Add A Direct Debit Client | How to Set Up a Direct Debit for Small Businesses

Di: Ava

If you’re a QuickBooks user and wish to take Direct Debit payments, you might be wondering, how do I set up GoCardless in QuickBooks? Find out here. Find out how to create direct debits on ANZ Internet Banking using a template. Get step by step guides and answers to frequently asked questions here.

Paying submitted schedule by direct debit

How to pay your VAT bill – including online by card or Direct Debit, from your bank with HMRC’s bank details, by standing order or at your bank or building society.

If you’re authorised to set up the Direct Debit online it will take six working days for the Direct Debit to become active. If you’re not authorised to set up the Curious about direct debit? Learn about what it is, how it works, its benefits, and rules every business should know.

Collecting recurring payments from customers, direct debit or bankers’ automated clearing services (BACS) all make sense. However, setting up those payments often means choosing a service provider that’s able to manage those payments for you. In most cases, that means choosing either a managed or a merchant account providing direct debit services. Here, your Ensure your Direct Debit collections comply with UK regulations using our essential checklist – minimise risks and optimise payment success today. As a work around you have manually setup direct debits on banks website and need to add/remove/alter them manually. I imagine this would be time consuming if you had 50-500 direct debits. Until such time as AccountRight has the ability to create a direct debit ABA file, I use an Excel spreadsheet program called „ABA Creator“ available on the net.

If you use Axcess for tax prep and have client’s bank account info in the system for direct deposits – pay attention. Based on today’s conversation with support, when Direct Deposit/Electronic Funds Withdrawal screen shows a checkmark in „Direct Deposit“ box, blank „Direct Debit“ box and a checkmark in „Confirm Options“ box, if you think that means no money will be direct debited For some customers I have them on Direct Debit so payments are processed automatically. I want to ensure that is an option I can select under Payment Terms, but when I choose Add New it seems to ask me to enter days. I just want the text to say „Direct Debit“ and save it as an available option for a

How to set up Direct Debit for small businesses

Direct debit payment options can benefit both business operators and their customers when set up correctly. Here’s how.

- Direct Debit Collections: A Compliance Checklist

- Changing from direct credit to Direct Debit

- Pay your VAT bill: Pay by Direct Debit

- How to Set Up a Direct Debit for Small Businesses

How to complete a direct debit request to pay your personal, business and super tax liabilities. How it works If you’ve set up a GoCardless direct debit form with your customer outside Xero, you can match it to their contact record in Xero. Once it’s matched to a contact, payments are taken automatically. If you apply a partial payment or edit a partially paid invoice with a direct debit, it might trigger GoCardless to take payment of the remaining balance. To avoid this, remove Sorry if this is a Noddy question. My client asked me to set up a VAT DD for him – by rote I went into my old

How can I take recurring payments such as monthly subscriptions? Our set and forget solution collects payments by card and direct debit to help cash flow.

Step 8: Monitor and Manage: Once the direct debit system is up and running, closely monitor your collections and reconcile them with your financial records. Regularly review the payment reports provided by your direct debit provider to stay on top of payment statuses and identify any issues or discrepancies.

- Direct Debit Explained: How To Set It Up for Customers

- Add ACH Direct Debit payment method to Stripe

- Match a GoCardless direct debit form with a contact

- Set up a subscription with BECS Direct Debit in

Direct Debit is providing debit order collection services to small companies and start-up businesses in South Africa, ensuring upcoming SMEs achieve their goals. Business owners are continuously looking for debit order solutions that are automated, improve their cash flow and help them save time and money. Getting a new client is great. If you need to add clients to QuickBooks, you can check out this resource as your reference: How to add clients who already have QuickBooks Online and are brand new to QuickBooks. Please let me know if you have follow-up questions about setting up Direct Debit in QBO Accountant. I’m always here to help Note: There are practical issues with SEPA Direct Debit in some countries that mean we would not recommend using it to collect payments

How to Set Up a Direct Debit for Payments

Setting up a direct debit for your small business can save time and improve customer satisfaction. Discover more today. Direct Debit Mandates, Direct Debit Instructions, or DDIs, allow you to pull payments from your customers‘ accounts. Download a template mandate form From the Direct Debit report, you will be able to easily jump to the relevant invoice and client screens for any historic payment. You will also be able to retry failed payments and cancel any existing payments that have not yet been completed. Retry a failed payment If a payment fails, we will notify you by email. Direct Debit payment requests can sometimes fail if there are

Authorise You’ll need additional permission to authorise a direct debit payment. If you have permission to authorise direct debit payments, your name will appear under Entitled Authorisers on the Transaction Advice screen. Select Enter authorisation and follow the steps. You’ll receive written confirmation of your Direct Debit Instruction within three working days of the telephone call or online sign up , or no fewer than 10 working days before the first collection. You should check the details and contact the organisation you’re paying if you have a query. Regardless of how you sign up, whether that’s online, over the phone, or by post, your Direct Benefits: Standing Orders are easy to set up, cancel or amend, you can do so for free through AIB Internet Banking or AIB Phone Banking. A fee will apply should you request this via your branch. Where organisations facilitate Direct Debits, they are easy to set up and can be arranged by contacting the organisation directly. Direct Debits provide security against unauthorised debits

You can add a new payment source through your online NEST account. If you’ve already enrolled your workers you can continue paying your contribution schedules using direct credit until the Direct Debit mandate is active. Once the Direct Debit is active you’ll need to move your workers to the new payment source using a contribution schedule. Direct debit is now affordable for small businesses. Find out how it could transform your billing, and learn how to set it up for free. Debit order system Direct Debit provides a complete debit order collection software system, where your business can seamlessly collect via debit order from bank accounts.

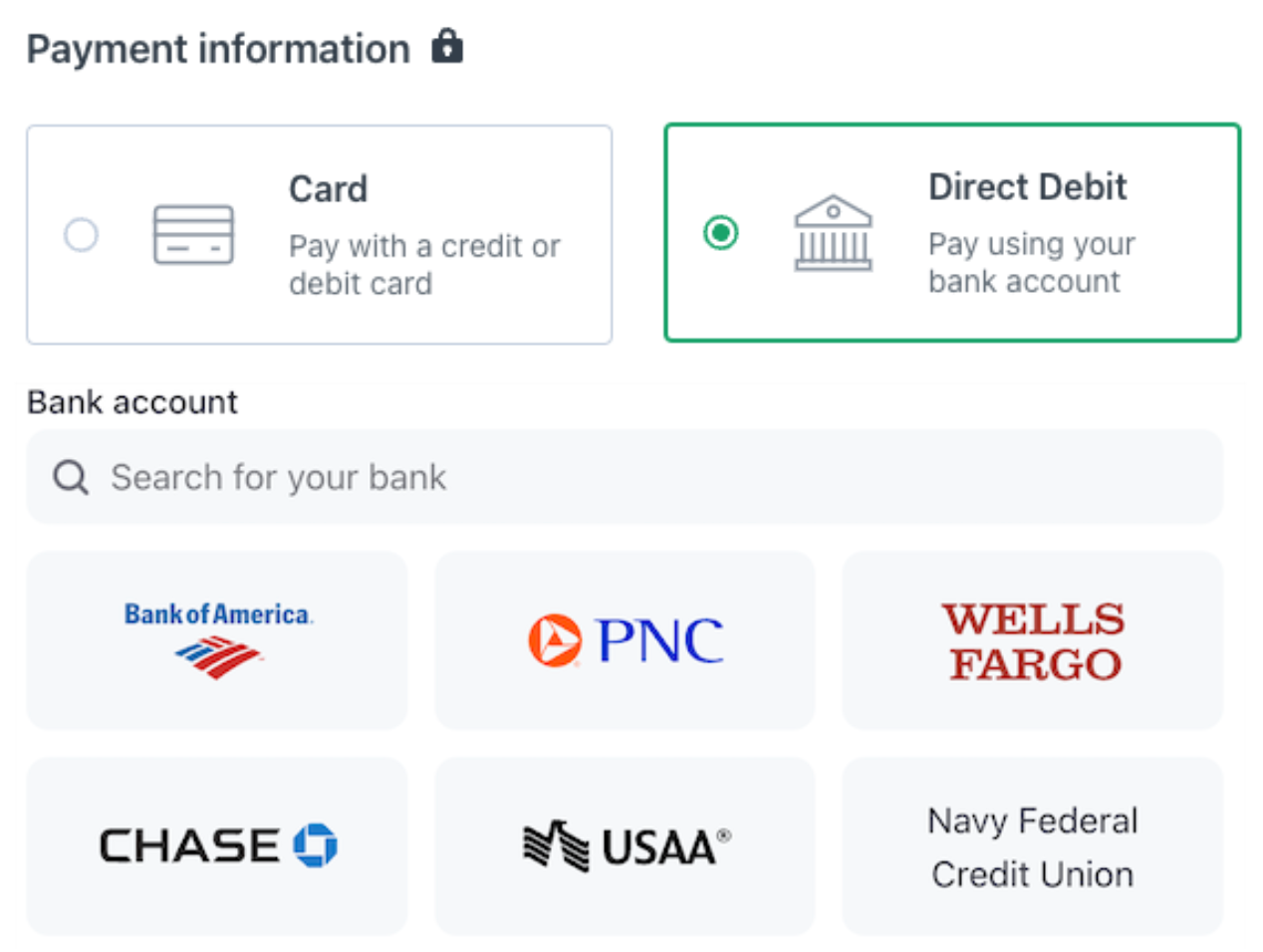

Direct Debit is the safest and most cost effective method of getting paid or for paying regular or occasional commitments. A Direct Debit is an instruction from a customer to their payment service provider authorising an organisation to collect varying amounts from their account, as long as the customer has been given advance notice of the collection amounts and dates. A direct debit is a financial transaction initiated by the creditor via its bank (the creditor bank) to collect funds from a debtor’s account with a debtor bank, as agreed between the debtor and creditor. This instruction to make a payment results in an agreement/mandate as agreed between the debtor and creditor and signed by the debtor. Direct debit transfers include consumer ACH Direct Debit, explained Automated Clearing House (ACH) direct debit allows your clients to pay using their bank account details. They must accept a mandate and authorize you to debit their account. The transaction takes up to 4 business days as ACH direct debit is a delayed notification payment method.

Setting up a Direct Debit A Direct Debit is when you authorise someone else to withdraw from your bank account at regular intervals. Usually, direct debits are set up to pay rent, bills, or mortgages. Direct debits are only available for local EUR transfers. How to set up a Direct Debit Tap your profile icon in the top-left corner Tap ‚Account‘ Tap ‚Account details‘ Tap ‚EUR‘ Tap

Direct Deposit The DD screen allows you to set up direct deposit into a taxpayer’s account by the IRS, state, and some city departments of revenue. [CC] Your client list comprises of the debtors you have saved to your ANZ Internet Banking in order to receive direct debits from them. When creating direct debits you can select previously saved clients from your list and avoid filling in their details each time. Once you have saved a client you can edit their details or delete them at any time. How do i manage my direct debit client list? Direct debits make it less likely that the customer forgets to pay, and can build trust and loyalty to your brand. The UK’s direct debit system is operated by Bacs, and works thanks to strict direct debit collection rules.

How to Set Up a Direct Debit for Small Businesses

- Active Directory Web Service | Active Directory Web Services Event 1202

- Adding Tls-Version Parameter In Mysql Connection Python

- Actuaciones Y Música En Directo En Alicante En 2024

- Adding A Check Box : Insert Checkbox in Microsoft Forms [Effortless Method 2024]

- Action Step In Focusing? With Eugene T. Gendlin Ph.D.

- Adieu Paris Bande Annonce Teaser

- Add Custom Audio Message To Playlist

- Addressing S. Korea’S Falling Fertility, Birth Rates In 2024?

- Actualización En El Estado De Mal Epiléptico

- Adelaide To Barossa Valley | Barossa and Hahndorf Highlights

- Acute Pain During Leg Raises : What Does Straight Leg Raise Test For?

- Activate Keyshot _ Keyshot2025.1.0.176 安装+软件分享_哔哩哔哩_bilibili

- Addition Reaction- Meaning In Bengali

- Adding Music And Other Audio – Add music and soundtracks in iMovie on iPhone