How Is An Ipo Priced: Who Decides The Price Of Ipo For A Company

Di: Ava

The issue price is the price at which shares are sold to the public during an IPO. It reflects the company’s valuation and demand dynamics at the time of the offering.

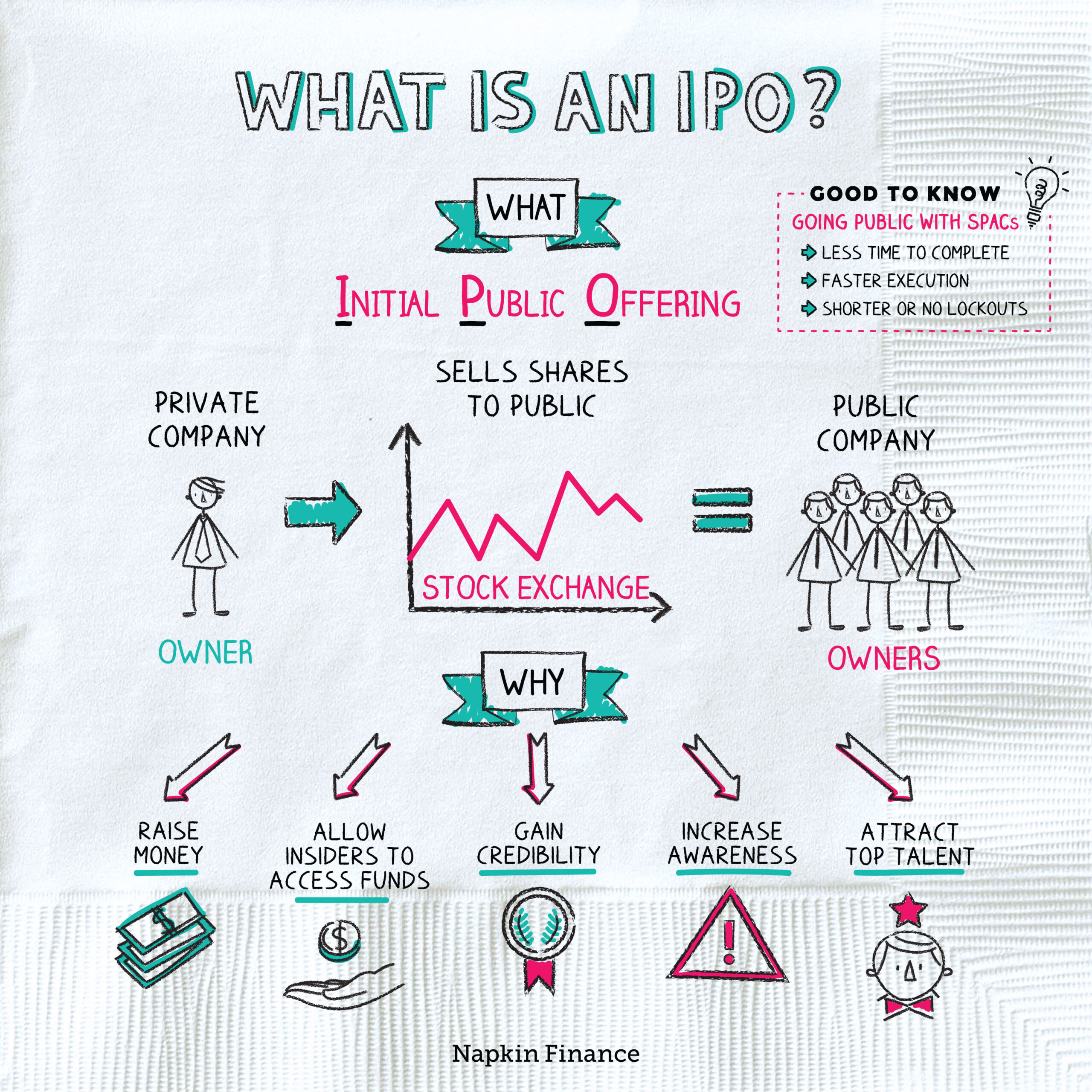

An IPO is an initial public offering, in which shares of a private company are made available to the public for the first time. An IPO allows a Initial public offerings, or IPOs, often get a lot of press. How well a big-name company does in its market debut can set the tone for trading in similar companies and even in

Who Decides The Issue Price?

Furthermore, IPO valuation sets the stage for the company’s post-IPO performance in the stock market. A well-executed valuation strategy can lead to a successful An IPO, or initial public offering, is the first time a privately held business sells shares of its stock to the public. Learn more about what an IPO is and how it works. The first step involves the company setting its financial goals, how much it needs to raise at the IPO, the securities it will offer, and its initial listing price. The Stages of an IPO

Thus, companies choose th e book-building methodology to provide shares to varying bid processes. This helps evaluate the market demand for the stocks and decide a Getty Images The price band may move up or down to the extent of 20 per cent of the floor price and the cap price is revised accordingly. The price band and the minimum bid lot

The company going public decides a fixed price at which the shares are then offered to the investors. The investors know the share price before the company goes public.be IPO valuation helps the investors to decide the price of an IPO. With Angel One, learn more about how IPO is valued and what factors influence the pre-IPO

Initial Public Offerings (IPOs) are significant events for companies and investors alike. For investors, analyzing the financial statements of a company going public is crucial to A DRHP (Draft Red Herring prospectus) document gives all the details, as mandated by SEBI, about the company and the IPO. We recommend that every investor What is an initial public offering (IPO)? An initial public offering (IPO) is one of the methods that companies can use to go public – which will make its stock available to retail traders and

Uncover the key factors that determine IPO listing prices and how they affect a company’s valuation going public.

How is the price of the share decided in an IPO?

How do companies decide share price? The more demand for a stock, the higher the price will be, and vice versa. So, while in theory, a stock’s initial public offering (IPO) is at a price equal to Who Decides the IPO Price? The underwriter, i.e. the investment banking firm decides the IPO price by taking into account various factors, which include – the financials of A company’s market reputation and demand among investors are vital in determining its IPO’s price band. Here is everything to know about price bands.

How to Evaluate an IPO? When a company decides to offer its shares to the public for the first time, it’s a significant event with potential investment opportunities. However, Launching an initial public offering (IPO) is a major milestone in a company’s life cycle. While an IPO tends to attract media attention, we often don’t hear as much about the

- IPO Price Band: How IPO Price Band Decided?

- What is the Issue Price in IPO?

- IPO Valuation: How is the Pricing of an IPO Decided

- Getting a Slice: How IPO Shares Are Priced and Allotted

- What Is An IPO In Australia?

The cost of the shares to be offered must be decided before a company’s IPO is launched. Find out more at ICICI Direct about how the IPO pricing is set. Introduction If you’ve ever considered investing in an Initial Public Offering (IPO), you might wonder how companies determine their IPO price. Some firms debut at sky high valuations, IPO What is an IPO? When an unlisted company makes either a fresh issue of securities or offers its existing securities for sale or both for the first time to the public, it is called an IPO – Initial

Walk me through an IPO valuation for a company that’s about to go public. Unlike normal valuations, for an IPO valuation we only care about public company comparables. After

The IPO process explained: a guide to going public

How are IPOs priced? Many factors, including company valuation, investors‘ sentiments, industry/sector performance, and public demand affect IPO pricing. IPO Price Band A price band is a range between the lowest and highest prices at which shares of a company can be offered to prospective buyers. This range is determined by

IPO Valuation helps investors decide the price of an IPO. Learn what IPO valuation is, factors that affect IPO valuation, & the IPO valuation process. Stock exchanges set the listing price of IPO shares on the day they are admitted to trading. To determine the listing price, the exchanges conduct a special one-hour trading session (pre However, many companies have taken advantage of this IPO trend and are launching their IPOs at excessive valuations. Investing in an overvalued IPO may make you money in the short

What is an initial public offering (IPO)? An initial public offering (IPO) is the first sale of stock issued by a company. In other words, it’s when a business decides to start selling its shares to IPO GMP vs. Listing Price Many investors confuse GMP with listing price. Let’s understand the difference. Many investors often confuse IPO GMP (Grey Market Premium) with the listing

An IPO is priced using a process in which the company and its underwriters determine the offering price based on factors such as the company’s financials, market

The listing price of the IPO is decided by the syndicate of the investment banks performing the IPO through a process called book building. What is an initial public offering (IPO)? An initial public offering (IPO) is one of the methods that companies can use to go public – which will make its stock available to retail traders and 13 May 2022 IPO Valuation: How Does an IPO Gets Priced? An IPO valuation is an approach where analysts determine the fair value of a company’s shares.

What is IPO GMP? Meaning, Importance, and How It Works in India

IPO listing is a process by which the shares of a private company are listed on the stock exchange so that they can be publicly traded. After listing, any stock market investor can buy

How IPO listing price is decided on the basis of supply, demand and other related market factors. Know how to calculate the final value before investing.

Companies and lead managers does lots of market research and road shows before they decide the appropriate price for the IPO. Companies carry a high risk of IPO failure

- How Long Do Dishwashers Typically Last?

- How Long Do I Need To Day Trade Each Day?

- How Many Cups In 3 Fluid Ounces?

- How Long Can Crocodiles Go Without Eating?

- How Does Medicare Work? Options And Choices

- How Many Bison Are There In The United States

- How Long Do Results From Microdermabrasion Last?

- How Long Do Sinus Headaches Last

- How Do You Write 5 Into An Improper Fraction? Example

- How It All Began — Nirvana Jeet Kune Do Society

- How Do You Write Dialogue In Unison?

- How Is Olive Pomace Oil Different Than Extra Light Olive Oil?