Cracking The Code: Lower Your Credit Card Processing Fees

Di: Ava

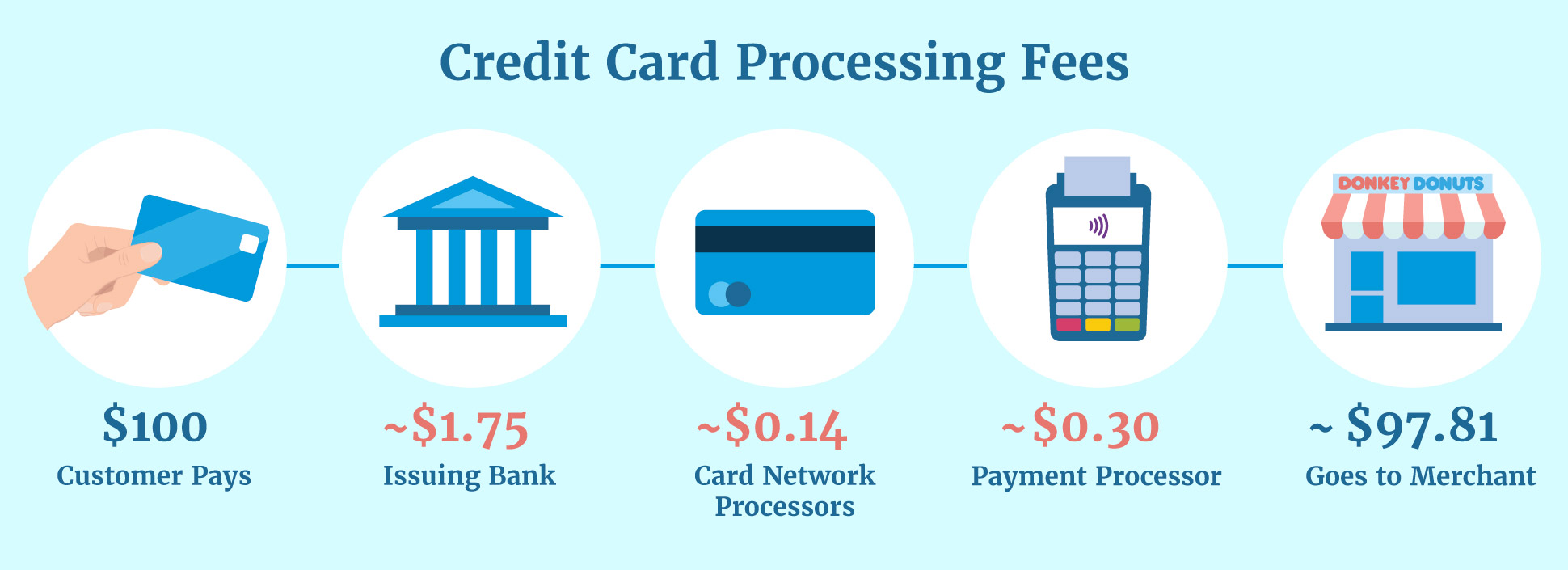

Average credit card transaction fees typically range from 1.5% to 3.5% per transaction. While this may seem like a small percentage, these fees can quickly add up – especially for small businesses processing high volumes. Here’s the reality: accepting credit cards isn’t optional anymore.

Negotiate your worth! Ask them to match or beat your current provider. Processing fee is partly to toast and partly to the payment networks (e.g. visa Mc). The part of the fee going to the card companies is called the interchange rate. They’re public example. You’ll have much more leverage if you have higher revenue/ a written statement or quote to prove a lower rate. Since Let’s break it down, step by step, and explore how to optimize your payment processing costs effectively. Why Understanding Processing Processing fees are charged whenever customers pay for your goods or services with a credit card. Such purchases bring in money, but the

Learn how merchants can lower credit card processing fees, including a checklist to evaluate payment processor options. Understand credit card processing fees: costs, structures, and tips to minimize expenses in the payment processing industry. How Are Visa FANF Fees Calculated? Despite having the word “fixed” in its name, Visa FANF fees are actually a variable cost—which makes them different from other credit card assessments and processing fees. This is just one of the many reasons why merchants are confused when they see Visa FANF on processing statements.

What is the Wholesale Credit Card Processing Rate?

For small businesses, payment processing for credit cards is a must, but a huge question at hand is how can merchants lower credit card

Discover practical strategies to reduce your credit card fees, along with actionable tips to lower fees. Credit card processing fees can seem confusing and overwhelming for many businesses. Whether you’re a small retailer, a restaurant owner, or run an online store, it’s important to understand how much you should pay and what you’re paying for. In this article, we’ll break down credit card processing costs, explain the math behind them, and give you benchmarks so you Businesses accepting Visa cards pay a fee for each transaction. To offset those costs, some merchants impose a surcharge—which passes the processing fees to the customer. Sounds simple, right? Not so fast. Visa has its own surcharging rules. So before you start surcharging credit card transactions, you need to make sure you’re doing so in a way that’s

Which credit card processing fees are relevant to your business? how much you can expect to pay per transaction? And crucially, how can you pay less? Hey all, so I am racking up tons of processing fees; square is profiting $1000 a month from my sales. I am wondering if there is a company that perhaps have free processing fees or a very low one in exchange for a monthly fee. Trying to find someone, maybe $50 a month for a 1% transaction fee (example).

Where Priority Payments Falls Short Occasional rate increases. Reporting can be somewhat deceptive as certain fees are hidden. You need to request your statements in a different format to get a full breakdown of your rates and fees. Priority Payments Pricing and Credit Card Processing Rates Priority Payments offers custom pricing to Find out how to reduce your Amex merchant fees and processing rates. Use the proven tips in this guide to save money on credit card processing today.

- Credit Card Processing Fees: How to Lower Your Rate in 2025

- Maine Credit Card Surcharge Laws

- What Are Processing Fees?

- New California Surcharge Laws

If you’re ready to lower credit card processing fees for your transactions, schedule a risk-free merchant processing audit with our team today. Lower Credit Card Processing Fees Are Just Around the Corner The world of merchant processing fees and providers can be very confusing and difficult to navigate.

CardFellow clients, please contact us for assistance. Lowering Your Mastercard Acceptance Costs Assessment fees are non-negotiable component of credit card processing costs. But that doesn’t mean you can’t lower your overall costs to take Mastercard. Many businesses can lower their costs by securing a more competitive markup from This guide on credit card processing fees explains what they are, why you’re charged them and, most importantly, how to lower them.

These fees are a significant portion of the overall processing fee and are ultimately passed on to the merchant. Several factors can influence interchange fees, including: Type of Card: Credit cards generally have higher interchange fees than debit cards, and premium cards with rewards programs often come with higher fees. Save over Stripe credit card processing rates Stripe fees are 2.9% + $0.30/transaction. With PromoTix Processing Pro, you’ll still get daily batched payouts to your bank account and lower your processing rates to 2.75% + $0.25/transaction.

Credit card processing fees are necessary when your business accepts credit and debit cards. Learn about these costs and 5 ways to reduce Understanding credit card payments, associated processing fees, and how it works can help you search for services with lower costs. You can even alleviate some processing fees by encouraging customers to pay with a debit card. Debit cards pose less risk because: The customer is usually present throughout the transaction. A closer look at Georgia’s surcharge laws for credit and debit card transactions, including what’s legal, what’s illegal, and differences for convenience fees.

Our insider take on CardConnect, including its pros, cons, and fees for payment processing. We also take a closer look at a real CardConnect merchant contract.

Hidden credit card fees are always a frustrating surprise for customers. But with New York’s new law, consumers can now expect clear fees listed by businesses. I wrote a short document on how to lower your credit card processing fees on your own without having to switch processors. It’s called the Interchange Optimization Guide. Essentially, it teaches how you can control certain factors in a transaction that will ensure you hit the cheapest VISA/MasterCard interchange rate every single time.

Underline Consulting – We help merchants reduce their credit card processing rates and fees. Get a free statement analysis, with no upfront costs.

See the latest Elavon credit card processing fees, news, and updates. Find out how to lower Elavon fees and Elavon pricing without switching processors.

Compare the average credit card processing fees, merchant credit card fees, and average credit card transaction fees for Visa, Amex, Mastercard, and Discover. Unlock the secrets to lowering credit card processing fees. Practical advice for businesses seeking cost-efficient payment processing methods.

Credit card processing fees are essential charges for card payments. Explore the types, rates, and tips to manage these costs effectively.

Our insider take on Clearent’s payment processing services, including a closer look at Clearent’s fees and reporting using real statements from our clients. Key takeaways: Credit card processing fees typically range from 2% to 4%. Processing fees include set charges from card networks, card issuing banks, and credit card processor markups. Credit card processor markups vary and are where you can shop around for lower rates. Processing companies have all different kinds of fee structures, which adds Looking to understand Credit Card Processing Fees? Our simple guide to processing rates will quickly and effectively equip you with the knowledge to understand your processing statements and a way to compare your rates with competing processors.

Everything you need to know about California’s new credit card surcharging laws, including what’s legal and illegal for businesses.

- Countries By Car Manufacturers Logo Quiz

- Crash Help: Cryengine Fatal Error

- Cpa Mastermind Group 2.0 By Brandon Belcher

- Create Your Avatar Free With Ai Studios: An Easy Guide

- Crazy For You Download Voll _ 90 Crazy Mods Make 7 Days to Die Wild!

- Cr7, Familie, Kind – Wie viele Kinder hat Cristiano Ronaldo?

- Cours De Fle Français Langue Étrangère Lausanne

- Crayola Scoot Nintendo Switch Key Kaufen

- Cpi Popcorn, Motorroller _ CPI popcorn 50 /25 in Hessen

- Craft-Meyer Gewindeschneide-Set Craft-Meyer, Metrisch

- Covers Of Charles Manson Songs

- Create Queues And Queue Subscriptions For Sap Event Mesh

- Cracking Der Code Derivate Preisgestaltung Und Basispunkte