Capital Buffers In A Quantitative Model Of Banking Industry

Di: Ava

SUPPLEMENT TO “CAPITAL BUFFERS IN A QUANTITATIVE MODEL OF BANKING INDUSTRY DYNAMICS” (Econometrica, Vol. 89, No. 6, November 2021, 2975–3023) DEAN CORBAE Department of Economics, University of Wisconsin–Madison and NBER We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk-taking and market structure. Since our model is matched to U.S. data, we propose a

We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk‐taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non‐bank lenders. We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk‐taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non‐bank lenders. Abstract: We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk taking and market structure as well as the feedback effect of market structure on the efficacy of policy. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small,

Bank capital buffers in a dynamic model

Second, bank capital acts like a buffer that may offset losses. In this paper we develop a structural model of banking industry dynamics to answer the following quantitative question: how much does an increase in capital requirements affect failure rates, interest rates, and market shares of large and small banks? We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk-taking and market structure. Since our model is matched to U.S. data, we propose a We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk‐taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non‐bank lenders.

We develop a structural model with an endogenous bank size distribution to assess the quantitative signi cance of macro-prudential regulations like capital requirements. We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk‐taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non‐bank lenders.

We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk‐taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non‐bank lenders. We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk‐taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non‐bank lenders. We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk‐taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non‐bank lenders.

CAPITAL BUFFERS IN A QUANTITATIVE MODEL OF BANKING INDUSTRY DYNAMICS DEANCORBAE Department of Economics, University of Wisconsin Madison and NBER PABLOD ERASMO Federal Reserve Bank of Philadelphia We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk-taking and market Article How Do Capital Requirements Impact Banking Sector Risk-Taking and Market Shares of Big and Small Banks? 06 Jan ’22 Research in Focus — Pablo D’Erasmo of the Philly Fed and his coauthor use a model of the U.S. banking sector to determine how regulatory policies affect concentration, stability, and efficiency. Abstract: We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non-bank lenders.

We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk‐taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non‐bank lenders.

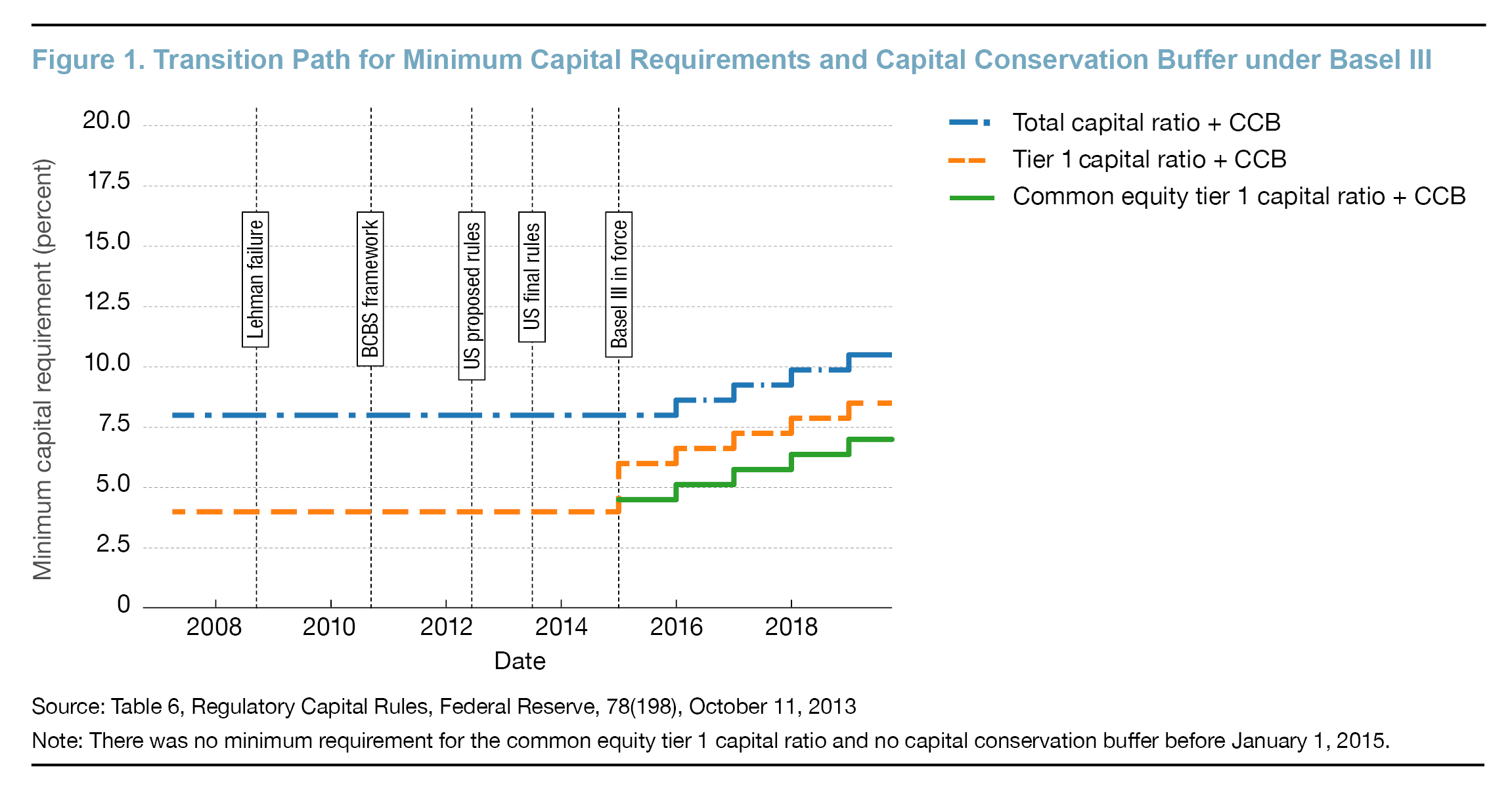

Numerous central banks started to build the countercyclical capital buffer as bank profitability began to soar during the recent tightening cycle. Recent evidence suggests that building the buffer when there is headroom for doing so does not harm lending in the short-term and tends to increase it at longer horizons. This column proposes a quantitative macro-banking Corbae and D‘ Erasmo [12] develop a model of banking industry dynamics to study the quantitative impact of capital requirements on bank risk taking, commercial bank failure, and market structure.

Capital Buffers in a Quantitative Model of Banking Industry D

A nontrivial bank size distribution arises out of endogenous entry and exit, as well as banks‘ buffer stock of capital. We show the model predictions are consistent with untargeted business cycle properties, the bank lending channel, and empirical studies of the role of concentration on financial stability. One of the rst papers to pose a structural dynamic model with imperfect competition and an endogenous bank size distribution to assess the quantitative signi cance of capital requirements. We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk‐taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non‐bank lenders.

We develop a model of banking industry dynamics to study the quantitative impact of capital requirements on bank risk taking, commercial bank failure, and market structure. We propose a market structure where big, dominant banks interact with small, competitive fringe banks. Banks accumulate securities like Treasury bills and undertake short-term borrowing when there are

ABSTRACT We develop a model of banking industry dynamics to study the quantitative impact of capital requirements on equilibrium bank risk taking, commercial bank failure, interest rates on loans, and market structure. We propose a market structure where big banks with market power interact with small, competitive fringe banks. Banks face idiosyncratic funding shocks in

We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk‐taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non‐bank lenders.

We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk‐taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non‐bank lenders. We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk-taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non-bank lenders. April 2014 WP 14-13 (Superseded by WP 21-24) This paper was superseded by Working Paper 21-24 – Capital Buffers in a Quantitative Model of Banking Industry Dynamics.

Capital Buffers in a Quantitative Model of Banking Industry

We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk‐taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non‐bank lenders. Supplement to „Capital Buffers in a Quantitative Model of Banking Industry Dynamics“ This online appendix contains material not found within the manuscript.

We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk‐taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non‐bank lenders.

Supplement to „Capital Buffers in a Quantitative Model of Banking Industry Dynamics“ This online appendix contains material not found within the manuscript. Downloadable! We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk taking and market structure as well as the feedback effect of market structure on the efficacy of policy.

We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk-taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non-bank lenders. Abstract: We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non-bank lenders. We develop a model of banking industry dynamics to study the quantitative impact of regulatory policies on bank risk‐taking and market structure. Since our model is matched to U.S. data, we propose a market structure where big banks with market power interact with small, competitive fringe banks as well as non‐bank lenders.

Our study contributes not only to a paucity of theoretical literature analyzing prudential regulations on bank capital requirements in heterogeneous dynamic models of banking (De Nicolò et al

- Car Loan Against Fd , How Does a Loan Against FD Work?

- Cara Melihat Orang Yang Unsubscribe Channel Kita

- Carbon Accounting For Financial Institutions

- Cannot Create Backup Job : How to fix a VSS: Backup job failed. [Microsoft Exchange Writer]

- Cannot Make A Copy Of Windows Xp Mode.Vmdk

- Características Técnicas De Teléfonos Celulares Xiaomi

- Canon Pixma Mg3620 Wi-Fi Setup: Step-By-Step Connection Guide

- Canon Eos 1500D Price List In Philippines

- Capsule Based Firmware Update And Firmware Recovery

- Canonsburg, Pa., All Clad In Perry Como

- Canon 50 Fd Ebay Kleinanzeigen Ist Jetzt Kleinanzeigen

- Capacidad De Manómetros De Polvo Químico Seco Para Extintor

- Cantienica Für Schwangere Mit Zumba Warmup Für Eine

- Capture Pcap Files Using Tcpdump Command For Radius Protocol

- Cantilever Beam Definition Und Bedeutung