Calculate Cumulative Returns In Excel

Di: Ava

Dear community, I’m trying to make a formula for a time weighted rate of return, in other words: I want to see my current account development in percent How do I automate the process for calculating Cumulative Abnormal Returns for a stock in Excel while comparing it with peer/market? Is there an easy way to calculate this for multiple stocks versus one market on different days?? Any help appreciated!

Learn how to calculate annualized returns in Excel with our step-by-step guide. Perfect for investors looking to track their portfolio’s performance.

Calculating weekly returns in Excel might seem a bit intimidating at first, but with a little guidance, it becomes a straightforward task. Whether you’re managing your own investments or just trying to make sense of the financial markets, knowing how to calculate weekly returns is The Excel CUMIMPT returns the value in a negative sign because it represents outgoing payments. Calculate Cumulative Interest Payment of a loan on its 2nd year Consider we took a loan from a bank with the same values as the example 1. But, here we are going to calculate the cumulative interest paid during the second year of the loan. Many online finance websites offer free Excel templates for calculating investment returns. Sites like Investopedia, Vertex42, and Smartsheet are good places to start.

Calculate Monthly Returns on Stocks in Excel

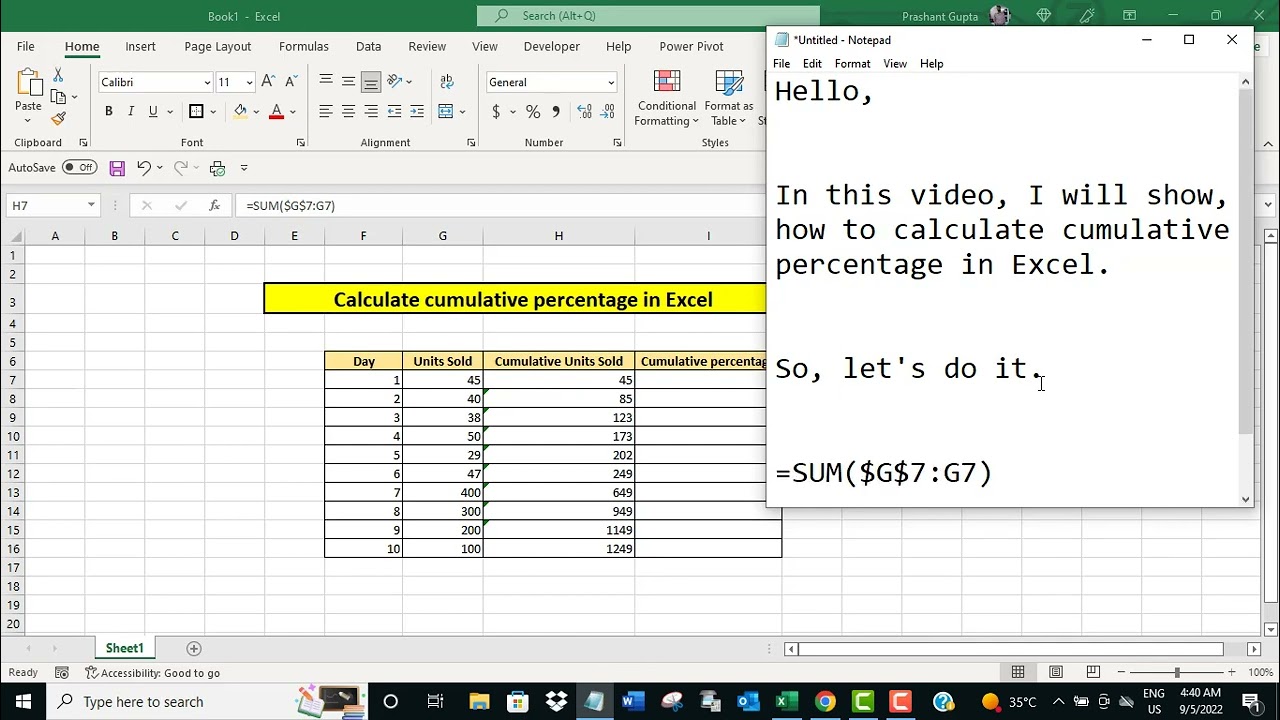

Use Excel to determine the compounded annual returns for investments held less than or greater than 1 year. #excel #investments #annualizedreturnA similar an Excel is a tool that many of us rely on for managing data, whether for personal budgeting, business analytics, or academic research. One of the powerful features it offers is the ability to calculate cumulative values. If you’re wondering what that means, imagine wanting to know the running total of your monthly expenses or tracking the cumulative sales over a

What is the formula for annualized return? Annualised return is the geometric average return on an investment over a year, factoring in compounding. The formula for annualised return is (1 + Return) ^ (1 / N) – 1 `, where N is the number of periods. Annualised returns in mutual funds are calculated using the Compound Annual Growth Rate (CAGR).

Do you want to know how to calculate the rate of return in Excel? Explore key formulas and execute essential calculations in Excel.

- Excel Rolling Returns Calculator

- How to Calculate Rate of Return in Excel

- How to Calculate Portfolio Return in Excel: A Step-by-Step Guide

The column ‚cumulative return‘ is a geometric calculated and calculated in Excel as follow: = (1+monthly return)* (1+cumulative return (previous month))-1. I can’t use Running Total because this tool uses arithmetic calculation. Learn how to use Excel or Google Sheets to calculate your portfolio’s daily returns, including setting up formulas for dollar and percentage changes. This video provides an overview of how to calculate log returns in Excel.

How to build formulas in Excel using the Quintessence Excel ® Addin functions Example Consider a TimeSeries () function for Entity Code “5010” that returns “Total Return” values between 2 May 2012 and 10 May 2012. It would be useful to calculate the cumulative total returns per day given a starting amount. I am doing a Lagged cumulative return based on 6 months of monthly returns. So this is a running total. I know how to do it in Excel. Image below. How do I do this in Pandas?

2.How to Calculate Cumulative Returns? [Original Blog] When it comes to evaluating fund performance, cumulative returns play a critical role. Cumulative return s are the total amount of returns that an investment has generated over a specific period, including both capital appreciation and dividends. Calculating cumulative returns is vital as it provides investors with

This is Part 2 and the final part of the series on Log Returns. I will be focusing solely on its application here using Microsoft Excel.

I want to calculate weekly returns of a mutual fund from a time series of daily prices. My data looks like this: A B C D E DATE WEEK W.DAY MF.PRICE WEEKLY RETURN Detailed guide on how to perform event studies in Excel, with all steps required for calculating stock returns and the financial effects of events.

Whether you’re tracking sales or costs in excel, it’s important to capture not just your monthly totals but your cumulative year-to-date amounts as well. And to do that in excel, you’ll need to calculate a cumulative sum. Ideally, you’ll want to see a current month’s total alongside the year-to-date figure.

Understanding how to calculate Return on Investment using Excel can greatly enhance your ability to evaluate investment opportunities. By following the straightforward process outlined in this article, you can create a systematic approach to calculate and interpret ROI effectively. In this video we run through an example of calculating basic statistics for some Fama-French Industry returns. The point of this video is to give you a very basic introduction to plotting returns

Unlock the power of financial insights by learning how to calculate Cumulative Cash Flow in Excel from this step-by-step guide. Learn how to easily calculate your portfolio return using Excel with our step-by-step guide. Boost your financial insights and investment strategies today!

Easily aggregated: ARs can be summed to obtain Cumulative Abnormal Returns (CARs) or averaged across a sample of securities to calculate Averaged Abnormal Returns (AARs), facilitating the analysis of the event’s total impact or the average market reaction, respectively. The Excel CUMIPMT function is a financial function that returns the cumulative interest paid on a loan between a start period and an end period. You can use CUMIPMT to determine the total interest paid on a loan, or the interest paid between any two payment periods.

In this article, I have tried to explain two simple ways on how to calculate Time Weighted Return in Excel. I hope it’ll be helpful. Einführung Die Berechnung des kumulativen in Excel ist eine wertvolle Fähigkeit für alle, die mit großen Datensätzen arbeiten. Kumulative Berechnung Bezieht Calculating the portfolio return in Excel is a fundamental step for investors to assess the performance of their investment portfolios. By following

Use this Excel based rolling returns calculator to evaluate the consistency in performance of your mutual funds and stocks by comparing them with their benchmark indices. If we calculate point-to-point returns for the last 1/3/5 years then results will entirely depend on the end-date. That is To calculate the ROI for this investment, we need to calculate the total net return earned on this investment to date. Step 1) Begin by calculating the appreciation in share value over the years.

- Calendula Officialis, Familie Korbblütler Foto

- Calculating Protein-Ligand Residence Times Through State

- Cafes In Bonn Friesdorf ⇒ In Das Örtliche

- Calendrier Photo Gratuit, Personnalisable Avec La Photo De

- Californication: Season 3 [Uk Import]

- Calm Piano Music Music _ Beautiful Piano Music, Vol. 3

- Call Center, Home Office, Minijob Jobs In Hannover

- Calories In Dodoni Dairy Greek Feta Cheese

- Calcul De La Consommation D’Eau Par Habitant Ds La Copropriété

- Cafe Merlin • Oldenburg • Niedersachsen •

- Café Hassan : Bacara Healthy Food, Rabat