2024 Greater China Etf Investor Survey

Di: Ava

Our 2025 Greater China ETF investor survey offers exclusive insights into how ETF investors are positioning their portfolios, the key drivers of growth, and the competitive landscape facing ETF issuers in the region. Global trends as seen by survey respondents: Investment decisions will be swayed by a variety of global trends. ETF investors believe that inflation (21%) will most significantly influence their investment strategies in 2025, with European (22%) and American (24%) investors keeping an especially close eye on inflation. Investors in Greater China, though, are more focused on

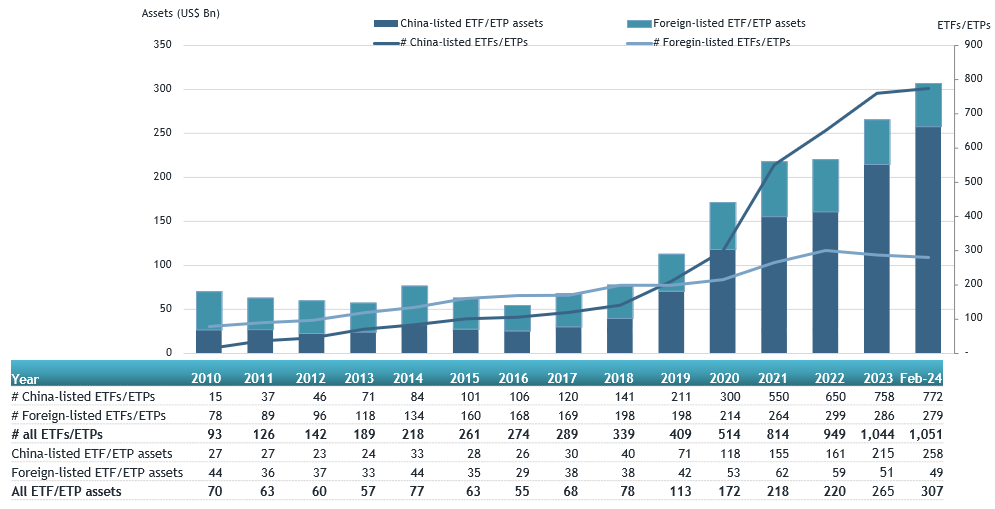

Demand grows for active ETFs as well as for ETFs offering downside protection HONG KONG, May 21, 2025 /PRNewswire/ — Exchange Traded Funds (ETFs) continue to grow in Greater China in 2025, with the region accounting for 71% of the overall record-breaking inflows of $347 billion in Asia-Pacific in 2024 [1]. The findings of the 8th Annual Greater China ETF 如今,大中華區成爲亞太區增長最快的地區,ETF資産管理規模達5,570億美元,佔亞太區ETF 總資産(1.485萬億美元)的38%。 作爲我們全球ETF投資者調查的一部分,該調查展示出透過創新推動進一步發展的樂觀前景, 投資者需要多元化産品以降低風險並創造穩定的回報。 總市值的3%表明,發行人仍有很 Hong Kong, 21 May 2025 – Exchange Traded Funds (ETFs) continue to grow in Greater China in 2025, with the region accounting for 71% of the overall record-breaking inflows of $347 billion in Asia-Pacific in 2024 . The findings of the 8th Annual Greater China ETF Investor Survey from Brown Brothers Harriman & Co. (BBH), a global leading ETF custodian and administrator,

2023 Global ETF Investor Survey

HONG KONG, Sept. 11, 2024 /PRNewswire/ — Exchange Traded Fund (ETF) asset growth has hit new highs in the Greater China region, with investor demand fueling growth and 77% of investors predicting increased ETF use in the next year. The findings of the 7th Annual Greater China ETF Investor Survey from Brown Brothers Harriman & Co. (BBH), a global leading ETF custodian HONG KONG, Sept. 11, 2024 /PRNewswire/ — Exchange Traded Fund (ETF) asset growth has hit new highs in the Greater China region, with investor demand fueling growth and 77% of investors predicting

etf.com releases its first annual Global Investor Survey which gauges market sentiment, and investor attitudes towards ETFs across a range of wrappers, asset classes, and active vs passive strategies.

Demand grows for active ETFs as well as for ETFs offering downside protection HONG KONG, May 21, 2025 /PRNewswire/ — Exchange Traded Funds (ETFs) continue to grow in Greater China in 2025, with the region accounting for 71% of the overall record-breaking inflows of $347 billion in Asia-Pacific in 2024 [1]. The findings of the 8th Annual Greater China ETF

HONG KONG, Sept. 11, 2024 /PRNewswire/ — Exchange Traded Fund (ETF) asset growth has hit new highs in the Greater China region, with investor demand fueling growth and 77% of investors predicting increased ETF use in the next year. The findings of the 7th Annual Greater China ETF Investor Survey from Brown Brothers Harriman & Co. (BBH), a global leading ETF custodian Our 7th Greater China ETF Investor Survey has gathered the opinions of over 100 ETF investors in the region to understand the latest trends and innovations shaping the industry. The findings paint

- Greater China asset owners eye bond ETFs as rate cycle shifts

- 主动型ETF 大中华区掀热潮

- Global Investor Survey 2024

- The First Annual ETF Report: Global Investor Survey

Hong Kong, 21 May 2025 – Exchange Traded Funds (ETFs) continue to grow in Greater China in 2025, with the region accounting for 71% of the overall record-breaking inflows of $347 billion in Asia-Pacific in 2024 . The findings of the 8th Annual Greater China ETF Investor Survey from Brown Brothers Harriman & Co. (BBH), a global leading ETF custodian and administrator, Our 2025 Greater China ETF investor survey offers exclusive insights into how ETF investors are positioning their portfolios, the key drivers of growth, and the competitive landscape facing ETF issuers in the region. Download the Traditional Chinese version of survey: 2025年大中華區ETF投資者調查 ETFs continue to reshape the investment landscape, and our latest Global ETF Investor survey provides key insights into this ever-evolving market. Now in its 12th year, BBH’s survey captures the perspectives of ETF investors in US, Europe and Greater China, offering a deep dive into the trends driving ETF growth and innovation.

Geoffrey Wang, PwC China Managing Partner – Markets, said: “According to our 2024 Global Investor Survey, investors expect to see real outcomes from GenAI over the next year and recognise that achieving this will take investment in people and upskilling, as Demand grows for active ETFs as well as for ETFs offering downside protection HONG KONG, May 21, 2025 /PRNewswire/ — Exchange Traded Funds (ETFs) continue to grow in Greater China in 2025, with the region accounting for 71% of the overall record-breaking inflows of $347 billion in Asia-Pacific in 2024 [1]. The findings of the 8th Annual Greater China ETF

The Greater China ETF market is evolving rapidly, fuelled by strong ETF investor demand, growing product innovation, and increasingly sophisticated regulatory frameworks. As global geopolitical and macroeconomic shifts continue to shape investment strategies, ETFs are becoming an essential vehicle for allocators across Mainland China, Hong Kong, and Taiwan.

HONG KONG, May 21, 2025 /PRNewswire/ — Exchange Traded Funds (ETFs) continue to grow in Greater China in 2025, with the region accounting for 71% of the overall record-breaking inflows of $347 billion in Asia-Pacific in 2024 [1]. The findings of the 8th Annual Greater China ETF Investor Survey from Brown Brothers Harriman & Co. (BBH), a global leading ETF custodian ETF 市场日趋发展成熟,投资者正持续加大发行人在大中华区占据主导地位,配ETF ETF但深谙本地市场特性的国际发行人仍存在发展机遇。本报告立足大中华区市场特殊性,旨在为行业参与者提供关键洞察。 HONG KONG, Sept. 11, 2024 /PRNewswire/ — Exchange Traded Fund (ETF) asset growth has hit new highs in the Greater China region, with investor demand fueling growth and 77% of investors predicting increased ETF use in the next year. The findings of the 7th Annual Greater China ETF Investor Survey from Brown Brothers Harriman & Co. (BBH), a global leading ETF custodian

据国际资产管理机构Brown Brothers Harriman(BBH)发布的「2024 Greater China ETF Investor Survey」,主动型ETF正在大中华区正快速兴起,成为市场聚焦的下一个 ETF 仍是 ETF投资者 兴 的类别 因为科技与长远趋势密不可 在2022 ETF 82%年 五项意增 这 略 较年增长中 三项 于 焦于科技的产品 展 未来 10% 的大中 区投资者 2022 内 投资者仍 对主题 略 兴 年十项净 增资金 的ETF中 项 于主题或行业产品 数字资产事务监 员会认可使用

Our 7th Greater China ETF Investor Survey has gathered the opinions of over 100 ETF investors in the region to understand the latest trends and innovations shaping the industry. Welcome BBH’s 8th Annual Greater China ETF Investor Survey, which is a subset of its Global ETF Investor Survey, comes amid a period of heightened market dislocation, as trade tensions continue globally. 如今,大中华区成为亚太区增长最快的地区,ETF资产管理规模达5,570亿美元,占亚太区ETF 总资产(1.485万亿美元)的38%。 作为我们全球ETF投资者调查的一部分,该调查展示出通过创新推动进一步发展的乐观前景, 投资者需要多元化产品以降低风险并创造稳定的回报。 总市值的3%表明,发行人还有很

Our 2025 Greater China ETF investor survey offers exclusive insights into how ETF investors are positioning their portfolios, the key drivers of growth, and the competitive landscape facing ETF issuers in the region.

Welcome BBH’s 8th Annual Greater China ETF Investor Survey, which is a subset of its Global ETF Investor Survey, comes amid a period of heightened market dislocation, as trade tensions continue globally. The Greater China ETF market is evolving rapidly, fuelled by strong ETF investor demand, growing product innovation, and increasingly sophisticated regulatory frameworks. As global geopolitical and macroeconomic shifts continue to shape investment strategies, ETFs are becoming an essential vehicle for allocators across Mainland China, Hong Kong, and Taiwan. Our 7th Greater China ETF Investor Survey has gathered the opinions of over 100 ETF investors in the region to understand the latest trends and innovations shaping the industry. The findings paint

BBH’s 11th Annual Global ETF Investor Survey unlocks the trends, strategies, and product innovations driving the next evolution in ETFs, including a special section: The Era of Active. We surveyed 325 ETF investors, including institutional investors, financial advisors and fund managers across the U.S., Europe (including the U.K.), and Greater China. 40% manage The Greater China ETF market is evolving rapidly, fuelled by strong ETF investor demand, growing product innovation, and increasingly sophisticated regulatory frameworks. As global geopolitical and macroeconomic shifts continue to shape investment strategies, ETFs are becoming an essential vehicle for allocators across Mainland China, Hong Kong, and Taiwan.

Demand grows for active ETFs as well as for ETFs offering downside protection HONG KONG, May 21, 2025 /PRNewswire/ — Exchange Traded Funds (ETFs) continue to grow in Greater China in 2025, with the region accounting for 71% of the overall record-breaking inflows of $347 billion in Asia-Pacific in 2024[1]. The findings of the 8th [] In its 11thyear, BBH’s Global ETF Investor Survey comes at a pivotal time. In March, the ETF industry reached a milestone of $12.71 trillion in global assets.1ETFs are continuing their meteoric rise, with actively managed strategies taking center

In its 11thyear, BBH’s Global ETF Investor Survey comes at a pivotal time. In March, the ETF industry reached a milestone of $12.71 trillion in global assets.1ETFs are continuing their meteoric rise, with actively managed strategies taking center Exchange Traded Funds (ETFs) continue to grow in Greater China in 2025, with the region accounting for 71% of the overall record-breaking inflows of $347 billion in Asia-Pacific in 2024[1]. The

In its 11thyear, BBH’s Global ETF Investor Survey comes at a pivotal time. In March, the ETF industry reached a milestone of $12.71 trillion in global assets.1ETFs are continuing their meteoric rise, with actively managed strategies taking center

Hong Kong, September 11, 2024 – Exchange Traded Fund (ETF) asset growth has hit new highs in the Greater China region, with investor demand fueling growth and 77% of investors predicting increased ETF use in the next year. The findings of the 7th Annual Greater China ETF Investor Survey from Brown Brothers Harriman & Co. (BBH), a global leading ETF custodian and

- 2024 Pfeiffer University Rankings

- 2024 Le Castellet : ELMS 2024 4h Le Castellet

- 2024 Lincoln Navigator Problems, Issues

- 2024 Bmw X5 Xdrive50E: Start Up, Test Drive, Walkaround, Pov

- 2024 Silverado High Country Undisguised Photos

- 2024 Lexus Nx 350 Luxury Specs

- 2024 Golden Tours London Hop-On Hop-Off Open Top Sightseeing Bus Tour

- 2024 University Of Stellenbosch Online Application Form

- 2024 Kawasaki Vulcan 650 S Backrests

- 2017 Harley-Davidson Road King Test

- 2024 Aab Conference : AB Show 2024: Our Attendees

- 2024 It Intern Resume Example , 20+ IT Internship Resumes & Guide for 2025

- 2024 Book Award Contests List : 2025 Best Indie Book Awards®

- 2018 Polaris Ranger Xp® 1000 Eps

- 2024 Nfl Draft Profile: Di Dexter Lawrence, Clemson