Countries Developing A Central Bank Digital Currency

Di: Ava

Abstract and Figures This paper delves into the evolving landscape of Central Bank Digital Currencies (CBDCs) with a focus on the strategies and developments in China, the United States, and Sweden. After several years of exploring the possibility of introducing a digital currency in Canada, the central bank is shelving the idea. The Bank of Canada confirmed to CBC News it has shifted its Discover the current status of Central Bank Digital Currencies (CBDCs) worldwide and their potential impact on global finance.

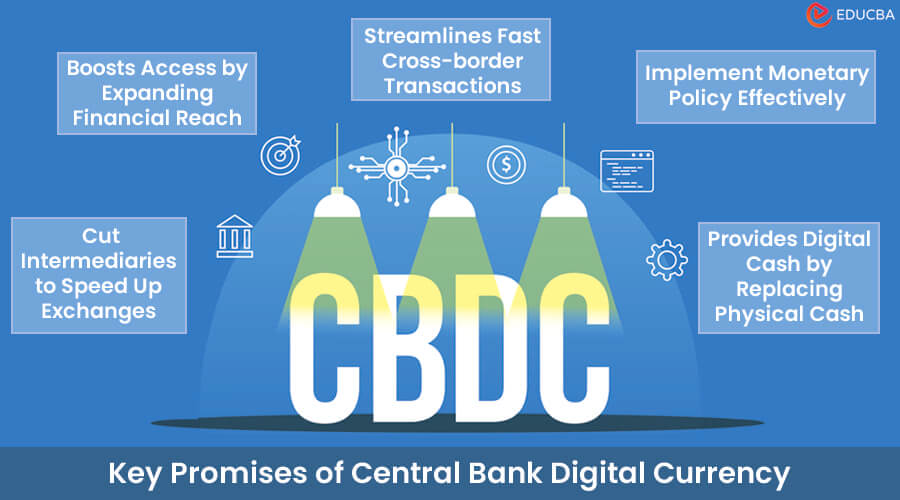

In simple terms, a central bank digital currency would be a digital banknote. It could be used by individuals to pay businesses, shops or each other (a retail However, the shift toward digital currencies is already underway. Central banks are exploring the development of CBDCs, while Digital currency (digital money, electronic money or electronic currency) is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. Types of digital currencies include cryptocurrency, virtual currency and central bank digital currency.

Central bank digital currencies are being talked about all over the world — CMC breaks down what exactly each country is doing (or not doing!) with their CBDCs.

What are central bank digital currencies?

As the world is becoming more digital, central banks are exploring the possibility of issuing their own digital currencies. How would we use CBDCs in everyday commerce? Central Bank Digital Currencies (CBDCs) mark a significant evolution in digital finance. This study examines the factors influencing CBDC adoption, highlighting the roles of regulatory quality and digital financial access. Financial inclusion is a key policy objective that central banks, especially those in emerging and low-income countries, are considering for retail CBDC. About 60 percent of emerging and low-income countries see financial inclusion as one of the top three motivations for issuing CBDC (Kosse and Mattei 2023). Globally, 1.4 billion people remain outside of the formal financial

The imminent arrivals of rich countries’ central bank digital currencies (CDBCs) and, even more pressing, Facebook’s digital currency are significant threats to developing countries’ payments syste However, given the many technical and policy challenges associated with CBDCs, developing countries may consider the potential of fast retail payment systems and improved auxiliary digital infrastructure to provide more rapidly available financial solutions.

Australia is to trial central bank digital currencies, while more than 100 countries are also exploring CBDCs. But what are they – and will they make cash obsolete? The chapter investigates the trends in Central Bank Digital Currencies (CBDCs) development and implementation around the globe, which is central banks’ response to the challenges of the financial sector digitalization. Based on a study of a host of empirical data, including data from the Bahamas, Nigeria and Jamaica, where CBDCs have been officially

Interest in developing their own central bank digital currencies remains strong among central banks worldwide, but so far, only three countries—The Bahamas, Nigeria and Jamaica—have followed through on releasing retail CBDCs. A few countries to watch for upcoming retail and/or wholesale CBDCs include China, Kazakhstan and Australia.

- IMF Approach to Central Bank Digital Currency Capacity Development

- Central bank digital currencies: An active role for commercial banks

- Central Bank Digital Currencies

- 9 Countries That Have Digital Currencies

China has been both active and cautious in developing a central bank digital currency (CBDC). China CBDC has been in research and development since 2014. The process speeded up in 2019. It is current India’s central bank, i.e., the RBI. In November and December of last year, the RBI launched a pilot project for digital rupees in the wholesale and retail sectors, respectively.India is neither the first nor the only country to launch an ambitious pilot project for its digital currency. This study attempts to explore the macroeconomic development factors that determine countries’ decisions to implement CBDCs. The study uses data regarding CBDC adoption and macroeconomic variables

The primary purpose of the research is to develop and validate a comprehensive scale for measuring the adoption of digital currencies, aiming to provi The global central banking community is actively exploring Central Bank Digital Currencies (CBDCs), which may have a fundamental impact on both domestic and international economic and financial stability. Over 40 countries have approached the IMF to request assistance through CBDC capacity development (CD). Current IMF CBDC CD efforts have Central Bank Digital Currency Tracker Our flagship Central Bank Digital Currency (CBDC) Tracker takes you inside the rapid evolution of money all over the world. The interactive database now tracks over 135 countries— triple the number of countries we first identified as being active in CBDC development in 2020.

Achieving Financial Inclusion Through Digital Currencies

Frequently Asked Questions 1. What is a central bank digital currency (CBDC)? A CBDC is a digital form of central bank money that is widely available to the general public. „Central bank money“ refers to money that is a liability of the central bank. In the United States, there are currently two types of central bank money: physical currency issued by the Federal • Central banks worldwide, including those in the Bahamas, China, India, Russia, and the United States, are actively developing or exploring central bank digital currencies (CBDCs). • It is imperative to understand the CBDC adoption challenges faced by countries.

In this paper, we develop a model incorporating the impact of financial inclusion to study the implications of introducing a retail central bank digital currency (CBDC). CBDCs in developing countries (unlike in advanced countries) have the potential to bank large unbanked populations and boost financial inclusion which can increase overall lending and reduce bank The Atlantic Council’s latest report shows that 134 countries, representing 98% of the global economy, are now exploring central bank

- CBDC: What is CBDC and Which Countries Will Use It?

- The Status of Central Bank Digital Currencies in 2024

- Achieving Financial Inclusion Through Digital Currencies

- Recent Global Trends in CBDC Development

- Central Bank Digital Currencies in 2024

Roughly 90 percent of the world’s central banks are pursuing central bank digital currency (CBDC) projects.1 Some, including those in the United States and South Africa, are at the exploratory phase; others are development projects (the European Union) and pilots (China). In some locations, including Nigeria and the Bahamas, solutions are already operable, and central Governments across the globe have begun to explore the merits of digital currency and the utility of central bank digital currencies (CBDC) in particular.

Over 130 countries are now deciding whether to launch a central bank digital currency CBDCs have already launched in China, India, Nigeria, and across The Caribbean They’re a digital form of coins and banknotes, often based on top of blockchains Potential benefits include faster and cheaper

Project mBridge reached the minimum viable product (MVP) stage in mid-2024. The project aimed to explore a multi-central bank digital currency (CBDC) platform shared among participating central banks and commercial banks, built on distributed ledger technology (DLT) to enable instant cross-border payments and settlement. Project mBridge was the result of

Central Bank Digital Currencies: 4 Questions and Answers

An overview of Central Bank Digital Currencies (CBDCs) in 2024 along with initiatives by countries, statistics, and their impact. A CBDC is a central bank-backed digital currency issued and authorized by the central bank of a country. Nearly 114 countries are currently

To keep abreast of the opportunities surrounding these changes, many central banks are actively experimenting with the idea of issuing digital versions of national currency, in the form of central bank digital currencies (CBDCs).

Let me start by thanking the Atlantic Council for providing a fitting venue to discuss central banks’ forays into Digital Currencies. Since its founding in 1961, the Council has made important contributions to strategic, political, and economic policy debates. Those debates have served us well The IMF also is publishing new chapters of our CBDC handbook, guided by specific country capacity development questions on evaluating the Explore Central bank digital currency evolution in 2023, including key developments from central banks and what is next for the digital euro.

Executive Summary The purpose of this Technical Paper is to garner a more robust understanding of the potential macroeconomic impacts and related regulatory challenges of central bank digital currencies (CBDCs) and other digital currency initiatives on developing countries. This paper begins from a point of recognition that the landscape of digital currencies, This chart shows the number of countries/currency unions with central bank digital currencies in advanced exploration phases.

CBDC: What is CBDC and Which Countries Will Use It?

- Courgette : Recettes De Courgette

- Counting Crows Albums Ranked _ counting crows discography

- The Most Common Flags In /Proc/Cpuinfo With Examples

- Countries That Eat Dog _ A brief list of countries which eat dog meat the most

- Costumbres Y Tradiciones Suizas En La Etiqueta Comercial

- Covid-19: Us To Advise Against Travel To 80% Of Countries

- Could We Light Jupiter Into A Star With A 500 Megaton Nuke?

- Coulomb Energy Of Α – Rutherford scattering experiments

- Countries By Car Manufacturers Logo Quiz

- Crackling In Ear: Causes, Symptoms And Treatment

- Corvette C3 In Mecklenburg-Vorpommern

- Cour Suprême De Cassation — Wikipédia