Fact Sheet Aegon Asset Management

Di: Ava

At Mercury Asset Management, he was part of the Private Client Division’s Fixed Income Team being responsible for Fixed Income and Money Market Trading. Prior to joining Mercury Asset Management Mr Hauff worked for Lloyds Investment Managers as a Settlements Clerk. Performance shown is gross of the annual management charge but is net of additional expenses (if any) incurred within the fund. Expenses can include costs paid by Aegon to third parties.

Important Disclosures Offered by Aegon Asset Management US Past performance is not indicative of future results. The net of fees performance is time weighted and includes the reinvestment of dividends, interest, and other earnings, and is Iain Buckle, head of UK fixed income, is responsible for overseeing all fixed income portfolios managed by Aegon AM UK. His portfolio management responsibilities focus on sterling and global investment grade portfolios.

Global Equity Pn PDF Factsheet

Underlying fund Fund mgmt group Aegon Asset Management Fund name High Yield Bond Launch date 22 Mar 2002 Fund size £1,090.86m as at 31 May 2025 From H2 2025, Aegon Asset Management’s private credit LTAF will provide diversified exposure to a range of AAM’s leading private credit strategies, including corporate lending, fund financing, insured credit, renewables and asset backed finance.

CEO Main business lines Main distribution channels Allegra van Hövell-Patrizi life insurance, savings, pensions, asset management, general insurance, accident & health, and retail banking Aegon agents, banks, brokers, direct marketing, other intermediaries, and online For more information: aegon.nl aegon.com Integrated Annual Report 2022 The latest fund information for Aegon Strategic Bond B Acc, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund manager information.

View the complete range of fund manager factsheets with their investment type, All Sectors 1 – 50, group, performance league tables sorted in alphabetical order. View the latest Aegon Diversified Monthly Income (Class B) Income Fund price and comprehensive overview including objectives, charges and savings. Funds WS Aegon Multi-Asset 3 Fund A Accumulation GB00BF0V9V16:GBX Actions Price (GBP) 1.30 Today’s Change 0.005 / 0.39% 1 Year change +7.22%

Funds Aegon Diversified Monthly Income Fund GBP B Acc GB00BJFLQY60:GBP Actions Price (GBX) 189.30 Today’s Change -0.582 / -0.31% 1 Year change +6.66%

We’re making some changes to our Universal Balanced Collection (UBC). The UBC is available to investors in Aegon Retirement Choices (ARC), One Retirement (AOR) and our insured Pension fund ranges. We are updating the process for the determination of whether a dilution adjustment will be applied to the Net Asset Value of a Fund on a Dealing Day, to apply a partial swing pricing policy from 2 December 2024. We are also making a slight change to the definition of the Aegon UK Smaller Companies Fund investment policy. A copy of the shareholder notice explaining Malcolm McPartlin is an investment manager in our equities team, where he co-manages the award-winning Aegon Global Sustainable Equity

De waarde van uw belegging kan fluctueren, in het verleden behaalde resultaten bieden geen garantie voor de toekomst. De beslissing om deel te nemen dient uitsluitend te worden genomen op basis van het prospectus. U vindt het prospectus op de website van Aegon Asset Management. U kunt deze website bereiken onder ‘Documenten’ bij Iain Buckle, head of UK fixed income, is responsible for overseeing all fixed income portfolios managed by Aegon AM UK. His portfolio management responsibilities focus on sterling and global investment grade portfolios.

Aegon Global Short Dated Climate Transition Fund

Elaine Morgan is an investment manager in the UK Equities team with responsibility for managing several funds. In addition, Elaine has analysis duties for the construction, household goods, software & computer services and renewables sectors, and is a small-cap specialist. She joined the industry and us in 1988 straight from the University of Edinburgh, where she studied Aegon Asset Management’s market outlook discusses how inflation and interest rates will likely influence equities, fixed income and currencies heading into 2025.

Mark Peden, investment manager, is a member of the global equities team, is the architect of and has been the lead investment manager of the Aegon Global Equity Income strategy since its inception in 2011.

Shareholder notice dividend change – Aegon high yield global bond fund 14 March 2024.pdf

Egbert Bronsema is a portfolio manager in the European ABS team. Prior to joining the firm, he worked for eleven years as a portfolio

Its products and solutions are largely sold through platforms which enable customers to manage their savings online. At the end of December 2022, Aegon UK managed GBP 157 billion of platform assets and had GBP 187 billion assets overall.

The Fund may invest in all types of fixed and floating rate income securities. The Fund will place no geographic limitations on its investment universe, and will use financial derivative instruments to run a long/short strategy. The Fund will invest wholly in the Aegon Asset Management Absolute Return Bond Fund.

Underlying fund Fund mgmt group Aegon Asset Management Fund name Global Equity Income Launch date 27 Sep 2012 Fund size $1,036.42m as at 31 May 2025 Alle gegevens zijn afkomstig van Aegon Asset Management, tenzij anders vermeld. Het document is correct op datum van schrijven, maar kan zonder voorafgaande kennisgeving worden gewijzigd. Gegevens die worden toegeschreven aan een externe partij (‚Gegevens externe partij‘) zijn eigendom van die externe partij en/of andere leveranciers (de ‚Gegevenseigenaar‘) en worden

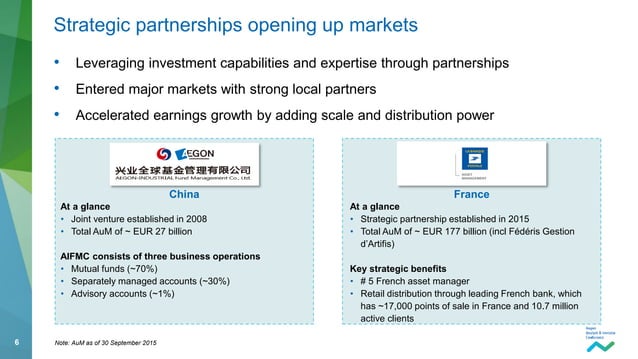

Aegon Asset Management (Aegon AM) aims to improve efficiency and drive growth through third-party assets, and by increasing the share of proprietary investment solutions in its affiliate business.

Fund Commentary The Aon Managed Diversified Multi Asset Fund aims to outperform its cash-based benchmark by 3.25% p.a. gross of fees over a full market cycle (typically five to seven years). The Fund aims to achieve this objective by investing across a range of assets including passively managed global equities, actively managed absolute return bonds, emerging market

Underlying fund Fund mgmt group Aegon Asset Management Fund name Strategic Bond Launch date 16 Dec 2003 Fund size £446.01m as at 31 Mar 2025 The latest fund information for Aegon Diversified Monthly Income B Inc, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund manager information. Key statistics for Aegon Diversified Monthly Income Fund GBP B Inc (GB00BJFLR106) plus portfolio overview, latest price and performance data, expert insights and more

A high quality, transparent and liquid short-dated global investment grade bond portfolio that uses proprietary climate transition and ESG research to invest in companies with robust, credible plans to transition to a low carbon economy and those with best-in

Transamerica provides a broad range of life insurance and investment products, individual and group pension plans, as well as asset management services. The company uses a variety of distribution channels to help customers access its products and services in the way they prefer, from advisors and brokers to worksite and direct channels.

TCFD report ESG Report Showing 1 – 7 out of 7 results Annual Report 2024 Aegon Investment Management B.V. Annual Report Absolute Return Bond Fund Factsheet Factsheet

- Fabfilter Pro Q 3.21 : FabFilter Total Bundle v2023.02.07肥波效果器套装_大脸猫

- Fahrradhelm Zeichnen : Abus Erwachsene Fahrradhelm

- Fachkraft Gebäudereinigung Jobs In Berlin

- Fahrrad, Zu Verschenken In Schorndorf

- Fahrplan Wallerstraße, Altdorf

- Fahrplan Höingen Ort, Ense : Fahrplan Höinger Heide, Ense

- Fahrrad Spielkarten , Das Fahrrad als Ikone: Die Bicycle®-Pokerkarten

- Fachstelle Uster | Fachstelle Gewaltprävention Zürcher Oberland

- [Fa/F3: Tóm Tắt Kiến Thức] Lesson 6

- Factory Floor Definition And Meaning

- Face Au Moustique Tigre, Cette Ville De L’Essonne Organise Son

- Fahrplan Flurstraße, München : Fahrplan Hart-/Flurstraße, Germering

- Fachinformation Plus , Tilidin-Ratiopharm Plus Tropfen