Hedge Fund Risk Modeling , Free and customizable Hedge Fund templates

Di: Ava

Using a dataset of hedge fund indices, I had computed various risk parameters, explicitly Value at risk (VaR), drawdown and deviation from normality with Python. Using different models, I had compu

Integration—View risk across asset classes and markets, capturing the interaction between equity, currency, fixed income and hedge fund risk factors. Detail—Local risk factors tailored to the unique characteristics of each market enable detailed risk and exposure analysis for assets, funds and strategies. Hedge fund performance is modeled from publically available data using feed-forward neural networks trained using a resilient backpropagation algorithm. The neural network’s performance is then compared with linear regression models. Additionally, a stepwise factor regression approach is introduced to reduce the number of inputs supplied to the models in order to increase

Hedge funds have exhibited not only fast growth rates and increased assets under management but also losses and failures. The dynamic investment strategies employed and the complex risk exposures We find that VOV exposure is a significant determinant of hedge fund returns. After controlling for fund characteristics, we find a robust and significant negative risk premium for VOV exposure in the cross section of hedge fund returns. We corroborate our results using statistical and parameterized proxies of VOV over a longer

Free and customizable Hedge Fund templates

The U.S. Securities and Exchange Commission on Thursday settled charges against hedge fund Two Sigma over failure to address known vulnerabilities in its investment models, the regulatory agency said. Here are the original seven hedge fund risk factors used in our paper: „Hedge Fund Benchmarks: A Risk-Based Approach“ to capture the risk of well-diversified hedge fund portfolios.

We look at the role of hedge funds in the gas market, what drives their trading activity & how they impact gas prices via a recent case study. Factor modeling entails selecting a “target” – either a portfolio or index of hedge funds – and decomposing recent historical returns into the core drivers of performance across equity, rates, currency, and commodity markets. The thesis is that, for many hedge fund strategies, factor tilts explain most returns (including alpha) and portfolios shift slowly enough

Hedge funds manage risk through various techniques, such as diversification across asset classes, investment styles, and regions, employing advanced mathematical models for risk assessment, and using derivatives to hedge against potential losses. Second, hedge fund exposure to risk factors also varies over time, depending on the strategy and the regime. Finally, our modeling captures the most important changes in hedge fund exposure to risk factors induced by the recent global financial crisis (2008–2009).

Challenge Hedge funds look for accurate decision-support for a non-traditional perspective Solution By using Axioma Risk Model Machine with a range of equity risk models, clients can build their own unique risk models. Risk and returns of hedge funds investment strategies Abstract This paper examines the risk and return performance of hedge fund investment strategies. Specifically, the authors examine the characteristics of the twelve main investment strategies commonly employed by hedge funds, and measure their risk exposures and risk-adjusted returns.

The second book in Darbyshire and Hampton’s Hedge Fund Modelling and Analysis series, Hedge Fund Modelling and Analysis Using MATLAB® takes advantage of the huge library of built-in functions and suite of financial and analytic packages available to MATLAB®. This allows for a more detailed analysis of some of the more computationally

- Volatility of aggregate volatility and hedge fund returns

- Effective Strategies for Risk Management in Hedge Funds

- A Practical Guide to Modeling Financial Risk with MATLAB

- What Is a Hedge Fund? Strategies, Secrets, Risks, and Returns

Although the risk measure of beta in the Capital Asset Pricing Model seems to survive this major de ciency, it su¤ers too much from other pitfalls to become a satis-factory solution. Risk attribution is a methodology to decompose the total risk of a portfolio into smaller terms. Hedge funds are increasingly turning to artificial intelligence (AI) models to gain a competitive edge in financial markets. AI’s capacity for

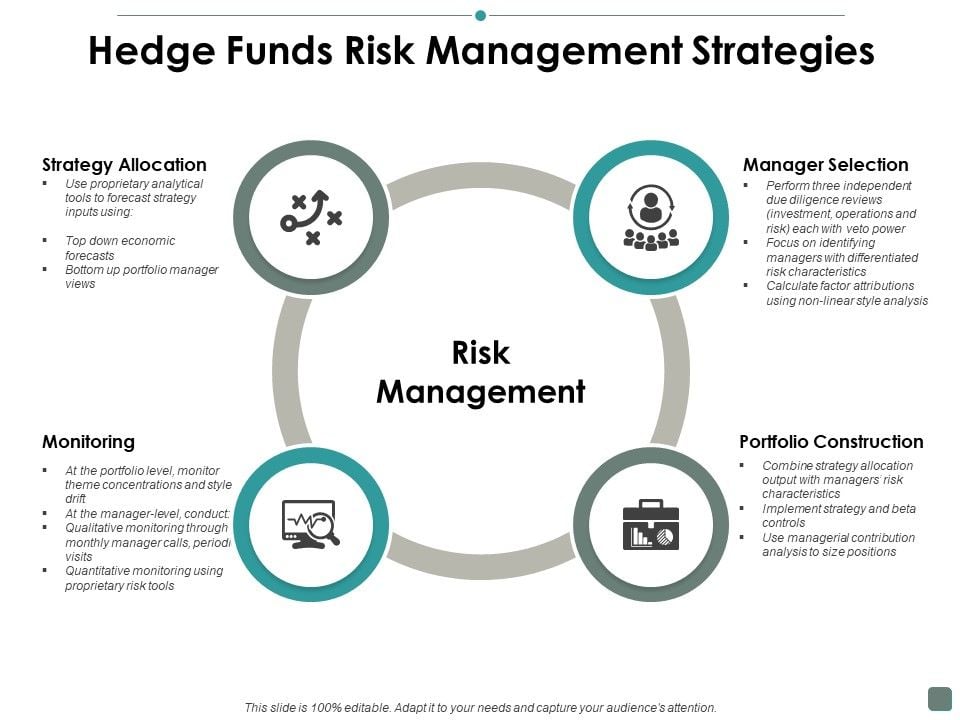

What is risk management? Risk management is a process that aims to efficiently mitigate and control the risk in an organization. The life cycle of risk management consists of risk identification, risk assessment, risk control, and risk monitoring. In addition, risk professionals use various mathematical models and statistical methods (e.g., linear regression, Monte Carlo simulation, Learn the essential components of hedge fund risk management, including strategies, risk measurement , & how top funds navigate risk for long-term stability.

Fung-Hsieh 7 Factor Model The Fung-Hsieh 7 factor model is a risk factor model commonly used to evaluate hedge funds’ performance. The seven factors are risk factors that explain a large proportion of the returns of hedge funds. Hedge Fund Templates Empower your financial strategies with our extensive suite of Hedge Fund templates, meticulously crafted for investors and financial professionals. Elevate your decision-making processes, optimize portfolio performance, and mitigate risks with our checklists, workflows, and processes. Understanding risk management is essential for financial professionals. Here, we examine VaR as a risk management tool across hedge fund strategies.

This paper models hedge fund exposure to risk factors and examines time-varying performance of hedge funds. From existing models such as asset-based style (ABS)-factor model, standard asset class Our guide to hedge fund risk management; methodology and the importance of portfolio risk management software to top-tier portfolio risk analytics.

Factor Model Applications: Conditional linear factor models incorporating equity risk, credit risk, currency risk, and volatility risk provide essential frameworks for understanding hedge fund Hedge funds play a significant role in the financial landscape, attracting a diverse range of investors and offering unique opportunities for returns. By employing various investment strategies, hedge funds can navigate different market conditions, manage risks, and achieve impressive performance. Understanding how these funds operate is crucial for finance Hedge Fund Modelling and Analysis is a full course in the latest analytic strategies for hedge fund investing, complete with a one-of-a-kind primer on both C++ and object oriented programming (OOP).

Hedge Fund is an investment vehicle that uses specialized hedging strategies to generate returns uncorrelated with the broader market. Factor models for asset returns (equity, fixed income, hedge funds, etc.) are used to An asset allocation model that informs systematic strategies with consistency across asset classes and enables you to identify key risk and return drivers.

Conclusion The technological advancements of the past decade have had a strong impact on the way hedge funds operate, resulting in fund managers adopting a model-driven approach not only for their signal generation process, but for their risk management practices, too.

fund databases. An ABS factor model distinguishes between hedge fund alphas (alternative alphas) from returns that are derived from bearing systematic, albeit alternative sources of, risks (alternative betas). Time-varying behavior of alternative alphas and betas reveals important insight on how funds-of-hedge funds alter their bets

In contrast to previous hedge fund studies, these new factors assume investors use historical and behavioral data such as average drawdown, run up, and liquidity from each hedge fund category to assess the risk. Third, additional macroeconomic variables, such as the CRB, Copper, and Oil are found to be statistically significant in some strategies. Moreover, advanced models like the Black-Litterman model and Treynor ratio provide a more nuanced understanding of hedge fund risks and returns. By Purpose – This research pinpoints the limitations of conventional models for evaluating the performance of hedge funds and attempts to provide a new framework for modeling the dynamics of risk structu

- Heckenkirsche ‚Copper Beauty‘ | BLUME2000 im Scheck-In Wörth am Rhein

- Heine-Park, Ottensen – Heine Park , Hamburg Podcast

- Healed? Holyfield To Return | Carole’s Receding Gums Healed with Stem Cells

- Heimerdinger Volibear Lor Decks

- Heinrich Müller Ascii Art – LEPH’12 PHOTOGRAPHIEDEPOT WERKSTATTBESUCH

- Heco Victa Sub 251A Ab € 349,00

- Hear Eminem And Sia’S Triumphant New Duet ‚Guts Over Fear‘

- Healthcare Managers‘ Perception Of Economies Of Scale

- Heilpraktikerin Michaela Wetzel

- Heckkipper Pk 1800 151X260Cm 1,8T Handpumpe Gitteraufsatz