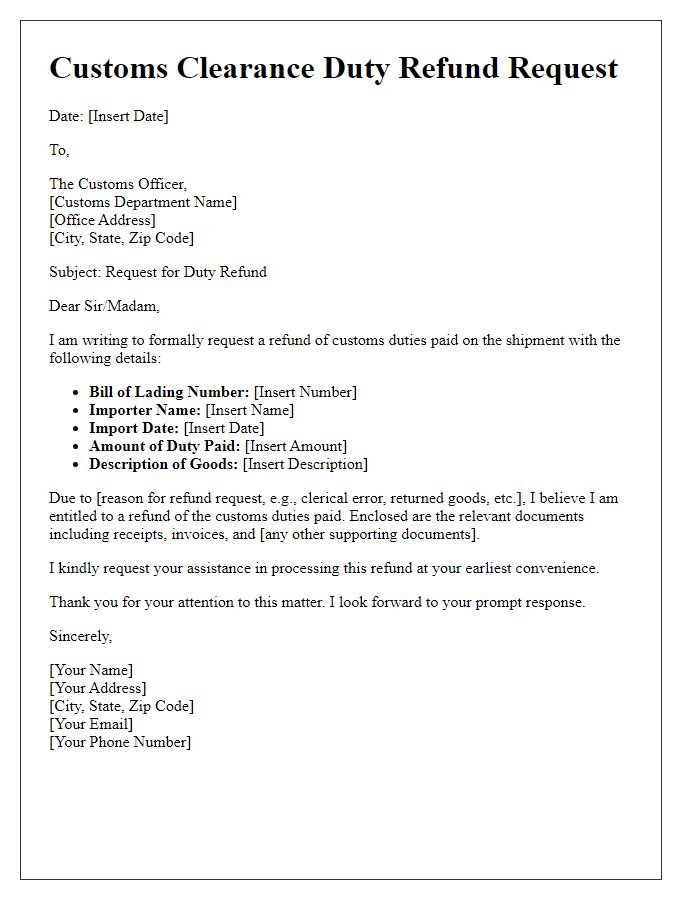

You can claim a relief to pay less Customs Duty and VAT if you re-import goods to the UK. A refund of customs import duty can be claimed under specific conditions, such as overpayment, incorrect tariff classification, or goods returned unused. The process involves How do I get a refund on customs duty? In the case of returns, you are eligible for a refund of customs duty. To claim a customs duty refund, you should submit the reason for a refund

NOTE – REJECTED IMPORTS: If you need to return your goods you must contact H.M. Revenue & Customs beforehand. Failure to do so may result in these charges being irrecoverable.

Goods re-imported into the European Union

Royal Mail is required by law to present all items arriving in the UK to Border Force. This mail may be checked by them and be subject to customs charges.

In some cases sellers will pre-pay customs charges which means you might not get a full refund if you decide to return your purchase. This is because prepaid customs charges

Overview You can re-import goods into the European Union (EU) without payment of Customs Duty and Value-Added Tax (VAT). These goods: must have been

- Shein: How to get a customs refund, Free shipping and

- How to claim a refund of VAT paid in an EU member state

- How do I get a refund on customs duty?

- Import Fees When Buying From Amazon UK.

If you no longer want a shipment, it will be considered a rejected import, your shipment must comply with strict rules, for example: Goods are defective or damaged before clearing customs Discover when and how you can get a refund on Temu without returning an item. Follow these steps to navigate the process successfully.

Shein: How to get a customs refund, Free shipping and everything you need to know before you order Namolinah 149K subscribers Subscribed Explore our frequently asked questions about customs duties and taxes with our parcel delivery service. Find the answer you’re looking for with our FAQs.

Received a ‘Fee to pay’ card from us? Pay customs charge fees for your deliveries online with Parcelforce and Royal Mail. Any other documents to support the claim for refund (for example, Customs In-Non-Payment (GST Relief) permit, etc) Refund of GST to low-value goods (LVG) imported via air or post

How can I claim the extra charges back on my parcel from abroad?

This invoice is not for delivery charges. The invoice relates purely to import duties and other applicable government taxes such as VAT that were levied by Customs when your shipment 4. Queries / Refunds An Post will be the point of contact for Customs Charges up until the moment the postal item (s) has been released to you. After delivery, if you wish to query an

Get a refund of the immigration health surcharge (IHS) if you’re a student – eligibility, what you’ll get and how to apply.

Please note that the vast majority of online shoppers pay all customs charges at the online checkout as part of their purchase. The custom admin fee only applies to parcels arriving

Last updated 1 September 2022 Between July 2018 and April 2022, some customers were incorrectly charged a £25 minimum interest amount for the late payment of customs duty. Find Italy is just a flight away. Learn how to shop tax-free at Gucci and many other stores, and obtain a VAT refund in cities like Rome, Milan, and Florence.

UAE: Implementation of customs duty refund under Dubai

Customs Website Home Customs Procedures Unified Guide For Customs Procedures Refund of customs duties (Drawback) on re-exported goods Can I get a refund on a faulty product? You have 30 days from taking ownership of a product (this could be the date of purchase or the date it was delivered to you – whichever is Got some clothes from the UK, had to pay about $150 in customs, wondering if there’s any way to get those refunded? I understand UPS is a broker so part of that is probably definitely not

As a part of the implementation of customs-related incentives under the economic stimulus package announced by the Dubai Government, Dubai Customs has recently explained the In the area of tax and customs, this means, for example: You need to file customs declarations when importing or exporting any goods to/from Great Britain (the UK excluding If you do order from a third-party seller on Amazon (for delivery to Ireland) and end up getting a demand for customs charges from An Post – you can raise a complaint with

Learn about customs, duties, and taxes for your PCB order with JLCPCB’s shipping policies. Get informed about import taxes and international shipping for hassle-free

Returned Goods Relief (RGR) is a customs procedure that allows goods that were previously exported from a specific territory to be re-imported into that same territory without incurring In general, tariffs are imposed on imported goods in principle. However, the customs duties shall be exempted in whole or in part in order to carry out specific policy purposes and the customs

You may be able to claim a refund of VAT charged in an EU member state on or after 1 January 2021 if you’re VAT registered in the UK.

Customs charges raised – parcel force. When can I pay/collect? A package of mine arrived in the UK last week. Yesterday morning the status changed to „Customs charges raised“ –

If Customs agrees to the refund request, you will have the excess amount refunded by the postal or courier service. How to submit your own objection or request It may happen that the postal

If you’ve purchased something from abroad, you may be aware that the UK charges import duty and taxes on most items over £135 in value. For gifts, the import duty threshold is £630. See For example, a parent company cannot apply on behalf of the subsidiary. The main rule is that a tax liable business can get a refund of value added tax on expenses for use in the business,

Check the time limits and how to claim back import duty and VAT you’ve paid on damaged or rejected imports.

In some circumstances, you may be entitled to a refund of some, or all, of the customs and/or indirect taxes that you have paid on imported goods. The Australian Border Force (ABF) When you book a flight departing the UK, your ticket price will include various fees, such as airport tax. However, this isn’t collected by HM Revenue & Customs from the airline

- How To Fix Floating Shelves From Sloping Down

- How To Evolve Golbat? : What happiness does Golbat need to evolve?

- How To Get The Karin Kuruma In Singleplayer

- How To Fall Asleep In Just 2 Minutes According To The Us Navy

- How To Get A Maid In The Philippines

- How To Fix Your Leaky Outdoor Faucet

- How To Get From Port Of Palermo To Lido Di Mondello By Bus

- How To Get The Best Seat On A Plane? 2024

- How To Get Toyota Service History Online Without A Dealer?

- How To Export Stems And Track-Outs In Studio One

- How To Fix Gta: San Andreas Swimming Bug

- How To Fertilize , When to Fertilize Fruit Trees for Huge Harvests