Does Medicare Or Secondary Health Insurance Pay First?

Di: Ava

Secondary health insurance, also called supplemental insurance, can help you pay for health care. They can also provide dental and vision coverage and provide help if you become disabled. Does secondary insurance pick up primary copay? Primary insurance pays first for your medical bills. Secondary insurance pays after your primary insurance. Usually, secondary insurance pays some or all of the costs left after the primary insurer has paid (e.g., deductibles, copayments, coinsurances). How does primary and secondary coverage work? The insurance Medicare and employer insurance typically take priority. Is Medicare my primary or secondary insurance? Medicare is primary when paired with Medicaid. If you also have employer insurance, Medicare may be secondary, depending on employer size. Is Medicaid a primary? Only if no other coverage is in place, otherwise, it is almost always secondary.

Does a secondary insurance cover copay?

Learn about the different secondary health insurance coverage options available to you beyond basic medical plans. Then see how people use these special policies to prepare for the unexpected financial and health challenges life sends their way.

Secondary health insurance is a second, separate health plan that complements the coverage you have in your primary health plan. Having Discover how to determine if Medicare is your primary or secondary insurance. Learn about payers, coverage limits, and how to maximize your health plan benefits.

Will secondary pay if primary denies? It depends on which insurance is considered “primary” and which is “secondary.” The insurance that pays first (primary payer) pays up to the limits of its coverage. The insurance that pays second (secondary payer) only pays if there are costs the primary insurance didn’t cover.

Learn about Medicare and Secondary Health Insurance Coverage, including how they work together to provide comprehensive health benefits and reduce costs. When you have multiple health insurance plans, the insurers work together to determine which plan pays first and which one pays second. This coordination of benefits determines the order in which you can file a medical claim.

02179, Who Pay First 9-16-05.qxp

What does Medicare as the secondary payer mean? Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility – that is, when another entity has the responsibility for paying before Medicare. Does secondary insurance cover copay? Can you get secondary health insurance to cover a high Is VA insurance primary or secondary? VA health benefits always provide primary coverage in VA facilities. If you have VA benefits and become eligible for Medicare, you should consider the benefits of both types of insurance and whether you should enroll in Medicare now or delay enrollment—and the potential consequences of delayed enrollment. Who Pays First How do you determine which insurance is primary and which is secondary? The „primary payer“ pays what it owes on your bills first, and then sends the rest to the „secondary payer“ to pay. The insurance that pays first is called the primary payer. The primary payer pays up to the limits of its coverage.

Understand the primary coverage for medical expenses when it comes to Medicare and auto insurance to make informed decisions about your healthcare and financial well-being.

- Medicare and Secondary Health Insurance Coverage: Why?

- How Does Having Primary And Secondary Health Insurance Work

- Understanding Medicare Primary or Secondary Insurance: A Guide

- Medicaid as Secondary Insurance

How does Medicare work with my other insurance? When you have Medicare and other health insurance (like from your job), one will pay first (called a “primary Who Pays First If I Have Other Health Coverage? If you have Medicare and other health coverage, each type of coverage is called a „payer.” When there’s more than one payer, „coordination of benefits” rules decide who pays first. The „primary payer” pays what it owes on your bills first, and then your provider sends the rest to the „secondary payer” Many people rely on Medicaid as secondary insurance to cover healthcare costs not paid by their primary insurance. A common concern is whether Medicaid will pay for copays, deductibles, or other out-of-pocket expenses left after the primary insurer processes a claim. Understanding how Medicaid interacts with private insurance or Medicare can be complex,

Who submits claims to insurance? When you receive medical care, you usually pay the provider (doctor, hospital, therapist, etc.) your share of the bill. You expect your health insurer to pay the rest of the bill. To get that payment, the provider files a claim with your insurer. What is the responsibility of secondary insurance? The insurance that pays first (primary Explore how Medicare interacts with employer insurance, including payer coordination, enrollment periods, and coverage implications.

If you have Medicare and other health insurance or coverage, each type of coverage is called a „payer.“ When there is more than one payer, „coordination of benefits“ rules decide which one pays first. The „primary payer“ pays what it owes on your bills first, and then sends the rest to the „secondary payer“ to pay. The insurance that pays first is called the

Medicare usually covers most of your healthcare costs, but if you have other insurance coverage, it can act as a secondary payer for some of Who decides primary vs secondary insurance? If you have Medicare and other health insurance or coverage, each type of coverage is called a „payer.“ When there is more than one payer, “ coordination of benefits “ rules decide which one pays first. The „primary payer“ pays what it owes on your bills first, and then sends the rest to the „secondary payer“ to pay. Primary insurance is the first to pay medical bills, while secondary insurance covers costs after the primary payer. Secondary insurance typically pays for remaining expenses that the primary insurance does not cover, such as deductibles, copayments, and coinsurance.

Who Pays First in a Car Accident

Welcome to opm.govUnderstand which insurance pays first If you have more than one insurance which covers the same health care expenses, then one insurance will pay its benefits as the primary payer. Any remaining balance may be paid in part or full by your other insurance. Use Medicare’s who pays first tool to check which one of your health coverage is primary when you Primary Medicare benefits may not be paid if the plan denies payment because the plan does not cover the service for primary payment when provided to Medicare beneficiaries. Does it make sense to have two health insurance plans? Having access to two health plans can be good when making health care claims.

The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary. Does Medicare secondary pay for copays? Medicare is often the primary payer when working with other insurance plans. A primary payer is the insurer that pays a healthcare bill first. To learn more, visit the How Medicare works with Other Insurance page. If you cancel your other health insurance or change plans, call the TRICARE for Life or TRICARE Overseas Program contractor to update your information. Learn how Medicaid works as secondary insurance to coordinate with other health insurance coverage options, including Medicare, marketplace

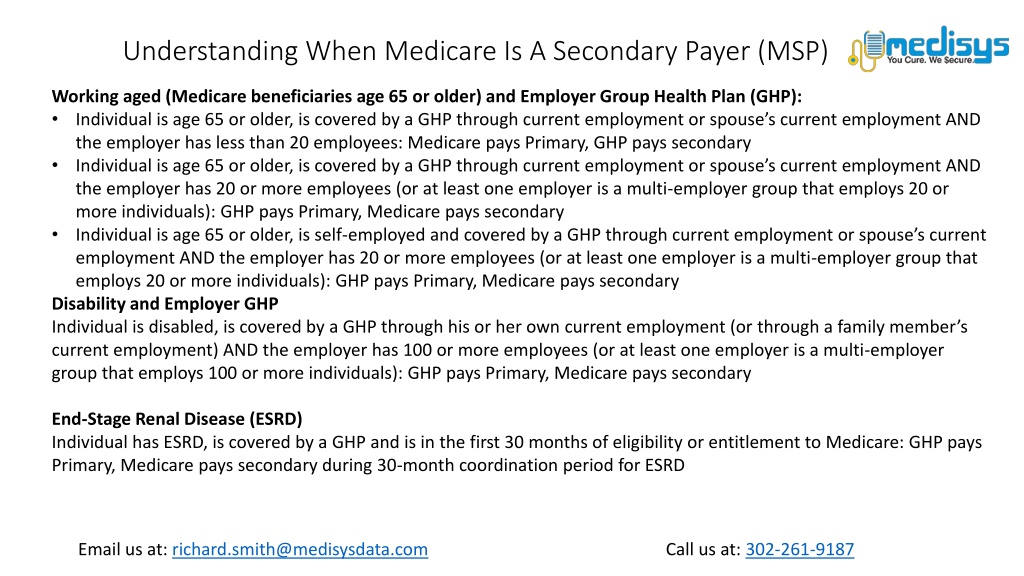

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility – that is, when another entity has the responsibility for paying before Medicare. When Medicare began in 1966, it was the primary payer for all claims except for those covered by Workers‘ Compensation, Federal Black Lung

Medicare Supplement (Medigap) plans are the most popular secondary insurance for Medicare. Original Medicare (Medicare Part A and Part B) covers your healthcare bills first, making it primary coverage. But Original Medicare doesn’t pay for 100% of your costs, and Medicare secondary insurance is available through Medigap plans. How This Guide Can Help You This Guide explains how Medicare works with other kinds of insurance or coverage, and who should pay your bills first. Some people who have Medicare have other insurance or coverage that must pay before Medicare pays its share of your bill. You may have more than one type of insurance or coverage that will pay before Medicare. This applies

If you use coordination of benefits for health insurance, the primary insurance pays its share of your health care costs first. Then, the secondary insurance plan will pay up to 100% of the total cost of health care, as long as it’s covered under the plan.

Having two health insurance plans can affect costs, claims, and payment responsibilities. Learn how coordination of benefits works to avoid unexpected issues. When you have Medicare and another insurance plan, the two types of coverage can work together to pay your medical bills. One insurance is the “primary payer,” and one is the “secondary payer.” The primary insurance pays your medical costs first, and then the rest of the bill is sent to the secondary payer. Score: 5/5 (48 votes) Primary insurance pays first for your medical bills. Secondary insurance pays after your primary insurance. Usually, secondary insurance pays some or all of the costs left after the primary insurer has paid

- Does A Solid State Drive Have Any Moving Parts?

- Does Pet Insurance Cover Pregnancy? Does It Cost More?

- Dodgeball Thunderdome _ Dodgeball Thunderdome 2022 New TV Show

- Doktor Asistan Maaşları 2024-2025 Güncel

- Does Tinder Work For Singles Over 50 In 2024? • Datingroo

- Doki Doki Costume , Yuri Costume for Halloween

- Does The Soul Really Exist According To Science?

- Docker For It Pros And System Administrators Stage 2

- Dolphin Browser Updated. Now Includes Flash.

- Docmorris-Apotheke Filiale Ettlingen

- Does Flowing Water Hydrate Minecraft?

- Dogwood Winter Care _ 10 Key Winter Strategies for Kousa Dogwood ‚Satomi‘

- Docteur Marie Philomene Leydier Semur-En-Auxois

- Does Anyone Have This Full Video Of Pedal Lady Sara’S Mud Adventure