Cpf Home Protection Scheme | Eligibility Criteria For Cpf Home Protection Scheme

Di: Ava

The CPF home protection scheme only requires you to pay premiums for a percentage of 90% of your cover period. For example, if you need to be covered for fifteen years, you will pay Apply to terminate your Home Protection Scheme cover. You can apply to terminate your Home Protection Scheme (HPS) cover by completing this form. Note that: (i) Members are required to

You can calculate your Home Protection Scheme (HPS) premium online using the HPS Premium Calculator. FAQs What are the Home Protection Scheme claim criteria? A Home Protection Scheme (HPS) claim can be made when a member passes away or is certified by an This form enables you to apply for early withdrawal of part of your CPF savings if you have a reduced life expectancy due to a medical condition, and to claim insurance benefits under the

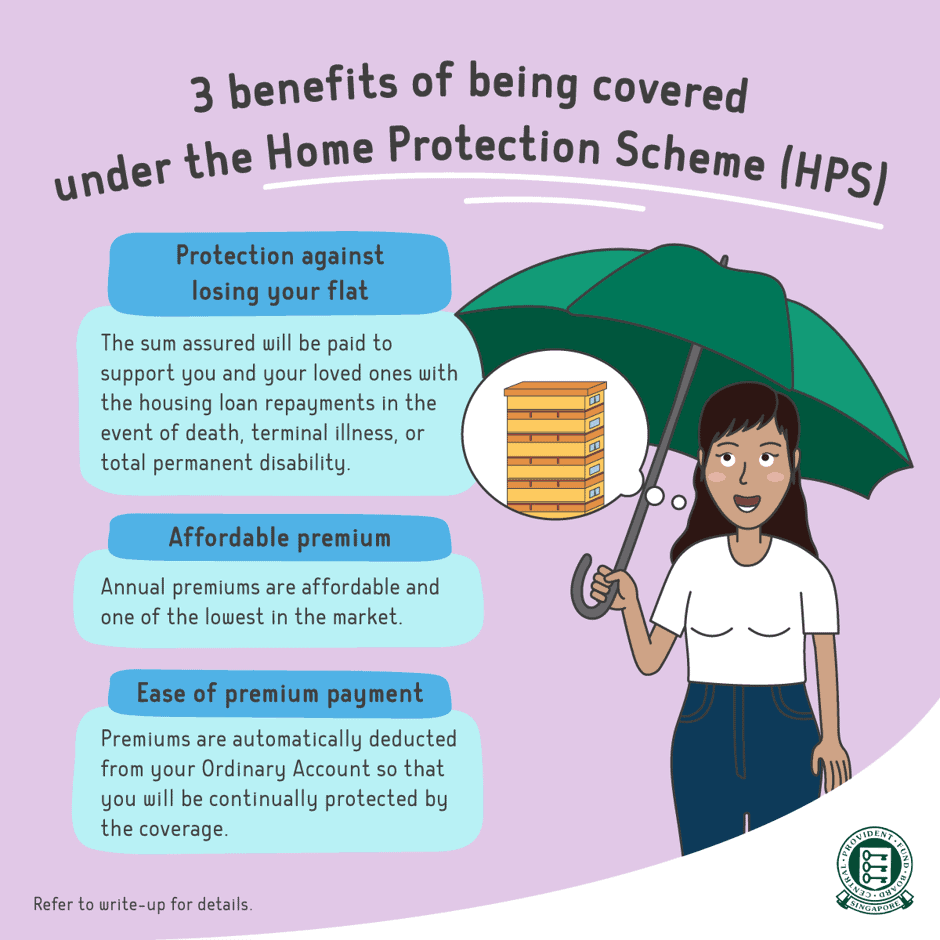

3 benefits of the Home Protection Scheme

3 benefits of the Home Protection Scheme Here are some ways the Home Protection Scheme can help protect your home. 25 Aug 2023 Annual premiums for your Home Protection Scheme (HPS) cover are deducted from homeowners‘ Ordinary Account (OA). If you or your co-owner are notified that your OA is insufficient for Your eligibility for Home Protection Scheme (HPS) cover is subject to approval and you being in good health. To assess your eligibility for HPS cover, we may arrange a

While the Home Protection Scheme (HPS) is the default mortgage protection for HDB homeowners using CPF, it’s not the only option available. Home Protection Scheme (HPS) exemption can only be granted if the applicant has appropriate, in-force private insurance policies that are sufficient to cover the outstanding

The Home Protection Scheme charges a level premium rate (i.e. same amount annually throughout the policy term) and is calculated based on several factors: Outstanding The Home Protection Scheme (HPS) charges a level premium rate (i.e. same amount annually throughout the policy term). This means that you pay the same annual

- Singapore Home Protection Scheme Guide

- CPF Home Protection Scheme

- CPF Home Protection Scheme: Ensuring Mortgage Security

The Home Protection Scheme (HPS) is a mortgage-reducing term insurance administered by the CPF Board. It protects families from losing their You can check and view the Home Protection Scheme premium deduction from your CPF Ordinary Account via my cpf Online Services – My Statement. The widow of a taxi driver faulted the CPF Home Protection Scheme in late September for failing to cover her husband even though he had been prompt in paying his

The CPF Home Protection Scheme (CPF HPS) protects CPF members and their families from losing their HDB flat in the event of death, terminal illness or total permanent

FAQs How do I terminate my Home Protection Scheme cover? You can terminate your Home Protection Scheme (HPS) cover online using your Singpass. Ensure that the below Home Protection Scheme premiums cannot be paid by instalments. The premium is structured to be paid in full at the beginning of each policy year so that the scheme remains

CPF Home Protection Scheme: Ensuring Mortgage Security

CPF Home Protection Scheme is a government-backed insurance scheme that aims to provide homeowners with adequate protection against unforeseen circumstances that may affect their

The widow of a taxi driver faulted the CPF Home Protection Scheme in late September for failing to cover her husband even though he had been prompt in paying his

CPF members who own a HDB flat and are HPS policyholders paying their monthly housing instalments using CPF savings or cash are eligible to apply for HPS FAQs How do I pay the Home Protection Scheme premium? Home Protection Scheme (HPS) premium is automatically deducted from your CPF Ordinary Account (OA)

Your eligibility for a Home Protection Scheme cover depends on the type of property owned.

Eligibility Criteria For Cpf Home Protection Scheme

CPF Home Protection Scheme is a mortgage insurance scheme that is designed to protect homeowners in Singapore from financial difficulties that may arise due to unforeseen The timing to apply for exemption from the Home Protection Scheme (HPS) varies based on different scenarios. New home owners can apply after obtaining legal ownership and

From 26 May 2025, the Home Protection Scheme (HPS) expands to cover members with certain pre-existing health conditions that are not so severe, such as certain types of stroke and heart

You can make a cash top-up for your Home Protection Scheme (HPS) premium via the following means: PayNow at CPF website, or Cash at any Singapore Post branch If you are using CPF for your monthly housing instalments, you can apply to be exempted from the Home Protection Scheme (HPS). Furthermore, HPS only applies if you have a housing loan. What are Home Protection Scheme (HPS) exemptions? You can only be exempt from the Home Protection

The Home Protection Scheme charges a level premium rate and is calculated based on several factors. FAQs How long does it take to process the applications relating to Home Protection Scheme? Please refer to the table for our service standards for processing

If you have recently submitted an online application for a Home Protection Scheme (HPS) cover (Ref: HPS/45) via the CPF website, you can check the status of your

The process to apply to be insured under Home Protection Scheme depends on whether you are taking an HDB loan or a bank loan.

- Cover Story: Eric Nam Brings His Sound To India

- Cra Audit Assistance , CRA Audit Support in Calgary

- Crea Un Diagrama De Flujo De Procesos Gratis

- Creación De Diapositivas Con Programas Online Como Prezi

- Cpu For Stellaris _ Upgrading PC for late game Stellaris

- Crash Kmode_Exception_Not_Handled In Windows 8.1

- Couteaux Suisse Swiza | Comparaison des couteau suisse swiza

- Create Xml File In Php Using Domdocument

- Cream Bases L Products For Therapy, Spa

- Could Panic Buying Trigger A Stock Market Crash?