18 Canadian Reits That Offer Safety And Value

Di: Ava

Real Estate Investment Trust (REIT) stocks are great for earning high dividends. Learn about the best Canadian REIT stocks and how to buy them.

Global X Equal Weight Canadian REITs Index ETF

Canadian REITs offer an appealing investment option as they don’t require in-depth knowledge or direct management of properties, as is typically required in real estate development. A Real Estate Investment Trust (REIT) investment in Canada has the potential to generate substantial wealth for property owners.

Fundamentals of REITs Disclosure Obligation Publicly traded REITs are vital companies that Publicly traded REITs, like other public companies offer investors the benefits of commercial real in the U.S., are required to make regular financial estate investment along with the advantages of disclosures to the investment community, investing in a publicly traded stock. including Here are some top Canadian REITs that seem to be good buys today for conservative investors who seek total returns. The post The Top Canadian REITs to Buy in August appeared first on The Motley Fool Canada.

Real estate investment trusts (REITs) in Canada are a smart way to invest in real estate without risking your

1 Canadian REIT Down 18% Is My Income Play of the Year This REIT might be down, but it’s one of the best options as housing markets change. There are numerous high-quality REITs that investors can choose from that offer attractive potential returns. Plus, with the market and economic environments worsening over the last year, there is a tonne of opportunities for savvy investors to buy these stocks cheaply. Therefore, now is an opportune time to explore undervalued Canadian REITs that have The Canadian REIT (Real Estate Investment Trust) scene is a great place to look if you’re looking for well-covered distributions that sport higher yields. Undoubtedly, the REIT trade may have

A closer look at the Canadian consumer staples sector using the investment philosophy focused on safety and value

Explore the best REITs to invest in Canada, offering top performance, stable dividends, and diversification to grow your real estate Top REIT ETFs in Canada The following Canadian REIT ETFs provide exposure to REITs using a variety of different strategies.

REITs Are Still Undervalued Despite Recent Outperformance

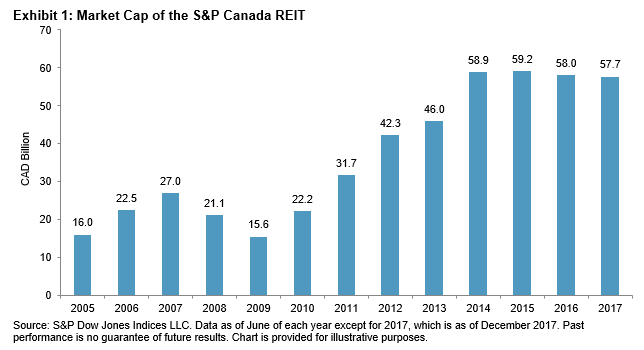

The first quarter of 2025 showed an interesting contrast in market performance. REITs gained 2.8% while the S&P 500 dropped 4.4%. This defensive asset There are Canadian REITs that offer similar or higher income than GICs. Typically, it’s the slow- to no-growth REITs that are offering higher yields than GICs. Canadian Real Estate Exposure REIT offers investors exposure to the Canadian real estate market through a diversified portfolio of real estate investment trusts (REITs), allowing participation in potential rental income and long-term capital

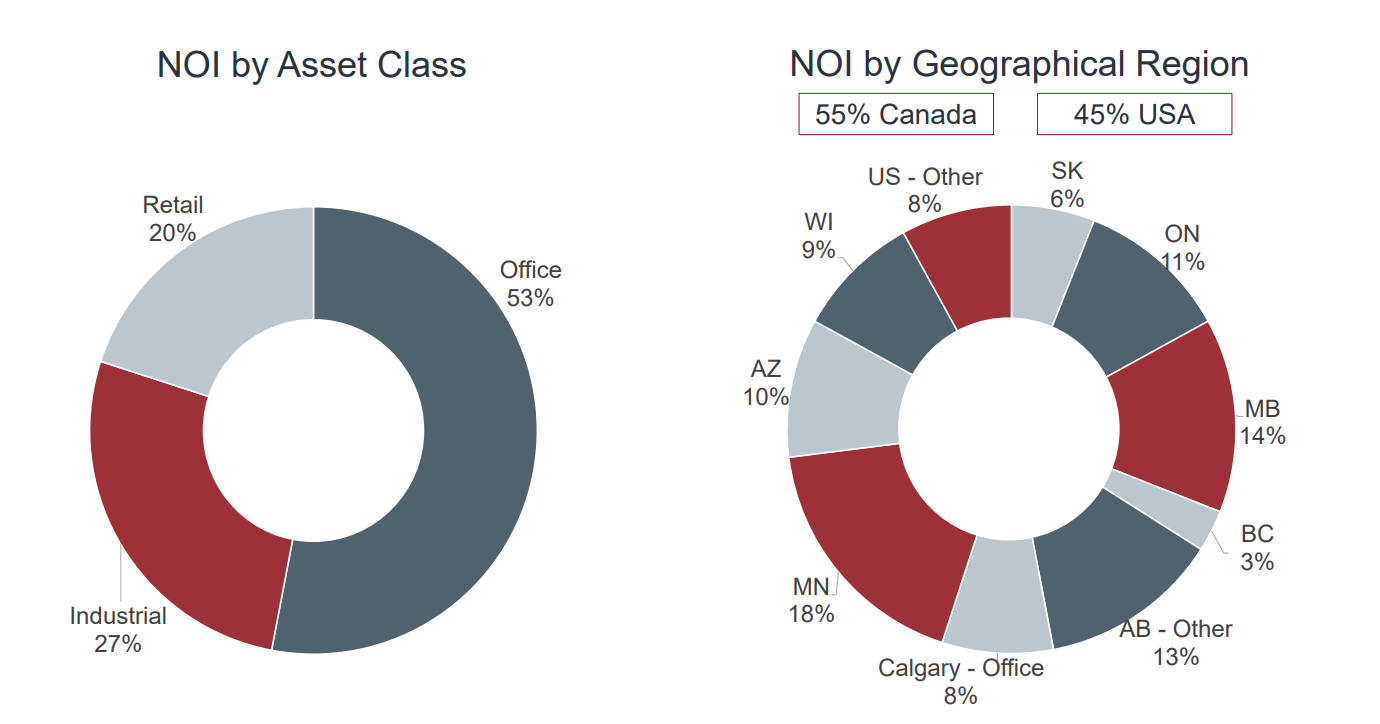

The model combines NAV – a great starting point and high quality estimates are essential – with the factors that impact the premiums at which REITs should trade: franchise value, balance sheet risk, corporate governance, and overhead. The compartmentalized nature of the model forces discipline to consider all relevant valuation issues. Investing in Canadian Real Estate Investment Trusts (REITs) offers a convenient way to add real estate exposure to your portfolio – without making major lifestyle changes. While buying a rental property and becoming a landlord is one option, it’s not for everyone. If you don’t have the time, energy, or cash/capital to manage physical real estate, Canadian REITs can be In this simple guide, we’ll explain all there is to know on how to invest in REITs in Canada conveniently, securely, and fast.

Canadians interested in investing and looking at opportunities in the market besides being a potato. Discussion is geared towards investment opportunities that Canadians have access to, including questions regarding individual companies, ETFs, tax Better yet, CT REIT units trade at a 19% discount to their most recent net asset value (NAV) of $17.31, offering a significant margin of safety rarely seen in such a stable, high-quality Canadian We started our search by filtering for Canadian-listed names in the financial sector with a minimum market cap of $7-billion. Market cap is a safety factor; generally, larger companies offer more

In Canada, Real Estate Investment Trusts (REITs) have gained significant attention for their potential to provide stable income and growth.

- 12 Best REIT Stocks To Buy In Canada Right Now

- Top Canadian REIT ETFs of 2025

- Canadian REITs: A Guide for Investors

- Investing in Canadian REITs 2025

- Top Canadian REITS of 2025

These three Canadian REITs offer high yields and efficient wealth-building. All three trade below intrinsic value, sport strong occupancy rates, and have clear catalysts to unlock capital gains. REITs offer diversification through real estate investments, making them a great way to build long-term passive income, especially when the real estate market starts bouncing back. Ever since the Bank of Canada started raising interest rates in early 2022, REITs have faced substantial headwinds. Higher borrowing costs, depreciation of asset values and uncertainty in property

Today’s REITs offer some juicy yields for good value within Canadian’s favourite financial topic: real estate. With all the positives that can come with owning REITs, there are some downsides and things to be cautious of as well. Discover some of the top Canadian real estate investment trusts (REITs) and decide if investing in REITs is a good strategy for you.

Real Estate Income Trusts or REITs are known to be retirees’ best friends. Why? Because they share several key factors for income-seeking investors. Notably, Canadian REITs are known for the following: Their generous dividend yield (may offer a yield over 3%) Many pay their distribution monthly (fits well with your budget!) REITs operate stable businesses

Discover the potential benefits of investing in Canadian REITs for income-focused investors seeking diversification and higher yields compared to US peers. What is the average return on a REIT in Canada? When assessing the average return on a REIT in Canada, it is important to differentiate between the public and private market. Key differences in liquidity, volatility, listing venue and regulatory requirements can lead to material imbalances in annual return profiles.

Healthpeak Properties (DOC), a popular healthcare REIT, moved from quarterly to monthly dividends in early 2025. Pembina (PBA) and Keyera Canadian REITs offer unique advantages, including potential tax benefits and access to a diverse range of high-quality real estate assets, making them an attractive option for both new and seasoned investors.

- 182€ Billigflüge Von Innsbruck Nach Budapest 2024

- 18 Sand Dollar Interesting Facts

- 16 Kontrollfragen-Karteikarten

- 1933 Yılından Sonra Alman Bilim Adamlarının Türkiye’Ye Göçü

- 16 Of The Best School Websites Built With Wordpress

- 18 Bible Verses About Clouds, Natural Use

- 1951 Twn Triumph Bdg 250 : Triumph 250bdg kleinanzeigen.de

- 19. Ihk-Begegnungswoche: Ostwestfalen Meets Europe

- 188 Ergebnisse Für Eiserne Kreuz Aufkleber

- 19 Best Books To Read Before Going To Ireland

- 1909 La Golondrina Ave, Alhambra, Ca 91803

- Drucksache 18/18772 – Bundestag: BT-Drs. 18/3158