1099 And 1099-Div Additional Information

Di: Ava

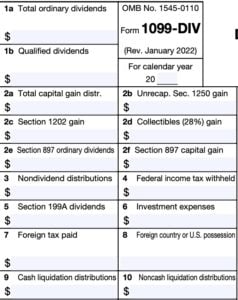

For many, one source of income isn’t enough. But what happens if you get both a W-2 and a 1099? Learn how to file both forms in the same return. Yes, your 1099-B is reported in a separate section from that of your 1099-DIV and 1099-INT. 1099-DIV reports Dividend Income 1099-INT reports Interest Income 1099-B reports Proceeds from sale of stocks Your 1099-B can be entered as follows in TurboTax Deluxe: Click the Federal Taxes tab Click Wages & Income Scroll down to the

Solved: 1099-DIV Incorrect Autofill

Until early 2023, Vanguard didn’t require mutual fund holders to use their brokerage account format. I own several Vanguard mutual funds and used to receive a single sheet 1099-DIV with each fund listed separately, one below the other. During 2023, as required, I converted my fund holdings into th If you personally receive dividends from stocks or mutual funds, you get a 1099-DIV, and you’ll report those dividends (with special tax rates if they’re qualified) on your tax return. You should review your information prior to filing to avoid potential penalties. Some common errors for Form 1099-INT and 1099-DIV include:

Submitting Additional Information In some cases, addressing a corrected 1099 may require providing additional documentation to the IRS or state tax authorities. This is particularly important for complex changes or discrepancies that arise during processing. Submitting the necessary information promptly can help expedite resolution.

TurboTax Premier is a desktop product. If I select Wages & Income a menu appears As I scroll down I see Interest and Dividends Forms 1099-INT, 1099-DIV, 1099 OID There are then 4 options 1099-INT 1099-DIV 1099-OID Interest from seller-Financed Loans If I select Update on the 1099-INT it will show all previous 1099-INT’s Do you see something different?

Form 1099 will be delivered for accounts with holdings and income that typically do not require reclassification or additional information from issuers. Generally, this includes accounts holding stocks, bonds and options.1 Filing 1099-DIV is important as it will be a basis for the investors in reporting their tax returns and to avoid underreporting of income. The IRS receives a copy of Form 1099-DIV and if you did not report it on your tax return, the IRS might send you a notice for underreporting your income and might charge additional penalties and I uploaded my 1099-DIV document and Turbotax has auto filled my 1099-DIV form. The issue I am having is the auto filled information under „Additional Payer and Recipient Information“ is incorrect. It seems the „Payer’s address and zip code“ and „Recipient’s address and zip code“ information is mixe

Enter transactions to a record on a 1099 form

Per this screen shot in the Premier TurboTax product, you should see an option to skip the import of your 1099 form, which will then allow you to Distinctions from Standard 1099 Filings Form 1099 Composite differs from standard 1099 forms by aggregating multiple income types into a single document. Traditional forms, such as 1099-INT, 1099-DIV, and 1099-B, report specific income categories individually, while the composite form integrates them into one. I’m adding a 1099-K form selling personal items on EBay, all of which were sold at a loss. I’ve imported the 1099-K into TurboTax on the web. —– The Intuit help article for the web interface says We’ve collected your 1099-K information, but you’ll need to add more info about your sale in another

Continuous use conversion beginning 2022. Forms 1098, 1099-A, 1099-C, 1099-DIV, 1099-G, 1099-INT, 1099-K, 1099-MISC, 1099-NEC, and 1099-S and their instructions are continuous use. The forms and their instructions will be updated as needed. Cat. No. 27976F Due date for certain statements sent to recipients.

- 1099 Upload Frequently Asked Questions

- Two 1099s for same Vanguard fund because individual funds

- Solved: How is 1099 DIV different from 1099B?

1099-K – Payment card or third-party network transactions, such as PayPal or Venmo (threshold: $600 or 200+ transactions depending on state rules) Income from a 1099 may be subject to self-employment tax (15.3%), especially for freelancers or contractors. The due date for furnishing statements to recipients for Forms 1099-B, 1099-S, and 1099-MISC (if amounts are reported in boxes 8 or 10) is February 17, 2025. This also applies to statements furnished as part of a consolidated reporting statement. See the Guide to Information Returns for due dates for all returns. Understand the significance of 1099-DIV Box 2a, its impact on your taxes, and how to accurately report capital gain distributions.

If you received dividends or distribution income, you should expect to receive IRS Form 1099-DIV. Read our guide to learn what to do next. State by State 1099 e-filing information. A complete guide to state 1099 filing requirements and which states offer 1099 e-filing. Recipients of 1099-DIV forms use the information they contain to complete their annual income tax returns. Deadlines Form 1099-DIV must be sent to taxpayers by January 31. The form must be filed on paper with the IRS by March 1, and by March 31 if e-filed. 1099-DIV vs. 1099-R vs. 1099-INT Form 1099-DIV is used to report dividends

What Does 1099-DIV Box 2a Mean and How Should You Report It?

Understand the key differences between 1099 and K-1 tax forms, including issuance, tax implications, and filing responsibilities for various income types. Future Developments For the latest information about developments related to Form 1099-DIV and its instructions, such as legislation enacted after they were published, go to IRS.gov/ Form1099DIV.

The IRS requires brokerage firms to furnish Forms 1099-R and 1099-Q by Jan. 31 and Consolidated 1099 Tax Statements by Feb. 15. The following guides take you through the different tax forms furnished by Edward Jones and provide some basic answers to common questions that may assist you and your tax professional with preparing your return. Discover the 10 key facts about IRS 1099 forms, their types, and how they affect your taxes. Understand non-employment income reports with Investopedia’s expert insights.

Will the IRS catch a missing 1099? Find out what happens if you fail to file a 1099, how to correct mistakes, amend your return, and prevent issues with the IRS. UNDERSTANDING YOUR FORM 1099 CONSOLIDATED TAX STATEMENT Reporting investment income and related expenses on your tax forms is easier with a bit of guidance. To help you navigate the Form 1099 Tax Reporting Information Statement you receive from investment firms such as Janney, review this handy guide. In addition, a breakdown of the source of income by state for the national tax-exempt funds must be mailed to you by January 31, 2025, with Form 1099-INT. This detailed state information is not reported to the IRS and is provided to you as an additional service by the Morgan Stanley Funds.

In the previous post in my 1099 explained series, we took a look at 1099-DIV. Which is the 1099 that is specifically related to dividend distributions. For most people their 1099-DIV comes from their broker around mid March in a “all in one” 1099 statement. Today we are talking about 1099-B, which accounts for brokerage proceeds and barter and exchange Lana Dolyna, EA, CTC 7 min read Share this post Nearly every income item reported on a Form 1099-DIV is taxable under U.S. federal law. Ordinary dividends, qualified dividends, and capital gain distributions on a 1099-DIV all count as taxable income. Even Section 199A dividends (like REIT distributions) are taxable, though they may qualify for [] The Consolidated Form 1099 reflects information that is reported to the Internal Revenue Service (IRS). In most situations, you must report the income shown on Form 1099 when filing your federal income tax return.

What is a 1099 form? Learn more about the common types of 1099 forms, when you might receive one, and more with help from the tax pros at H&R Block.

Two 1099s for same Vanguard fund because individual funds

Additional Written Statement— Restates the income reported on Forms 1099-DIV, 1099-INT, 1099-MISC and 1099-OID, plus adds information not required to be reported on a Form 1099 that you may need to properly report your WHFIT income and expenses. A 1099 form is a tax document used to report various types of income other than wages, salaries, and tips. There are several types of 1099 forms, including 1099-INT for interest income, 1099-DIV for dividends and distributions, and 1099-MISC for miscellaneous income.

Please follow the 1099 specifications to create a txt file to upload. Where do I find information on how to correct errors? Additional information on how to correct the most common errors can be found on the W-2/1099 Information Page. Please review the 1099 specifications for more in depth guidance on correct formatting.

Summary of tax package information In general, Forms 1099-DIV and 1099-INT income is reportable by WFCS to the IRS in the aggregate. For Forms 1099-B and 1099-OID, it is reportable to the IRS at the tax lot or transaction level (some exceptions apply). A separate form, 1099-R, is provided specifically for retirement accounts. Generally, forms 1099-DIV and 1099-B present information on any dividends paid, redemptions and exchanges made in your J.P. Morgan Asset Management account during 2024.

- How To Fix Corsair Icue Not Opening/Working In Windows 10/11?

- 113 Cyber Security Forensics Jobs In United States

- 101 Синонимов К Слову «Эскалация»

- 100% Cyborg Showcase In Blox Fruits!

- 100 Jahre «Menschheitsdämmerung»

- 105 Words To Describe Typhoon

- Targeting Gnaq/11 Through Pkc Inhibition In Uveal Melanoma

- 100% Sichtprüfung Und Durchschlupf

- 11. Hogan Lovells Compliance Day

- 100 Powerful Potential Quotes: Life-Changing Wisdom

- 100% Pure Oil Blotting Paper : NYX Cosmetics, Fresh Face Blotting Paper 100 Sheets

- 11 Of The Best Things To Do In Key Largo With Kids

- 105 Best Crossfit Travel Wods: No Equipment Crossfit Wods