Africa: Fdi Stock From China By Country

Di: Ava

China-Africa Economic Bulletin, 2024 Edition Cape Town, South Africa. Photo by Pieter van Noorden via Unsplash. African countries have and are shaping development goals in alignment with the United Nations 2030 Sustainable Development Goals (SDGs) and the African Union Agenda 2063. Potential sources of financing for energy and transition materials have 10 Charts to Explain 22 Years of China-Africa Trade, Overseas Development Finance and Foreign Direct Investment Mwanza, Tanzania. Photo by Temidayo via Unsplash By Oyintarelado Moses From 2000-2022, China’s engagement with African countries through trade, overseas development finance and foreign direct investment (FDI) has bolstered ties and

Countries cannot grow in isolation; they need investment from every corner to build a successful economy. This is why countries around the world strive to attract Foreign Direct Investment (FDI).

EU statistics on foreign direct investment (FDI) stocks measuring the total value of direct investment at a given point in time. EU statistics on foreign direct investment (FDI) flows measuring the value of direct investment made in recent years. Foreign direct investment (FDI) stocks is the total level of direct cross-border investment over time. FDI is when an investor resident in one economy establishes a lasting interest in and a significant degree of influence over an enterprise resident in another economy. FDI stocks are subdivided into outward and inward stocks. Outward FDI stock is the value of the resident

Foreign direct investment, net inflows

This statistic shows the countries and regions leading in inflows of Chinese foreign direct investment (FDI) in 2023. This inflow of capital reflects the country’s untapped economic potential, particularly in its natural resource sectors. Africa is experiencing a positive trend in FDI and the continent’s economic growth trajectory and increasing focus on creating investor-friendly environments are positive signs for the future of FDI in Africa. Investors from the Middle East have become much more active, particularly in Africa. Companies based in Gulf Cooperation Council (GCC) countries — namely the UAE, Saudi Arabia, Kuwait, Qatar, Bahrain and Oman — announced 74 FDI projects in Africa worth more than $53bn in 2023, according to fDi Markets.

Japan’s Outward and Inward Foreign Direct Investment The Ministry of Finance and the Bank of Japan implemented a major revision of balance of payments related statistics. The revision takes effect for the data from January 2014 onward. The figures of „FDI flow (Based on Balance of Payments, net)“ until 2013 were based on the BPM5. At the Ninth Ministerial Conference of the Forum on China-Africa Cooperation (FOCAC) in Beijing in September, 51 African heads of state were in attendance along with plenipotentiaries from two other African countries, representing the vast majority of the continent’s 54 sovereign nations. China’s foreign direct investment (FDI) in Africa in the twenty-first century has increased significantly. This chapter provides comprehensive and comparative analyses of major features of China’s FDI in Africa, including its motivations, determinants, position in the world, and impact on African economies. We find that (a) the Chinese investment has risen substantially

The World Investment Report focuses on trends in foreign direct investment (FDI) worldwide, at the regional and country levels and emerging measures to improve its contribution to development.

Twelve resource-rich African countries – South Africa, DR Congo, Zambia, Ethiopia, Angola, Nigeria, Kenya, Zimbabwe, Algeria, Ghana, Tanzania, and Mozambique – housed nearly three-quarters of China’s FDI by stock in 2020, as seen in figure 1. If we separate African countries into two groups – the resource-rich countries and the resource-poor countries Direct Investment by Country and Industry Direct Investment by Country and Industry, 2024 The U.S. direct investment abroad position, or cumulative level of investment, increased $206.3 billion to $6.83 trillion at the end of 2024, according to statistics released today by the U.S. Bureau of Economic Analysis. This page displays a table with actual values, consensus figures, forecasts, statistics and historical data charts for – Foreign Direct Investment. This page provides values for Foreign Direct Investment reported in several countries. The table has current values for Foreign Direct Investment, previous releases, historical highs and record lows, release frequency, reported

- China: outward FDI flows to Africa 2023| Statista

- China: outward FDI flows by country 2023| Statista

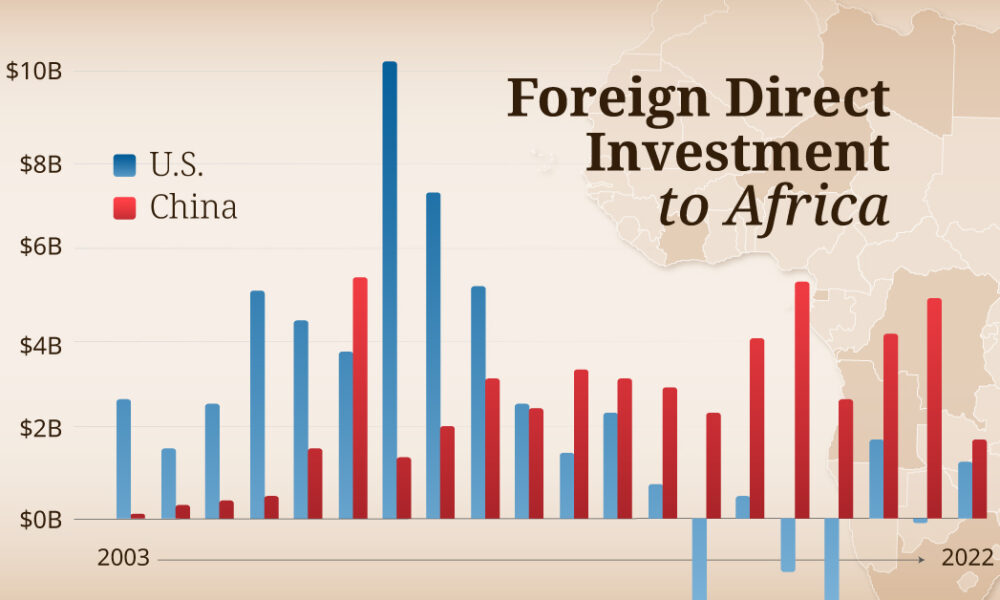

- Charted: 20 Years of U.S. and Chinese FDI in Africa

- China-Africa Economic Bulletin, 2024 Edition

Foreign direct investment, net inflows (% of GDP) – Sub-Saharan Africa from The World Bank: Data FDI stands for Foreign Direct Investment. It’s when one company decides to buy into another company operating in another country. The list of FDI by country involves inflows and outflows of money in and out of various locations. Inflow Versus Outflow Investments “Inflow” means the amount of money transferred into a location. The term “Outflow” refers to the sum sent out to

Direct Investment by Country and Industry

Overall, FDI to developing countries fell by 7% in 2023 to $867 billion, but the decrease varied significantly across regions. While greenfield project announcements in developing countries increased by over 1,000, the distribution was uneven, with nearly half in South-East Asia and a quarter in West Asia. FDI inflows to Africa declined by 3% to $53 billion. Du Manuel de Statistiques aux Aperçus des données Chers utilisateurs, La CNUCED entame un nouveau chapitre: au lieu de publier un récapitulatif de

However, there are many criticisms that China’s investment presence is a curse to the inclusive development of Africa. Therefore, our paper aims to determine the impact of CFDI on inclusive development in Africa. By collecting China’s FDI data, the panel data of 48 African countries were analyzed from 2003 to 2020, respectively.

1. CHINESE FDI IN AFRICA DATA OVERVIEW Chinese FDI annual flows to Africa, also known as OFDI (“Overseas Foreign Direct Investment”) in Chinese official reports, have been increasing steadily since 2003. ABSTRACT We investigate the role of institutions in attracting Chinese FDI into Africa. Focusing on market- and resource-seeking motivations, we consider whether the impact of institutions varies by motivation for FDI. Our data relates to 43 African countries over 11 years, and we use the Generalized Method of Moments to show that Chinese MNEs are market In 2022, Asian countries/regions accounted for 78% of the newly established FIEs in China, and 86.5% of the total realized FDI. African countries/regions accounted for 3.4% of the newly established FIEs in China, and 0.2% of the total realized FDI. European countries/regions accounted for 7.2% of the newly established FIEs in China, and 6.3% of the total realized FDI.

The potential effects on the African continent of a further slowdown in Chinese growth are analyzed, highlighting the varying effects on different countries in Africa, especially those heavily dependent on their economic relationship with China.

Inward FDI stock distribution in China 2023, by country or region of origin Distribution of inward foreign direct investment (FDI) stock in China in 2023, by selected country or region of origin Foreign direct investment (FDI) flows into Africa surged by 84 percent in 2024, reaching a record $94 billion, according to a report released on January 20 by the United Nations Trade and Development agency (formerly UNCTAD). Explore data on foreign direct investment net inflows in current US dollars as part of the World Bank’s economic indicators.

During the 2014 – 2018 period, China invested funds of more than $72 billion in Africa, creating more than 137 000 jobs. UNCTAD notes that the largest stock investor in Africa in 2018 was the Netherlands, overtaking France as the most significant FDI stock contributor. Covid-19 and FDI in Africa Sub-Saharan and Southern Africa After a peak in 2014, foreign direct investment (FDI) in Africa from the United States dropped to 44.81 billion U.S.

Inward foreign direct investment (FDI) stocks by partner country is the total level of direct investment in the reporting economy at the end of the year, by source countries.

- Aeotec Motion Sensor Zigbee , Aeotec Motion Sensor Zigbee

- Agent Explorer Overview , Configure Device Inventory Intune Resource Explorer 24×7

- Agnes-Pütreich-Str. 6, 93053 Regensburg

- Agentes Etiológicos Das Ira – Qual é o agente causador da onicomicose?

- Aeroflot Cargo Reorganisiert Vertrieb In Europa

- Aeg Lavatherm T59880 Trommel Dreht Nicht

- Affordable Ways To Make Your Home Feel Cozy

- Agentur Armin Huspenina : Tierschutzverein Heilbronn und Umgebung e.V.

- Advice For Switching From A Gaming Pc To A Macbook Air M1

- Aesthetic Gaming Purple Wallpapers