How To Calculate Apr. – Explain Apr Interest Rate

Di: Ava

To calculate the daily periodic rate, you divide the APR by 365. Using the example provided above, divide the 10 percent APR by 365, which equals 2.739 percent. To comply with the Truth in Lending law, a lender must provide you a document that tells you the cost of a loan in terms of its annual percentage rate and other finance charges. Annual Percentage Rate (APR) What is APR? APR (Annual Percentage Rate) is the annual rate of return — expressed as a percentage — before factoring in Learn how do you figure out your apr with 5 wild, simple steps on Mortgage Rater – master your mortgage math today!

Other APR Calculators Can’t Compete! Whether its a credit card APR calculator or a mortgage APR calculator or even a car APR calculator or a CD APR calculator that you need our free APR payment calculator can give you all of the data that you need and then some.

Annual Percentage Rate Formula: Financial Clarity

Learn the simple steps to calculate Annual Percentage Rate (APR) in Excel with our easy-to-follow guide. Boost your financial analysis skills today. Learn what APR is, how to calculate APR, and the difference between APR, interest rate, and APY. Discover the APR calculation formula with examples, only on Fibe. Average APR calculator blends multiple debts plugged-in, yielding a snapshot of total payment responsibilities for multiple cards, loans, and other debts. The tool simplifies simultaneous analysis of multiple debts, accounting for differences in rates and terms.

Learn what annual percentage yield and annual percentage rate are and find out the major differences between APY versus APR, including how to calculate them.

Use this calculator to find the APR (annual percentage rate) and true cost of any loan by entering its interest rate, finance charges and term.

The APR calculator is provided to compute annualized credit cost which includes interest rate and charges, applicable at the time of loan origination. To calculate APR, please provide input for Loan Amount in INR, Tenure in Months, ROI (without %) Q: I need some help understanding severity of illness (SOI) and risk of mortality (ROM) as it’s my first encounter with APR-DRG factors that may affect reimbursement. First, how does one measure the SOI and ROM? Could you elaborate on how complications or comorbidities (CC) and major CCs (MCC) affect severity levels?

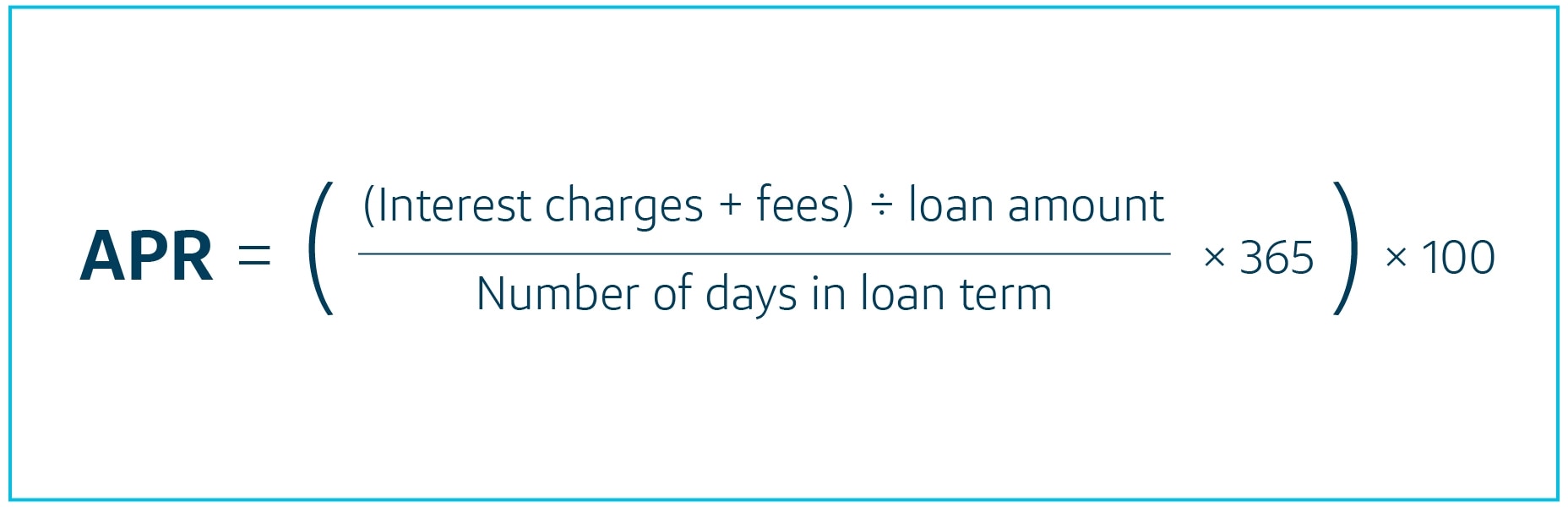

What is APR? The Annual Percentage Rate (APR) represents the true yearly cost of borrowing, including both the interest rate and additional fees. It provides a comprehensive view of the cost of a loan. Transparent cost analysis Enhanced loan comparison Compliance with federal guidelines How LendSaaS Helps LendSaaS streamlines the APR calculation process with a user-friendly, By considering the APR, you can gain a clearer picture of the total cost of borrowing and make more financially sound choices. How to Calculate APR Calculating the Annual Percentage Rate (APR) on a loan is essential for understanding the true cost of borrowing. Learn what APR (annual percentage rate) is, how it’s calculated, and how to compare rates across loans and lenders. Includes examples and a

APY vs. APR: Key Differences

Annual Percentage Rate (APR) is a crucial metric for understanding the true cost of borrowing or the real return on investment. It represents the annualized cost of credit or the annualized return on an investment, incorporating interest rates and other fees.Calculating APR accurately is essential for making informed financial decisions. Excel is a powerful tool [] Annual percentage rate (APR) represents the cost borrowers pay to use a loan. Read on to learn what APR is, how to calculate it and its effect on your mortgage.

Annual Percentage Rate (APR) or “Effective Annual Rate” is an important concept in retail lending. It represents the true yearly cost of borrowing money or obtaining credit, expressed as a percentage rate. By understanding APR, borrowers can compare the total cost of loans and make informed decisions.

Are you trying to calculate the cost of your next car loan? Learning how to calculate APR can help. If you have credit cards or bank loans for your home, you pay interest (or a finance charge) on that money at a specific percentage over the An annual percentage rate (APR) is the interest rate charged on loans. An annual percentage yield (APY) is the rate of interest earned on investments.

Learn how to calculate monthly interest for loans, bank accounts, credit cards, and more. With this calculation, you’ll know how much you pay (or earn) each month. Learn how to calculate APR in Google Sheets with our step-by-step guide. Master RATE functions, create amortization schedules, and build reusable templates.

How to Calculate APR in Excel

Click on CALCULATE and you’ll instantly see the annual percentage rate interest associated with the above APY. Understanding APR vs APY Financial

An APR calculator that calculates the annual percentage rate on a loan. This annual percentage rate calculator calculates the APR in each year until the loan matures.

How does the parking ratio calculator help in planning a commercial project? The parking ratio calculator helps determine the number of parking spaces needed per unit of measurement (e.g., per square foot of building area) in a commercial project.

Calculate how long it will take to pay off your credit card with interest using our APR Calculator. Get payoff time, interest paid & more! What Is Annual Percentage Rate (APR)? APR is the full cost of borrowing from a bank or financial institution over the course of one year. It considers all the various costs associated with borrowing money, such as late fees, extra charges, administrative fees, and more. This makes it a great way to calculate the total cost of borrowing. Put another way, the APR of

Learn how to calculate APR (annual percentage rate), what it is used for and some disadvantages of using it to shop for loans or credit cards,

How do you calculate APR in Excel? Learn step-by-step methods, essential functions, and create your own APR calculator for accurate

How to Calculate APR in Excel (Easy Examples) Have multiple borrowing options at your disposal but don’t know which one to choose? Calculate the APR for each option to know which option optimizes the borrowing cost for you. APR is a standard measure to express the annual borrowing cost of any lending arrangement. Easy to calculate and a commonly used Annual percentage rate (APR) is the real cost of funds during the year. While credit card companies give an interest rate, the interest rate does not account for compounding. By accounting for compounding, the actual interest rate will be

Loan calculator UK: Instantly calculate the monthly and total cost of any loan. How much can I borrow? Enter the loan amount and APR to get started. Calculate APRs with our Annualized Percentage Rate Calculator, simplifying the Annual Percentage Rate formula. Get expert help in calculating APRs today!

Understanding the basics of APR, setting up the Excel spreadsheet, and using Excel functions to calculate APR are essential steps in the process. Interpreting the calculated APR and using it to make informed financial decisions is key to financial planning and analysis.

APR Calculator – Google SheetsSheet1 Knowing how to calculate APR can help you compare loan and credit card offers. Learn the steps involved in calculating APR to find the true cost of borrowing.

Easily calculate the Annual Percentage Rate (APR) with our user-friendly APR Calculator. Whether you’re applying for a loan, comparing credit

- How To Change Font Encoding In Pdf?

- How To Build A Safe Playground For Your Pet Rats: 15 Steps

- How To Buy Electroneum In 4 Easy Steps In March 2024

- How To Clean A Rubber Roof On An Rv Best Cleaners

- How To Calculate Raid Size? , RAID Performance Calculator

- How To Check Etisalat Number | how to check etisalat mobile number

- How To Change Roblox Font? [2024]

- How To Build Charts With Chart.Js

- How To Change Macbook Name? How To Rename A Mac?

- How To Change Variable In Gitlab Cicd Pipeline Depending On Branch