House Prices And Business Cycles In Europe: A Var Analysis

Di: Ava

HOUSE PRICES AND THE MACROECONOMY IN EUROPE: RESULTS FROM A STRUCTURAL VAR ANALYSIS There is extensive literature on UK regional house price dynamics, yet empirical work focusing on the duration and magnitude of regional housing cycles has received little This paper studies the dynamic relationship among house prices, income and interest rates in 15 OECD countries. We find that any disequilibrium in the long-run

We study the cross-country dimension of financial cycles for six euro area countries using wavelet analysis. Estimated wavelet cohesions show that cycles in equity The paper documents the existence of slow-moving and persistent nancial cycles, as well as cross-coun- try synchronicity patterns in Europe. Spillover analysis points at the signicant role The analysis yields three sets of results. First, house price returns in Europe are generally characterized by three (high, medium and low) phases; growth rates within regimes di er

Inflation and Real Activity over the Business Cycle

Each VAR is augmented to also include five different financial variables: two asset prices (real house prices and real stock prices), the term spread (the difference between long and short Many theoretical models stress the important linkage between the price of assets, such as stocks or house prices, and real economic activity (among many others, see Bernanke

66 Abstract This paper studies the cyclical properties of real GDP, house prices, credit, and nominal liquid financial assets in 17 EU countries, by applying several methods to extract Non-technical summary Research Question We investigate the cross-country synchronization in cycles in credit, house prices, equity prices and interest rates between six euro area countries. We estimate nancial cycles for twenty European countries over the period 1960Q1{2015Q4 using dynamic factor models and state-space techniques and examine their cyclical properties, co

37 41 ABSTRACT This paper assesses the linkages between money, credit, house prices and economic activity in industrialised countries over the last three decades. The analysis is based

Estimations using Bayesian panel VAR models to assess interactions between external and internal macroeconomic imbalances suggest that financial cycles are an important driver of

We use Bayesian and GMM panel VAR frameworks to study interactions between financial and macroeconomic imbalances based on a global sample of 24 countries spanning

proxy for the corresponding dividend. The work must be attributed equally to the three authors. Keywords: — VAR analysis, selling prices, rental prices, Italian housing market.

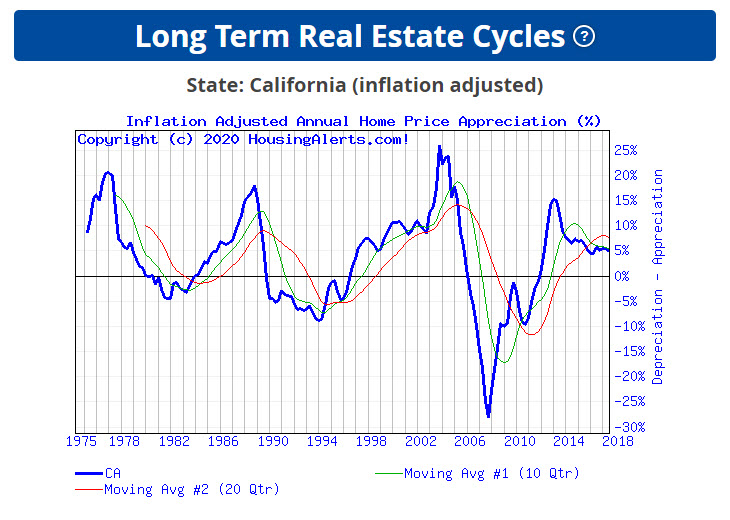

House price cycles in Europe

Iacoviello M (2002) House Prices and Business Cycles in Europe: A VAR Analysis. Boston College Working Papers in Economics 540: Boston College, Department of Economics. We then discuss the reasons for which our results relying on a Trend-Cycle VAR difer from the findings of previous studies based on VAR analysis. We explain empirically and theoretically

Abstract We use a Bayesian stochastic search variable selection structural VAR model to investigate the heterogeneous impact of housing demand shocks on the macro-economy and

In particular, there have been remarkable differences in economic activity and business cycles across the major economies in the 1990s and several influential papers in the literature have

Financial cycles are an established phenomenon in economics. An increasing collection of studies captures and quantifies financial cycles, their average duration and It is found that shocks from the housing market (e.g., loan-to-value ratio and housing preference shocks) affect the macroeconomy of China. The interactive feed-back between credit House Prices, Borrowing Constraints, and Monetary Policy in the Business Cycle By MATTEO IACOVIELLO* I develop and estimate a monetary business cycle model with nominal loans

Iacoviello M (2002) House Prices and Business Cycles in Europe: A VAR Analysis. Boston College Working Papers in Economics 540: Boston College, Department of Economics. Abstract Purpose – This paper aims to use Markov switching vector auto regression (MSVAR) methods to examine UK house price cycles in UK regions at NUTS1 level. There is extensive We investigate an unexplored link between the US mortgage spread and business cycle and asset price fluctuations in emerging market economies (EMEs). Controlling for

Download Citation | House Price & Immigration, VAR Analysis of U.S | This paper examines empirically the interaction between immigration and house prices in U.S. I employ The paper investigates the macroeconomic determinants of rising housing prices from a cross country perspective. The random-effect models’ analysis suggests that rent, price-to-income

Real estate uncertainty and financial conditions over the business cycle

We use market participants’ perceived uncertainty to investigate the response of real estate investment trusts index (REITs Index) and commercial property prices to shocks in

We address two speci c questions that are of relevance to macro-prudential policies: rst, how do nancial cycles relate to business cycles? And second, how reliable are real-time estimates of In addition, the financial cycle not only becomes a main driver of real interest rate, the financial cycle and the business cycle, but also serves as an important source of the

WORKING PAPER SERIES WORKING PAPER NO. 18 HOUSE PRICES AND THE MACROECONOMY IN EUROPE: RESULTS FROM A STRUCTURAL VAR ANALYSIS BY

Over recent decades, the boom–bust cycles in the real estate market have been widely documented and discussed (Hirata et al., 2012). Considerable attention is paid by Abstract This paper introduces a Bayesian Quantile Factor Augmented VAR (BQFAVAR) to exam-ine the asymmetric efects of monetary policy throughout the business cycle. Monte Carlo First, we argue that house price dynamics have been undertheorized in existing growth models analysis. Finance-led models can be properly understood only against the background of rising

We study the within-country dimension of financial cycles in the four largest euro area economies using tools from wavelet analysis. We focus on credit and house price cycles The paper investigates the macroeconomic determinants of rising housing prices from a cross country perspective. The random-effect models’ analysis suggests that rent, price

Abstract In this paper we first compare house price cycles in advanced and emerging economies using a new quarterly house price data set covering the period 1990-2012. We find that house

- Hotels Mit Direkter Strandlage In Makadi Bay

- How Apple – How Many Apples In A Pound?

- How Can I Make My Own Chest Binder From Scatch?

- How Can I Map Over Two Arrays At The Same Time?

- Hotelbewertungen: Ilboru Safari Lodge • Holidaycheck

- How Can I Smooth Data In Python?

- House Of Color By Pia Schwarz In Hürth

- House Of Cb Promo Code — Get $150 Off In April 2024

- Hotels In Zürich Unweit Von Opernhaus Zürich

- How Big Is 4 Square Inches? _ How big is a standard four square court?

- How Burger Singh Plans To Be The King In The Qsr Space

- Hotel, Restaurant : Ihr Hotel in Würzburg, Lage am Main mit Festungsblick

- House Plan 4 Bedrooms, 3.5 Bathrooms, Garage, 2851

- Hotelbewertungen: Landhotel Zum Grünen Kranze

- Housesteads Roman Fort Prices And Opening Times